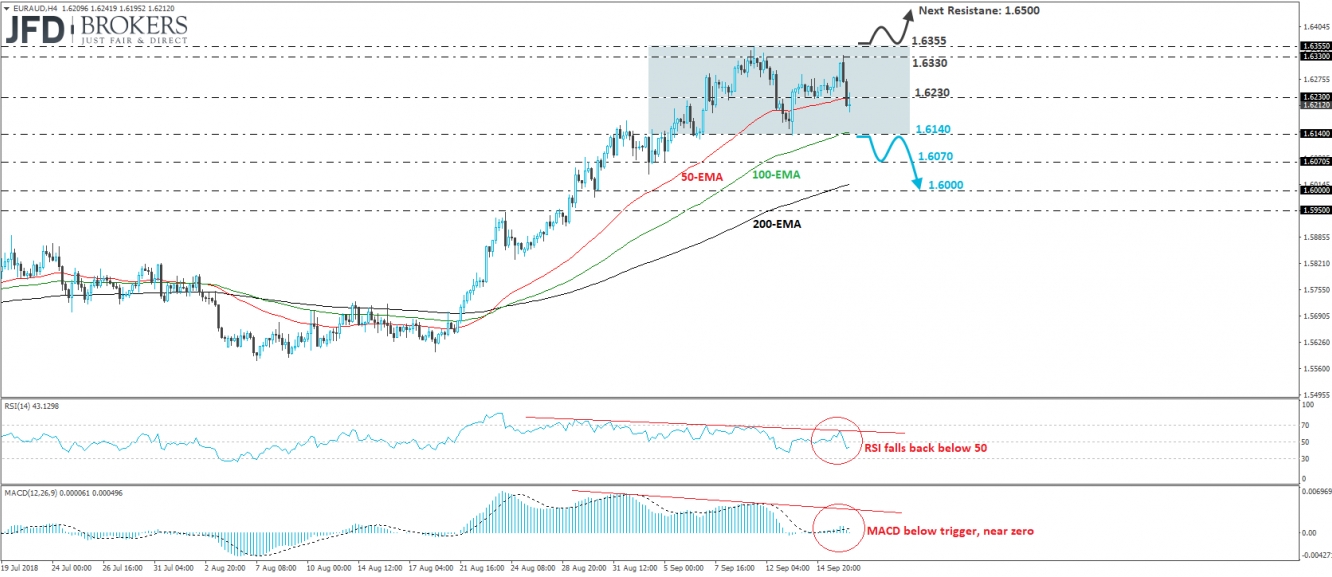

EUR/AUD tumbled on Tuesday, after it hit resistance near the 1.6330 zone overnight, to break below 1.6230 during the European morning. Following the steep uptrend that started on the 20th of August, the pair has entered a sideways mode between 1.6140 and 1.6355. We can also say that a double top may be in the works. That said, given that we don’t have any completion yet, we would prefer to remain sidelined for now.

In our view, a clear break below 1.6140 is the move that could signal a trend reversal. Such a move would confirm a forthcoming lower low on the 4-hour chart and could initially aim for our next support of 1.6070. Another dip below that zone could carry more bearish implications and is possible to pave the way for the psychological zone of 1.6000.

Shifting attention to our short-term oscillators, we see that the RSI turned down after it hit its respective downside resistance line, and then crossed below 50, while the MACD, already below its trigger line, appears ready to obtain a negative sign soon. What’s more, there is negative divergence between both these indicators and the price action. These momentum signs support the case for the rate to continue drifting lower, at least towards the 1.6140 zone.

On the upside, we would like to see a decisive move above 1.6355 before we start examining whether the prevailing uptrend is back in force. Such a move would confirm a higher high on both the 4-hour and daily charts and may encourage the bulls to drive the battle towards the psychological territory of 1.6500.