Airline carrier American Airlines Group (NASDAQ:AAL) stock has been recovering during the reopening trend in the post-pandemic era. Shares have seen a resurgence recently on the advent of the Merck & Company's (NYSE:MRK) COVID-19 treatment drug that holds the promise of cutting the death rate for hospitalized COVID-19 patients.

While business is not back to 2019 levels, American Airlines has found its foothold as the daily cash burn rate has turned positive to $1 million a day. The Company and its stock are “in the midst of an unprecedented recovery” as per American Airlines CEO Doug Parker in its Q2 2021 conference call. With that said, prudent investors seeking to get back into one of the key epicenter stocks of the pandemic recovery can look for opportunistic pullbacks in shares of American Airlines.

Q2 FY 2021 Earnings Release

On July 22, 2021, American Airlines released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) loss of (-$1.69) excluding non-recurring items versus consensus analyst estimates for a loss of (-$1.72), a $0.03beat. Revenues grew 361% year-over-year (YoY) to $7.48 billion meeting analyst estimates for $7.48 billion. The daily cash burn rate turned positive to a cash build rate of $1 million per day and ended the quarter with $21.3 billion in total available liquidity.

The Company expects Q3 capacity to be down approximately 15% to 20% compared to Q3 2019. It also expects liquidity to drop by $10 billion to $12 billion in 2022 and to reduce debt by $15 billion by the end of 2025 versus previous guidance of $8 billion to $10 billion. American Airlines CEO Doug Parker commented,

“We have taken a number of steps to solidify our business through our Green Flag Plan and it shows in our second-quarter results.”

“We have reshaped our network, simplified our fleet and made our cost structure more efficient, all to create an airline that will outperform competitors and deliver for customers. The green flag has dropped, and we are ready thanks to the tremendous efforts and dedication of the American Airlines team.”

The Company plans to operate more than 150 routes in the summer and new destinations. They plan to schedule 10 new domestic and four new international destinations from Austin in the fall.

Conference Call Takeaways

CEO Parker set the tone,

“We've flown more customers than any other airline in the second quarter. Our team safely transported more than 44 million passengers on nearly 470,000 flights. It's more than five times the number of passengers we carried in the second quarter of 2020 and more than two-and-a-half times the number of flights. We've ramped up the operation dramatically in response to customer demand, and our operational performance continues to improve as we grow in scale..

"As to our balance sheet, we entered second quarter with more than $21 billion of total available liquidity, by far the highest in American's history. We generated a cash build in the quarter for the first time since the pandemic. With this record liquidity and our confidence in the future, we've begun the deleveraging of American's balance sheet.

"This morning, we prepaid the entirety of our $950 million term spare parts term loan, which was scheduled to mature until April 2023. Derek will talk more about our deleveraging plans during his remarks, but I'll just say it feels great now being in a position of prepaying debt well before the term is due rather than continuing to incur it.

"In summary, I couldn't be prouder of this team. In response to demand, we're building back on our network faster than our largest competitors. We're hearing far more customers than any other airline, and our team is doing so safely with great care for our customers. We've reshaped our networks, simplified our fleet, and build efficiencies into the business that will serve us well for years to come. And today, as the recovery continues, we've begun the deleveraging of our balance sheet.”

AAL Opportunistic Pullback Levels

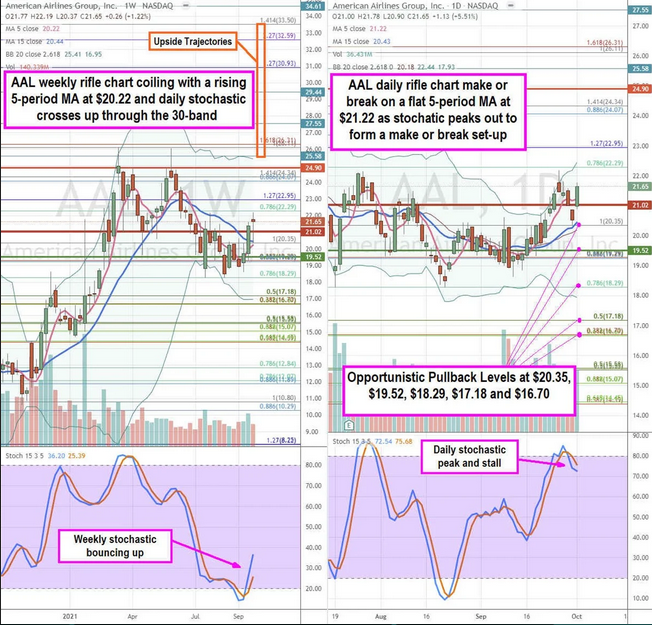

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field. The weekly rifle chart peaked twice off the $26.11 Fibonacci (fib) level. The weekly rifle chart is attempting another breakout attempt with a rising 5-period moving average (MA) support at $20.22 trying to cross over the15-period MA at $20.44.

The weekly stochastic has crossed back up towards the 40-band. The weekly market structure high (MSH) sell trigger formed at $21.02. The daily rifle chart peaked out with a flat 5-period MA at $21.22 and 15-period MA still rising at the $20.35 fib. The daily stochastic formed a peak and stalled on the cross down to form a make or break set-up.

The daily market structure low (MSL) buy triggered above $19.52. The daily upper Bollinger® Bands sit just above the $22.29 fib. Prudent investors can look for opportunistic pullback levels at the $20.35 fib, $19.52 daily MSL trigger, $18.29 fib, $17.18 fib, and the $16.70 fib.