Key Points:

- AUD/USD continues to appreciate thereby complicating economic rebalancing.

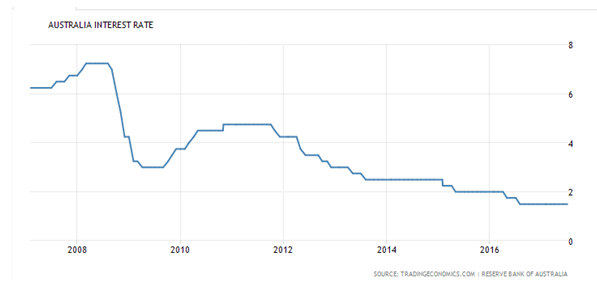

- Nominal real interest rates have continued to decline towards 1.00%.

- RBA unlikely to undertake monetary policy action in the near term.

The Australian Dollar has seen a stunning run over the past few weeks as the currency pair has been buoyed by a range of increasingly negative U.S. economic data. In particular, a softening in the Fed’s position regarding rate hikes has seen capital flowing into the AUD and, subsequently, price action has risen to presently trade around the 0.7843 mark. However, this could be complicating the path of rebalancing for the economy and might trouble the Reserve Bank in the coming months.

The fact is that the Australian economy is still somewhat reeling from the impact of the end of the commodity super cycle. In fact, the rebalancing process from mining to service based industries is still ongoing and reduced trade competition, based on an appreciating currency, is likely the last thing that the reserve bank needs to deal with right now.

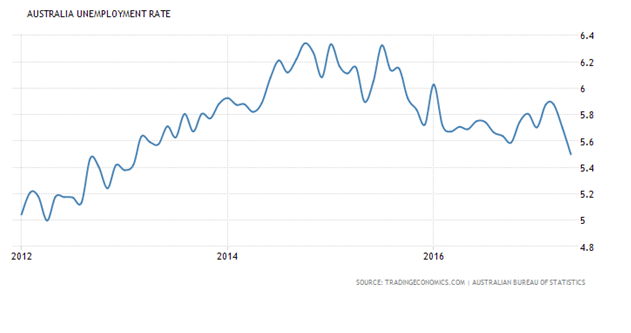

However, it isn’t all bad news for the central bank with the latest round of minutes suggesting that the recent rises in employment are likely to support an improvement in the household income and spending. This is most certainly the economic silver lining, despite the appreciating Australian Dollar, especially given that the RBA is estimating that the neutral real interest rate has fallen to 1.00%. Additionally, Unemployment continued to trend lower and the latest projections seem to suggest that the rate will move towards 5.0% over the next 18 months.

However, despite ongoing tightening within the labour markets, along with increasing inflationary pressures, the RBA is unlikely to take anything in the way of monetary policy action in the coming months. Although there is a broad trend of various central banks moving towards a tightening phase, Australia is unlikely to be one of them in the remainder of 2017. In fact, the coming year is likely to bring with it renewed expansionary fiscal policy which would likely cancel out any tightening. Subsequently, the RBA is likely to sit on the side lines in the coming month especially if they believe that the government will undertake a fiscal expansion in the near future.

However, the Australian economy is continuing to do relatively well considering the sharp domestic shock the end of the mining boom posed. Regardless, the RBA is unable to retain rates at the presently low level for too long lest they worsen much of the capital and lending issues within the banking sector whilst also encouraging further risky leveraging. Ultimately, the time will come for the central bank to take action and this can only occur after a significant rebalancing within the economy.