The U.S. Dollarwas trading mixed on Thursday. Economic data on the day showed that U.S. private sector firms added 179k jobs during November. This was below estimates of a 200k expectation.

Previous month's data was revised down to 225k from 227k previously. The ADP report comes ahead of today's payrolls data.

Elsewhere, German factory orders increased by 0.3% on the month beating estimates of a 0.4% decline. Previous month's data was revised down to 0.1%.

OPEC, which met in Vienna, decided to cut oil production. However, the cut in production was less than the market expectations as it pushed oil prices lower on the day.

The ISM's non-manufacturing PMI report showed that activity rose to 60.7 on the index. This beat a conservative forecast and non-manufacturing activity increased from 60.3 previously.

U.S. factory orders, however, showed a decline, falling 2.1% which was more than the forecasts of a 1.9% decline.

Data from Japan earlier today showed that average cash earnings increased 1.5% on the month. The European session stats with the industrial production figures from Germany and France.

German industrial production is expected to rise 0.3% on the month while French industrial production is expected to increase by 0.8%, partly reversing a 1.8% decline from the previous month.

Inflation expectations from the UK will be coming out later in the day while the final revised GDP for the third quarter is due from the Eurozone. No changes are expected as the GDP is forecast to remain steady at 0.2%.

The NY trading session starts with the labor market data from Canada, and the U.S. Canada's unemployment rate is expected to hold steady at 5.8%.

The U.S. unemployment rate is expected to hold steady at 3.7% as the economy is forecast to add 200k jobs in November. Wages are forecast to rise by 0.3% on the month, slightly accelerating from the 0.2% increase previously.

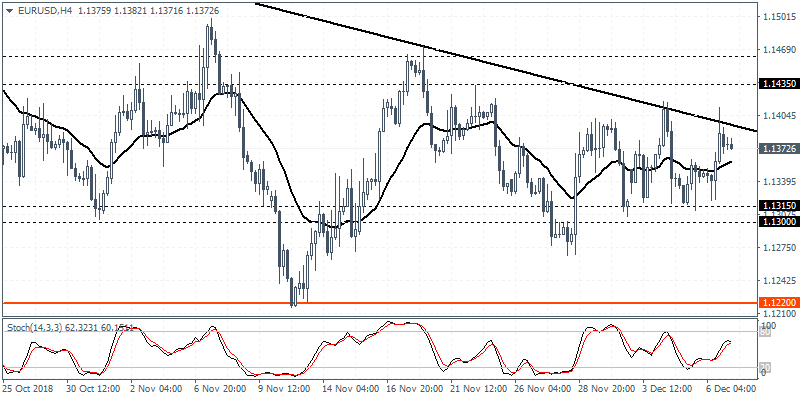

EUR/USD intraday analysis

EUR/USD (1.1372): The EUR/USD currency pair has been bouncing off the support level at 1.3150 - 1.3100 region. Price action is seen respecting the falling trend line, but overall, the common currency is expected to maintain the sideways range. The resistance level at 1.1435 remains a key level of interest which could be tested in the near term. There is a risk that the EURUSD could break below the support level. This could potentially pave the way for further declines as the common currency could be seen targeting 1.1220.

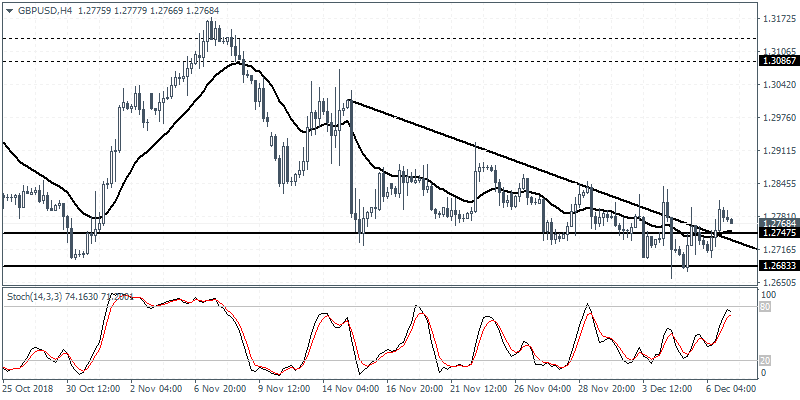

GBP/USD intraday analysis

GBP/USD (1.2768): The GBP/USD currency pair continues its consolidation. However, price action managed to break past the falling trend line and is seen currently pulling back. A retest of the support at 1.2745 could establish the upside if the gains hold at the support. To the upside, this opens the way for GBP/USD to test the previously established resistance level at 1.3088 region potentially.

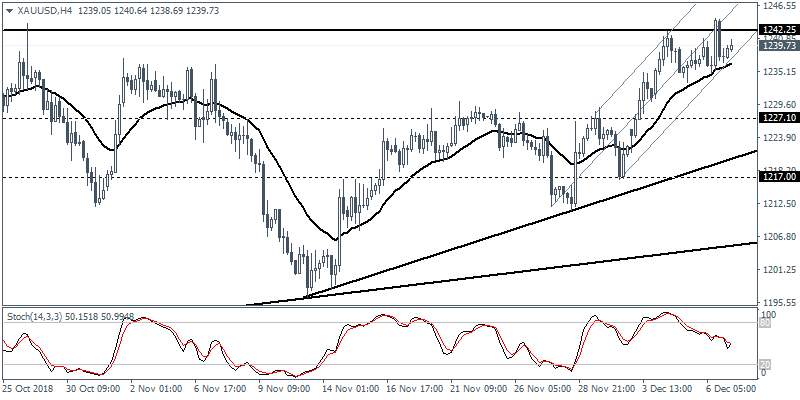

XAU/USD intraday analysis

XAU/USD (1239.73): Gold prices recovered from the interday pull back to advance gains. Price action retested the resistance level of 1242.25 once again only to reverse the gains. The current pullback could see yet another attempt to breach the resistance level. Failure to close above the resistance level could potentially confirm the downside correction to 1227.10. Alternately, a successful break of the resistance level could trigger further gains as gold is likely to target 1280.