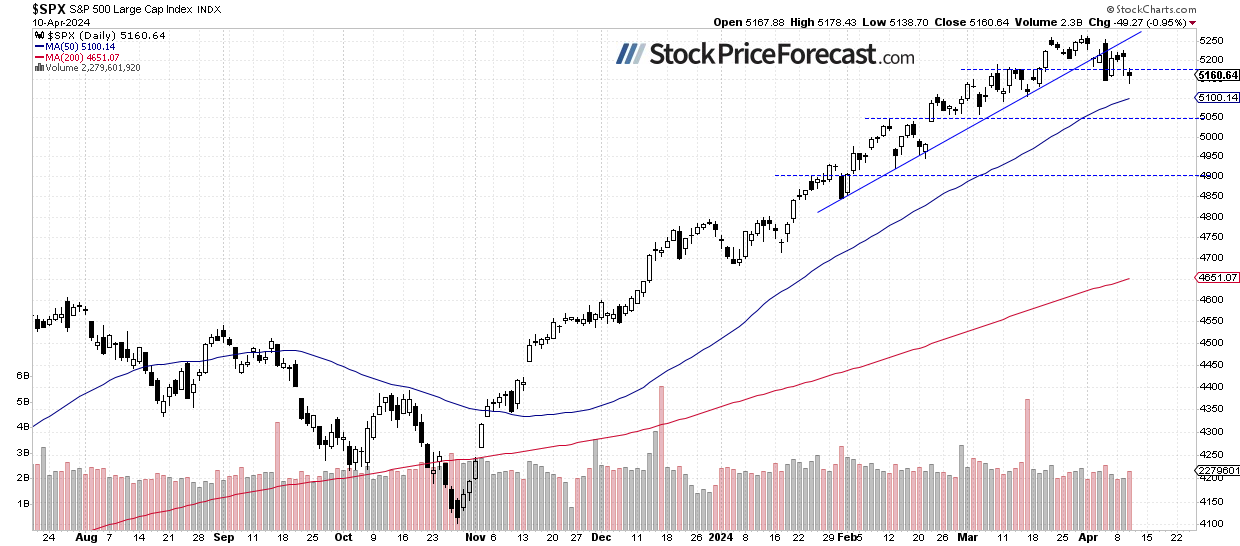

The stock market reacted negatively to the latest Consumer Price Index release yesterday, with the S&P 500 index dropping 0.95% and breaking the 5,200 level again. The CPI has been higher than expected at +0.4% month over month, which caused an advance of the US dollar, leading to stock markets’ sell-off. Futures indicate an 0.2% advance for today's S&P 500 opening, following lower-than-expected Producer Price Index release.

Last Tuesday, in my Stock Price Forecast for April, I noted,

“Closing the month of March with a gain of 3.1%, the question arises: Will the S&P 500 further extend the bull market in April, or is a downward correction on the horizon? From a contrarian standpoint, such a correction seems likely, but the overall trend remains bullish.”

The investor sentiment slightly worsened again, as indicated by yesterday’s AAII Investor Sentiment Survey, which showed that 43.4% of individual investors are bullish, while 24.0% of them are bearish. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

Today, the S&P 500 is likely to extend short-term fluctuations, however, remaining below the 5,200 level. Last Thursday, it broke its two-month-long upward trend line, as we can see on the daily chart.

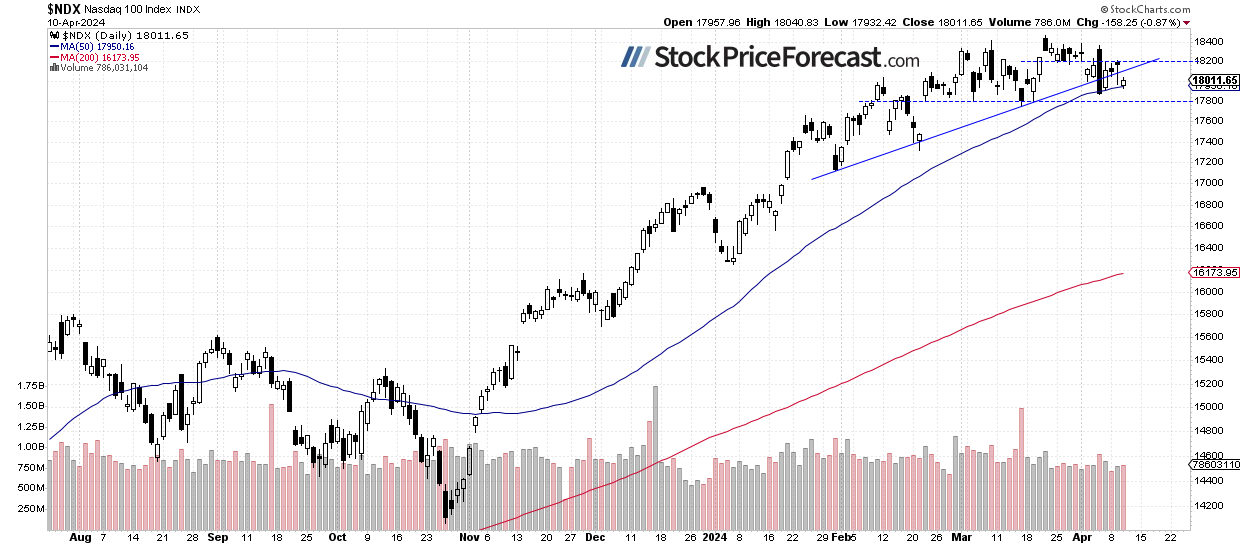

Nasdaq 100 Trading Along 18,000

The technology-focused Nasdaq 100 index backed off a bit, but it remained above the 18,000 level yesterday. Last week, the market went closer to local lows from February and March, before rebounding back above 18,000. Today, the Nasdaq index is likely to open 0.4% higher.

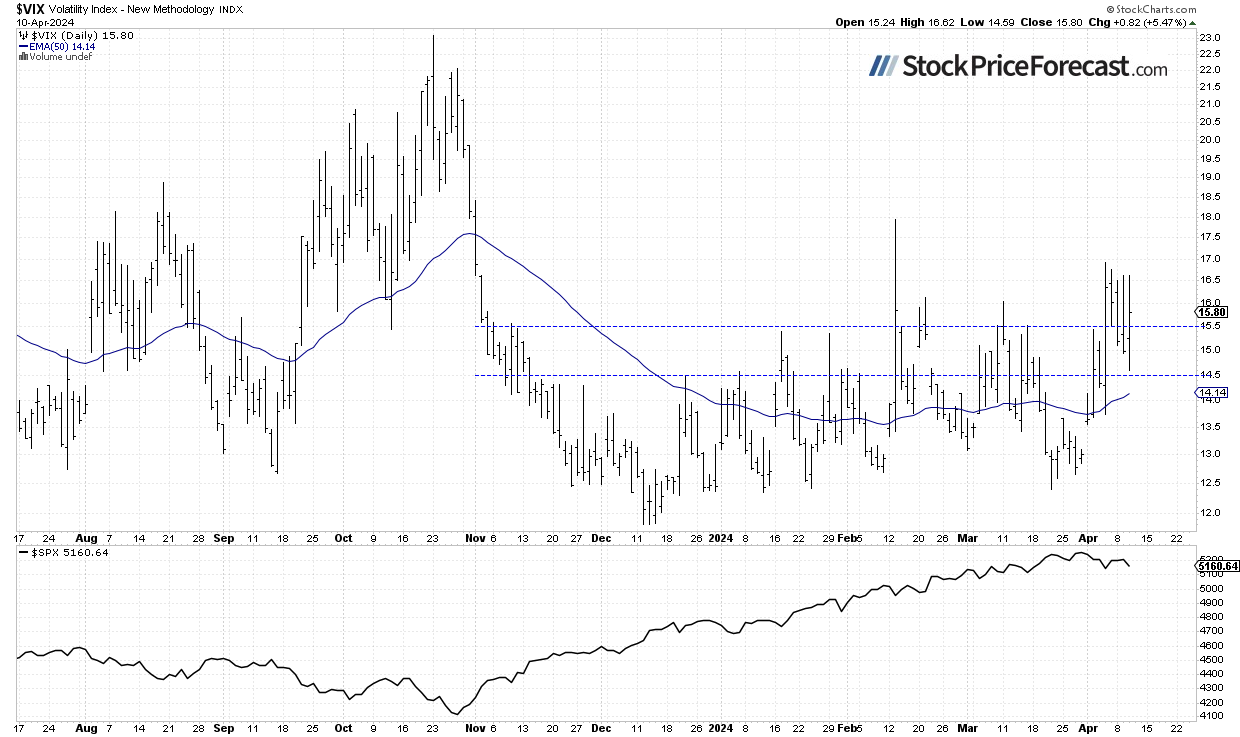

VIX: 15-17 Range

The VIX index, also known as the fear gauge, is derived from option prices. In late March, it was trading around the 13 level, and last week, market volatility increased, leading to an advance towards 17. Despite the decline of the index, yesterday it remained within the 15-17 range.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures Contract Trades Along 5,200

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it’s rebounding after the PPI data. The support level remains at 5,160-5,180, and the resistance is currently at 5,220. The market has been in a slight downtrend since the start of the month.

Conclusion

This morning, the S&P 500 is expected to open slightly higher. The Producer Price Index came in lower than anticipated at +0.2% month over month, leading S&P 500 futures to rebound from pre-session lows.

Investors will be waiting for more economic data. It’s also worth noting that the earnings season is approaching in mid-month. Tomorrow before the opening of the trading session, major banks will release their quarterly reports.

Last Tuesday, I wrote that

“In April, we will see a usual series of important economic data, but with the Fed leaning towards easing monetary policy, we should perhaps pay more attention to the quarterly earnings season. However, good earnings may be met with a profit-taking action this time. The market appears to be getting closer to a correction.”

Last Thursday, I added:

“It appears that profit-taking is happening. Is this a new downtrend? Likely not, however, a correction towards 5,000-5,100 is possible at some point.”

For now, my short-term outlook remains neutral.

Here’s the breakdown:

- The S&P 500 is likely to extend a short-term consolidation.

- In the medium term, stock prices remain somewhat overbought, suggesting the potential for a correction.

In my opinion, the short-term outlook is neutral.