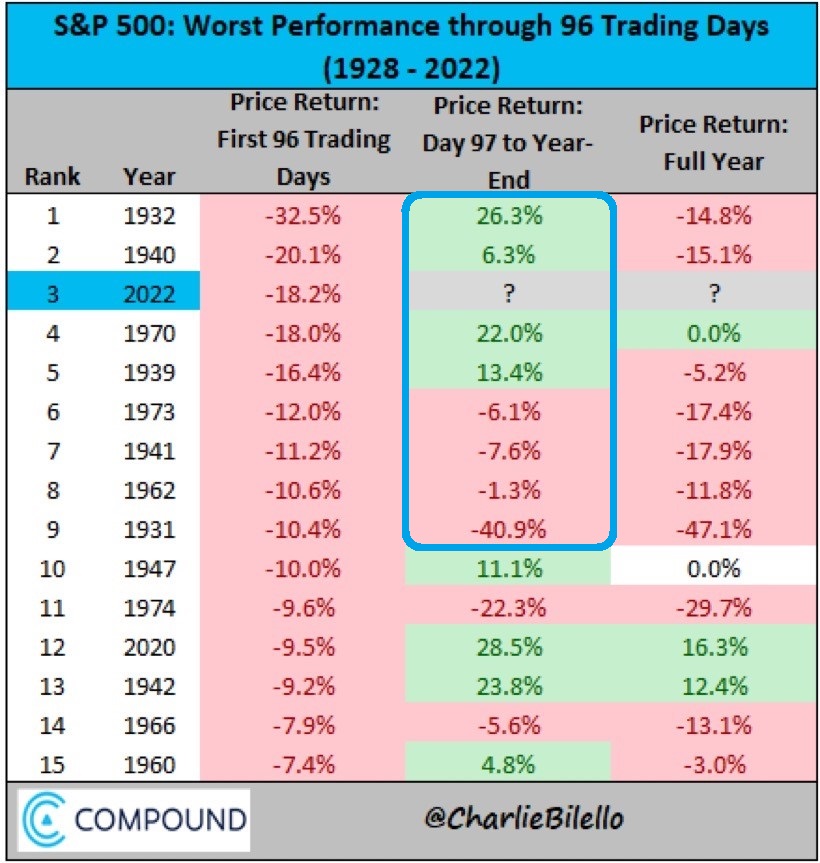

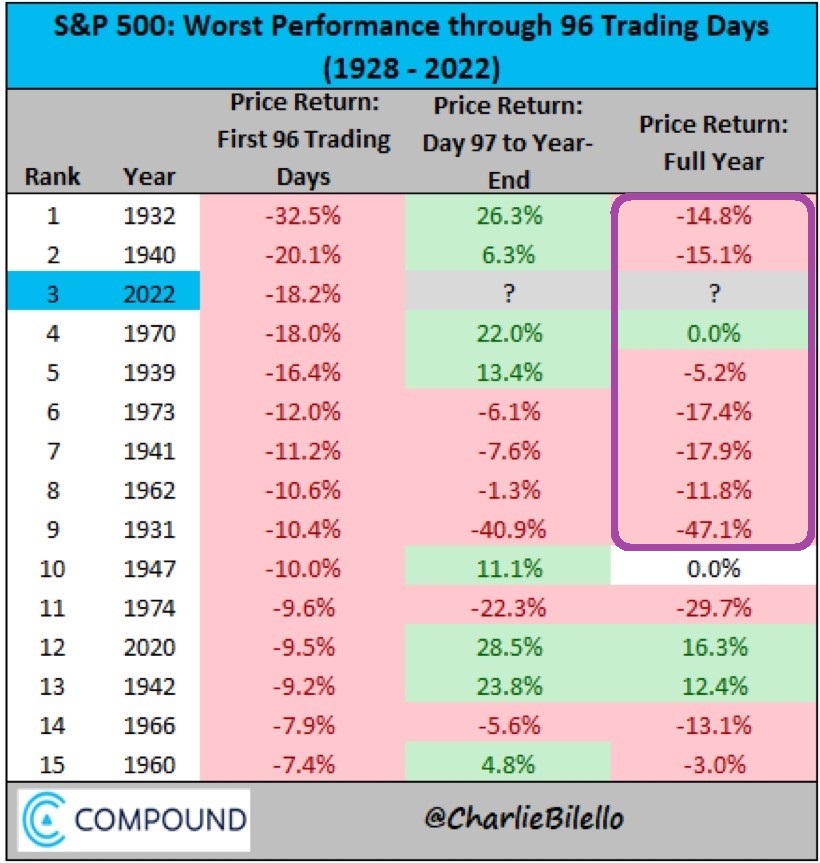

Stocks have already lost 18% through the first 96 trading days of 2022. Odds are, things should get better from here, right?

When stocks experience losses that surpass 10% through mid-May of a trading year, investors often see gains by the end of December. About half the time. 50-50.

That’s the good news.

On the flip side, if history rhymes, investors are unlikely to recover their principal in 2022. There are zero instances where early losses of 10%-plus offered full-year returns that were positive.

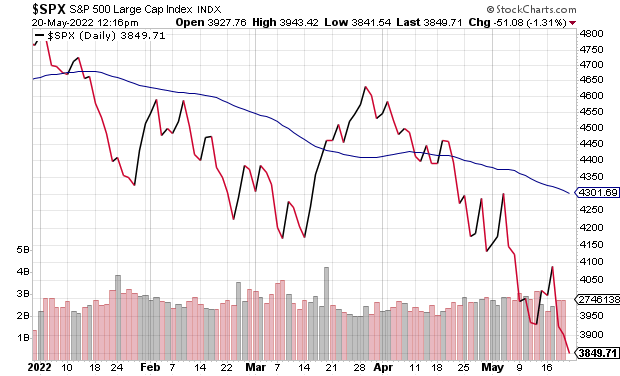

More importantly, perhaps, stocks are now a stone’s throw from the 20% bear market line. So far, buyers are stepping up at 3835-3840 on the S&P 500.

An end-of-day close below 3837, however, could alter the narrative. We may indeed see a shift from “buying the dips” to “selling the rips.”