In yesterday’s analysis, I wrote about how the current situation is similar to what happened in 2008 and what we can learn from that. Today, after another increase in our profits, I’d like to show you that there are quite a few fundamental similarities to 2008, which only increases the importance of yesterday’s comments.

Tick-Tock

It’s decision day for the FOMC, as a 50 or 75 basis point rate hike is likely a done deal. Moreover, with the U.S. economic clock counting down the seconds until a recession, the Fed’s rate hike cycle should be the straw that breaks the camel’s back.

To that point, with interest rates rising rapidly in recent days, the medium-term effects should be profound.

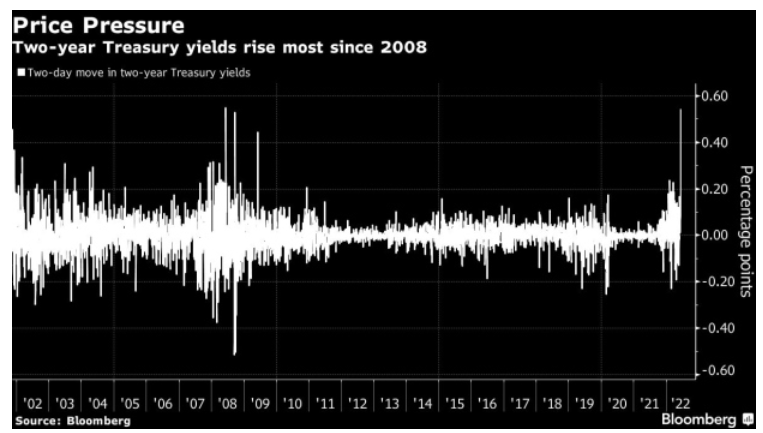

For example, the U.S. 2-year Treasury yield rallied by 54 basis points combined on June 10 and June 13—the largest two-day increase since 2008 (the white bar on the right side of the chart below). As a result, panic percolated throughout the bond market.

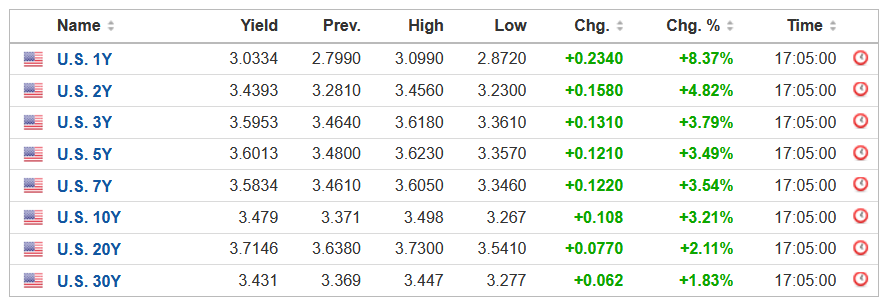

Likewise, the drama continued on June 14, as U.S. Treasury yields increased across the board. Thus, investors have taken front-running the Fed to a whole new level.

Source: Investing.com

Furthermore, the U.S. 10-year Treasury yield continued its ascent, and I warned on Apr. 20 that more carnage would unfold. I wrote:

Plenty of technical damage has been done, and the data could be used to support higher bond prices and lower long-term interest rates. However, even if oversold conditions elicit a short-term rally, the medium-term fundamentals remain intact.

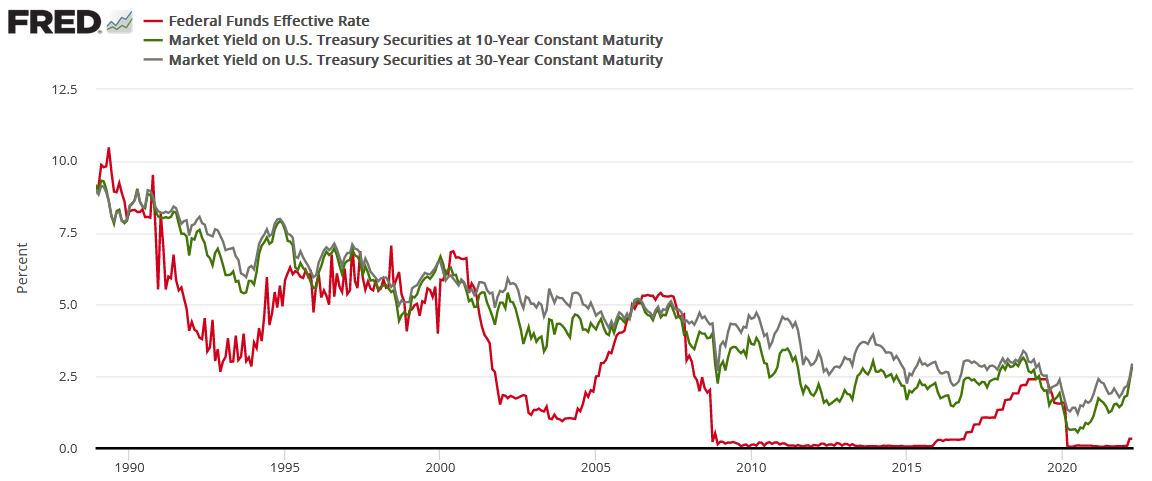

The red line above tracks the U.S. federal funds rate, while the green and gray lines above track the U.S. 10-Year and 30-year Treasury yields. If you analyze the connection, you can see that the latter two often take their orders from the former. In a nutshell: when the Fed raises interest rates, it takes several hikes of 0.25% before long-term yields rollover. For example:

- In 2018, the U.S. 10-Year Treasury yield peaked after ~9 rate hikes.

- In 2006, the U.S. 10-Year Treasury yield peaked after ~17 rate hikes.

- In 2000, the U.S. 10-Year Treasury yield peaked after ~7 rate hikes.

- In 1994, the U.S. 10-Year Treasury yield peaked after ~12 rate hikes.

For context, I'm prioritizing the U.S. 10-Year Treasury yield because its real yield is what we use to value gold. However, if you focus your attention on the red and gray lines above, you can see that the 10-and-30-year nominal yields have a tight relationship. As a result, it's an ominous medium-term sign for TLT.

Thus, with modern history showcasing that the U.S. 10-Year Treasury yield doesn't peak until the Fed is well within its rate hike cycle, please remember that the Fed has only hiked once. Therefore, with seven rate hikes as the minimum to elicit a peak over the last ~28 years, the U.S. 10-Year Treasury yield should have room to run, and this is bullish for real yields and bearish for gold.

As such, with the prediction proving prescient, the Treasury benchmark has behaved as expected.

In addition, iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) has gone in the opposite direction:

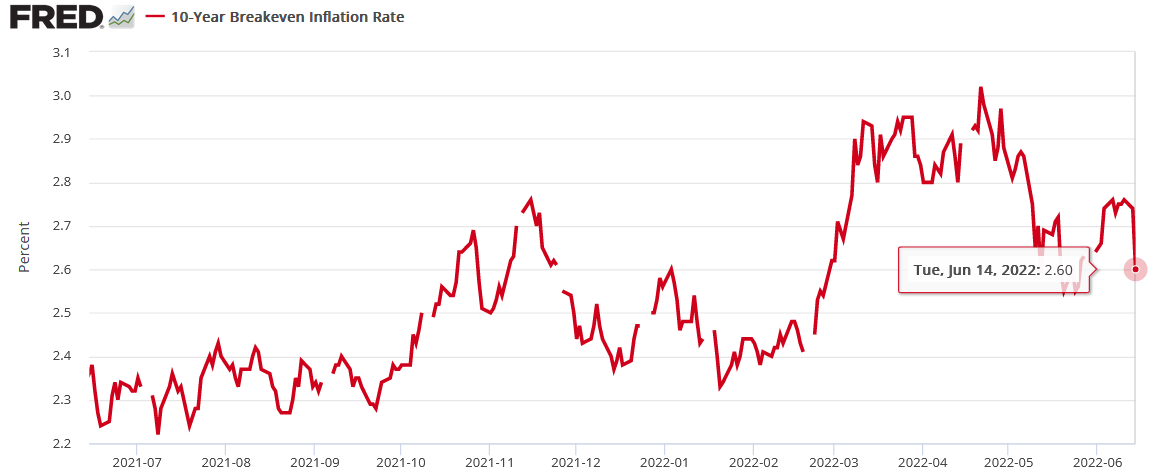

More importantly, the U.S. 10-Year breakeven inflation rate has also suffered amid the hawkish re-pricings, ending the June 14 session at 2.60%.

Therefore, the U.S. 10-Year real yield hit another 2022 high of 0.89%, and the PMs’ medium-term fundamental outlooks remain profoundly bearish.

Also, the tremors in the bond market matter because they spread throughout the real economy. Thus, the implications of higher interest rates should help underwrite the next U.S. recession.

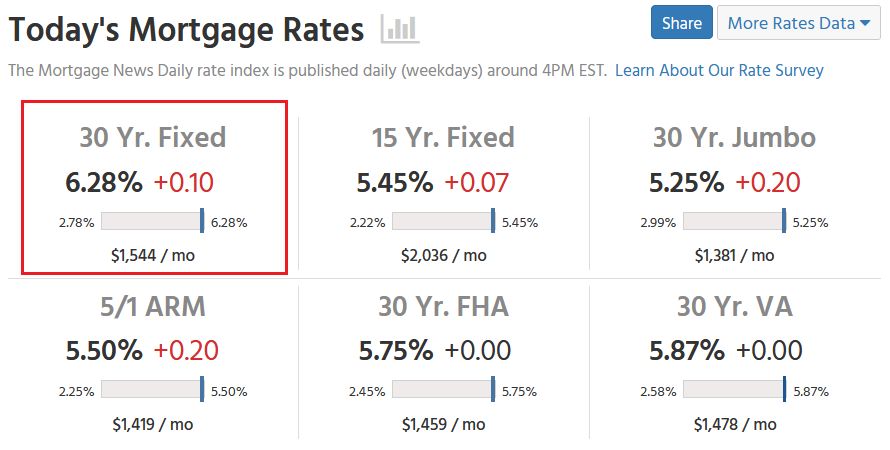

Case in point: Mortgage News Daily reported on June 14 that the 30-year fixed mortgage rate “moved above 6% yesterday for the first time since 2008.”

Moreover: “Today was just an addendum by comparison, but an unpleasant one in which rates moved even higher into the 6% range” the report stated. “The average lender is quoting top tier 30-yr fixed rates in the 6.25-6.375% range.”

Source: Mortgage News Daily

In addition:

“The fate of the current trend will be determined by the Fed tomorrow – at least in the short term. There are several avenues through which the Fed could surprise the market, but it's worth noting that some of those surprises could be good for rates as well. Either way, expect a substantial amount of volatility tomorrow afternoon starting at 2pm.”

Inflation And More Inflation

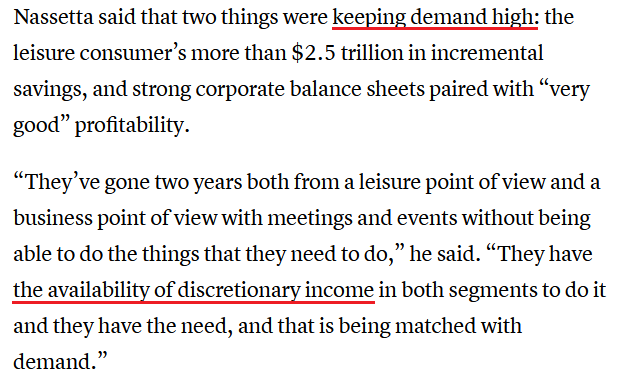

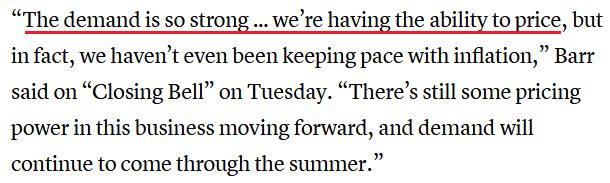

While I’ve been warning for months that inflation would showcase its might, investors have awoken to the harsh realities. Moreover, Hilton Worldwide Holdings (NYSE:HLT) CEO Chris Nassetta said on June 9 that the hotel chain will “have the biggest summer we’ve ever seen in our 103-year history this summer.”

“The price has gone up for everything, so we’re not different than when you go to a gas pump or the grocery store or any other aspect of life; it’s discretionary.”

Moreover, while I warned on numerous occasions that U.S. consumers were in better shape than many predicted, Nassetta noted that demand for accommodations is fueling the price increases.

Source: CNBC

Likewise, Marriott International (NASDAQ:MAR) CEO Tony Capuano added that over Memorial Day weekend the company’s revenue per available room increased by ~25% versus 2019.

“I think as long as we’re delivering on service, which can be challenged in markets where labor is difficult, we continue to see really remarkable pricing,” he said.

Making three of a kind, InterContinental Hotels Group (NYSE:IHG) CEO Keith Barr said robust demand should fuel more price increases in the summer months.

Source: CNBC

Therefore, while I continuously warned that market participants underestimated the demand side of the equation, they’re waking up to the reality that inflation won’t abate on its own.

As a result, the ball is in the Fed’s court, and we know how it usually ends.

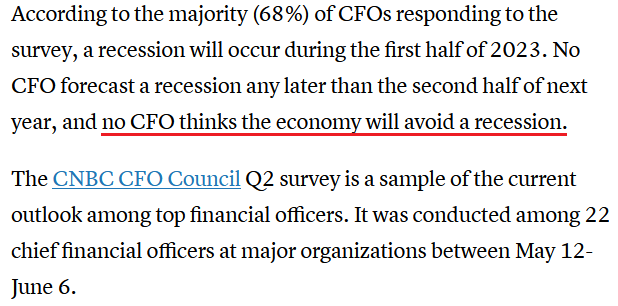

To that point, CNBC released its CFO Council Survey on June 9. An excerpt read:

“Over 40% of chief financial officers cite inflation as the No. 1 external risk to their business” and “almost one-quarter (23%) of CFOs cite Federal Reserve policy as the biggest risk factor.”

As a result, our analysis is now the consensus.

Source: CNBC

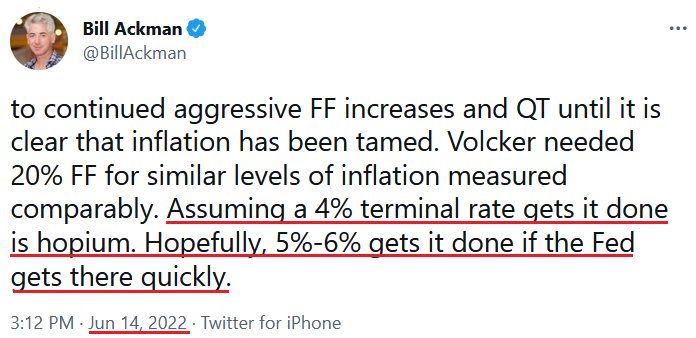

On top of that, I noted previously that billionaire hedge fund manager Bill Ackman shares our view of how demand destruction eventually cools inflation.

In a nutshell: the Fed must do the heavy lifting, as patience will only embolden commodity investors and exacerbate the inflationary spiral.

Furthermore, Ackman added on June 14 that:

“The [Fed] has allowed inflation to get out of control. Equity and credit markets have therefore lost confidence in the Fed. Market confidence can be restored if the Fed takes aggressive action with 75 bps tomorrow and in July, and a commitment to continued aggressive [federal funds rate] FF increases and QT until it is clear that inflation has been tamed.”

As a result, while I’ve long warned that nearly 70 years of data shows the U.S. federal funds rate needs to rise above the year-over-year (YoY) percentage change in the headline Consumer Price Index (CPI) to curb inflation, Ackman expects a similar outcome.

A Potential Short Squeeze

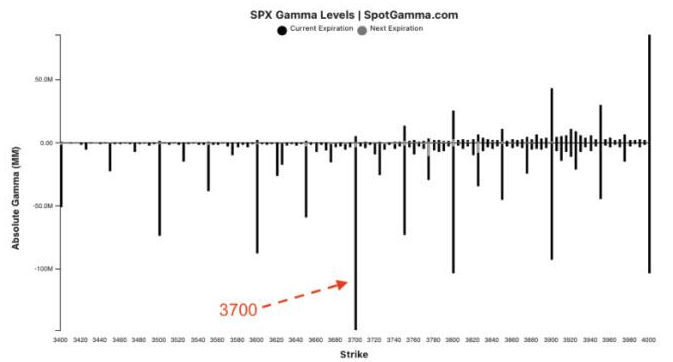

With the recent carnage across the financial markets rattling the bulls, sentiment and positioning are extremely stretched. Therefore, while a ‘sell the rumor, buy the news’ event may unfold, it’s prudent to stay focused on the S&P 500 and the VanEck Junior Gold Miners ETF's (NYSE:GDXJ) medium-term downtrends.

For example, a heavy dose of S&P 500 put options expire on June 17, and dealers may want to push the market higher to avoid paying out. Moreover, SpotGamma notes that 3,700+ is where most strike prices land, so a short-term squeeze reduces dealers’ potential losses.

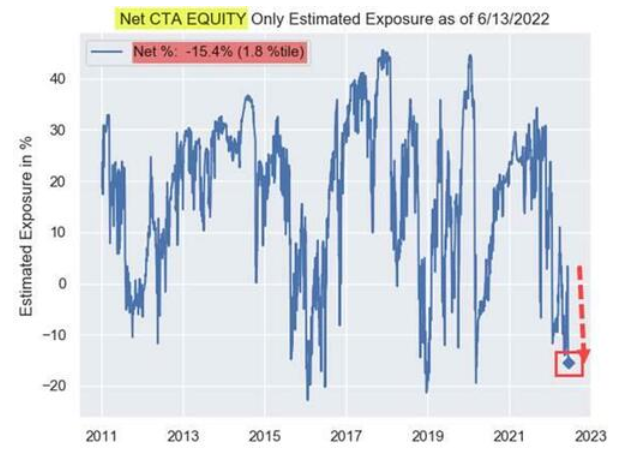

Second, Nomura's Cross-Asset Macro Strategist Charlie McElligott noted that CTAs (quite often quant investors) have estimated net-short positions near the low-end of the historical range. As a result, the algorithms could cover and fuel a short-term spike.

Source: Nomura

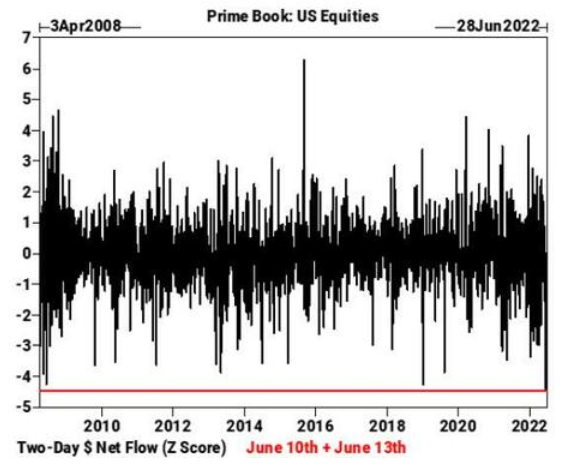

Finally, the liquidation frenzy (margin calls) that erupted recently coincided with hedge funds going on the largest two-day selling spree on record. If you analyze the chart below, you can see that Goldman Sachs’ prime brokerage data shows the z-score of combined net dollars sold on June 10 and June 13 exceeded the sell-off following the collapse of Lehman Brothers in 2008.

Thus, while it’s far from a sure thing, it’s prudent to note how these variables may impact the short-term price action.

Source: Goldman Sachs

The Bottom Line

Volatile moves in interest rates have the potential to turn day into night. Moreover, when earthquakes cause sharp swings in asset prices and mortgage rates, we move closer to a U.S. recession.

Therefore, while liquidations alone are profoundly bearish for the PMs, the U.S. 10-Year real yield has become unhinged, and the USD Index is gunning for new 2022 highs. As such, storm clouds are growing darker by the day.

In conclusion, the PMs declined on June 14, and the GDXJ ETF underperformed once again (and profits on our short positions increased once again). Moreover, while positioning and sentiment may elicit a short-term relief rally, Fed Chairman Jerome Powell could channel a more hawkish tone and create the opposite.

Either way, while the day-to-day is extremely difficult to predict, the S&P 500 and the PMs should confront lower prices in the months ahead.