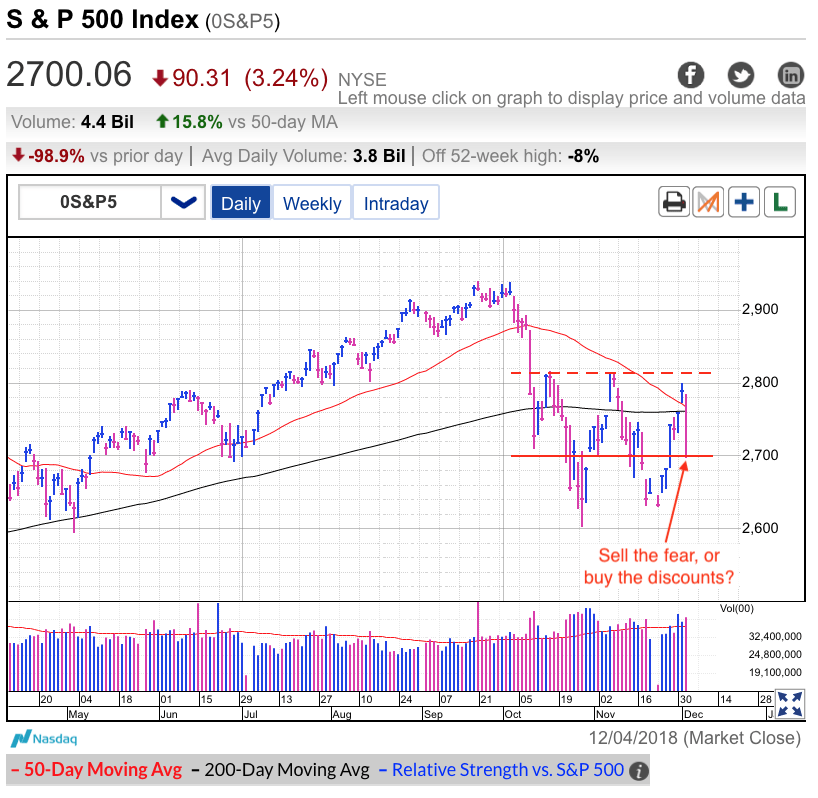

In the market, a lot can happen in a few days. My last free blog post was last Thursday after the S&P 500 smashed through 2,700 resistance. A buying frenzy pushed prices up to the 200dma after the Fed Chairman suggested interest rates were approaching his neutral target.

But rather than cheer those gains, I cautioned readers in that post from last week:

The market was a great buy Monday and Tuesday. But risk is a function of height and Wednesday’s large gains make buying now a lot less attractive. A big chunk of Wednesday’s buying came from chasing and short-covering. Those are both fleeting phenomena and now that they’ve come and gone, we need another group of buyers to come in and push us higher. Unfortunately, many of those with cash remain nervous, especially following such a large move higher. Their fear of heights will likely keep a lid on prices for a few days. And even a dip back to 2,700 wouldn’t be a surprise. Two steps forward, one step back.

While I expected this step-back, even I was caught off guard by the speed with which it happened. But even that isn’t a surprise. The market operates in two speeds, infuriatingly slow, or breathtakingly fast. This time the hivemind got together and turned the last few days of frenzied buying into a mad dash for the exits. Easy come, easy go.

While it was nice to see this weakness coming and prepare for it, that was then and this is now. What readers really want to know is what comes next.

Stock prices popped Monday after Trump and China reached an agreement this weekend to de-escalate the trade war. But that relief proved fleeting as traders started analyzing the details. The primary catalyst for Tuesday’s collapse was Trump disclosing the strings attached to his pledge to not increase tariffs on Chinese imports. The shine further wore off when Trump reiterated his pledge to impose tariffs if the Chinese didn’t make substantial concessions. That sent risky stocks tumbling and safe-haven bonds soaring. So much for the relief.

But the thing we have to ask ourselves is if Tuesday’s collapse was lead by rational and thoughtful selling, or if it was nothing more than herd selling because people sold for no other reason than other people were selling.

There are few, if any, 3.25% declines that are led by rational and thoughtful selling. Today was no different. We opened near yesterday’s close and slipped to normal losses by lunchtime, but slipping under Friday’s close triggered an avalanche reactive stop-loss sell orders that didn’t stop until we shed another 60-points. As I wrote previously, 2,700 was a key support level and the market found support and bounced off that critical level in afternoon trade. Unfortunately, the bounce proved fleeting and we closed right back at 2,700 on the nose.

The market is closed Wednesday in observance of a national day of mourning for President George H.W. Bush. No doubt the inability to trade Wednesday caused many would-be dip-buyers to sit on their hands knowing they would be unable to trade for a day and a half. Better safe than sorry. But the other thing this extra day off does is give traders a chance to collect themselves and decide if they really want to be selling these discounts, or if they should be buying them instead.

I expect global stocks to get hammered Wednesday as the world reacts to the U.S. market collapse. But after that, expect cooler heads to prevail. As I’ve been saying for a while, this is a volatile period for stocks. That means we large moves in both directions. But so far those wild gyrations have been consolidating October’s losses, not extending them. There is no reason to think this time is any different.

Trading so close to 2,700 support means there is a good chance we will violate it. But as long as the selling stalls and bounces not long after, that tells us most investors would rather buy these discounts than sell them.

I bought the Thanksgiving massacre and sold the frenzied relief rally up to 2,800. And I will do the same thing again this time. If impulsive traders want to keep giving away free money, I will gladly continue taking it.