Venture capital (VC) has played a crucial role in the growth of the digital asset industry over the past two years.

According to data from Pitchbook, VC investments in crypto skyrocketed in 2021, reaching $25.1 billion, which is a sevenfold increase compared to 2020’s $3.4 billion. And while 2022 in crypto was not for the faint of heart, crypto VC’s still managed to deploy a record high of $26.2 billion.

Across the board, valuations on practically all projects rose significantly during the 2020-2021 bull market, but as the market contracted throughout 2022, VC’s also started to see valuations of investments taking a heavy nosedive.

This was of course fuelled by the changes happening in the surrounding macroeconomic picture where a shift in economic and fiscal policy started to greatly influence the economy. And to top things up, the crypto domain suffered greatly in the wake of the industry-specific implosions happening with FTX and TerraLuna.

Crypto VC Funding Resilient Amidst 2022’s Bear Market

Seasoned crypto professionals are well aware that the cyclical bear markets are not something for the faint of heart, and that valuations cut in half or even worse are well within the norm of an ordinary bear market. Regardless, 2022 stands out as one of the toughest years for crypto to stomach since its inception.

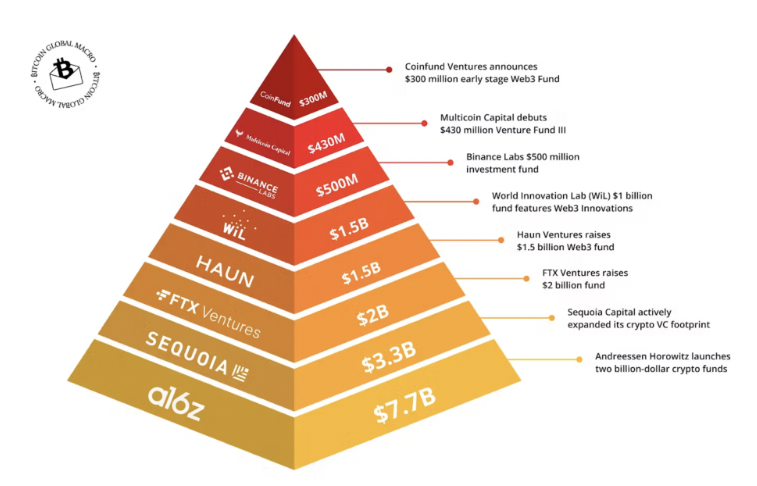

Nonetheless, the VC market still witnessed some action. Several big players in the industry such as Andreessen Horowitz (a16z) and Sequoia Capital launched billion-dollar funds dedicated to Web3, DeFi, NFTs and the metaverse. Many other funds had similar success in their funding rounds.

Below is a chart that summarizes some of the biggest crypto VC raises from 2022.

But even with so much fresh funding available for venture capitalists, most crypto VCs were caught up in an industry that had been plagued by a deteriorating macro environment and idiosyncratic disappointments within the industry itself.

The Venture Capitalists that understand risk were better off

However, what’s particularly worth noting is that VCs who were keen on their risk management strategies performed better than those who took asymmetrical bets and ended up with too much exposure in crypto projects that went under.

For instance, in the Luna fiasco, one of the leading crypto VC Pantera Capital reported up to a 100-fold return from their initial investment. The firm initially allocated $1.7 million in Luna and managed to sell 87% of the investment between January 2021 and April 2022, translating to an overall return of $171 million.

According to Pantera Capital’s co-chief investment officer, Joey Krug, the main reason for gradually reducing their exposure was to manage their risk and avoid having “a super large portion of the fund in one position”.

Another top VC that dodged the Luna bullet is CMCC Global, one of Terra’s seed investors in 2018. The company’s founder, Martin Baumann, told CNBC that it exited the Luna position two months before the May collapse, mainly because of regulatory concerns and the technicality of the UST stablecoin.

“As opposed to asset backed stablecoins, which are derivatives of existing USD in circulation, UST was effectively increasing the money supply of USD in existence. We figured, while an interesting concept, regulators would not tolerate tampering with money supply of the USD,” noted Baumann.

Who Bite the Dust?

On the contrary, there are many institutional investors that did not follow risk management procedures as stringent as the aforementioned, and as expected, they did not weather the storm equally well.

Most obvious examples are of course Alameda Research and Three Arrows Capital (both leading crypto hedge funds at the last cycle high). 3AC was among the first companies to be affected by Luna’s collapse. The now insolvent fund had invested $200 million in Luna tokens in February 2022, all of which became worthless when Luna collapsed in May. We now know that the now defunct Alameda Research was probably caught in the rain about the same time.

Multicoin Capital, a prominent name in the crypto VC space, was also caught off guard in the market chaos witnessed last year. While Multicoin Capital successfully dodged Luna’s implosion, it took a heavy hit from FTX’s collapse in November 2022. According to a copy of Multicoin’s yearly investor letter, the firm incurred a 91.4% impairment loss, mainly from its exposure in FTX-related tokens such as FTT, SOL and SRM.

It should be obvious to any observer of these markets that as prosperous as the waters may be, as deadly can they become once the tide turns, and it is likely that those who care most about managing risks are the ones who persevere on the longer haul.

Crypto VC fund directions in 2023

As expected, crypto VCs have become more selective following the events that rocked the industry last year. However, activity has slowly been picking up, with February recording $872 million in VC investments, a 54% increase from January’s $574 million.

But more interesting are the developing investment themes; speaking to Coindesk, Pantera’s Capital, Joey Krug, noted that the firm is particularly interested in the growth DeFi, especially following the rise of Layer-2 chains that have improved usability, reduced transaction costs and have the potential to attract more liquidity.

We also spoke with Benjamin Hovarth, a partner at Blockchain Founders Fund, which recently raised $75 million to support potential Web3 startups in the pre-seed and seed stages.

Hovarth observed that it is reasonable to anticipate more solutions that operate within regulatory acceptance, such as KYC/AMLA tools, permissioned blockchains, and centralized exchanges.

“There has been a renewed interest in decentralized stablecoins, currency mixers, privacy enablers, and DEXs. We expect this trend to continue moving forward and be one of the primary catalysts for the next bull run” Hovarth added.

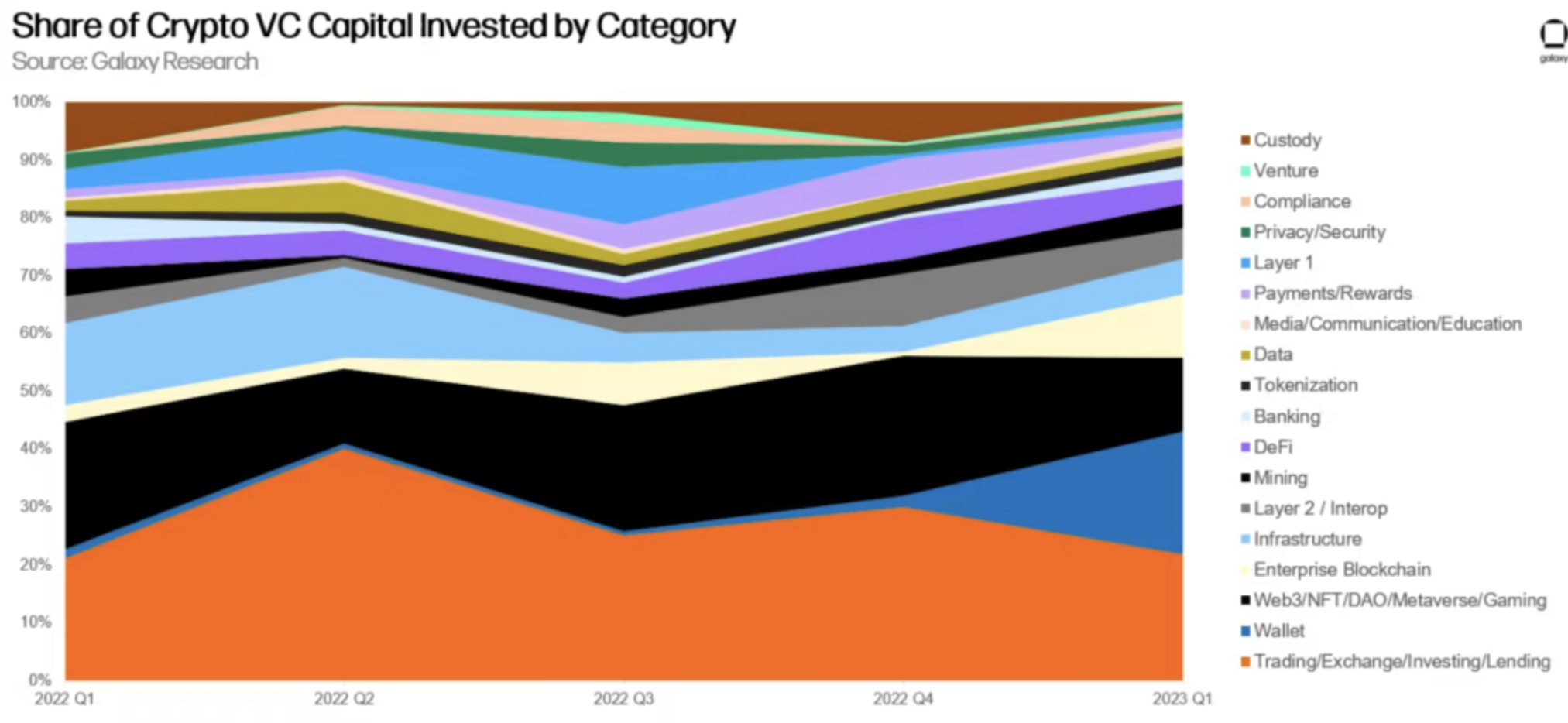

Crypto VCs in 2023 seem to be focused on investing in areas that had already shown significant potential prior to the recent market downturn. This trend is reflected in the Q1 2023 VC report by Galaxy Research, which indicates that trading, exchange, investing, and lending crypto startups received the most funding, accounting for 22% of all money raised, followed by wallet infrastructure, which received 21% of all funding.

At the same time, startups developing in the Web3, NFT, DAO, Metaverse, and Gaming space recorded the highest number of deals. This suggests that while investors may be prioritizing more established segments in terms of funding, they are also continuing to explore and support emerging trends and technologies in the crypto space.