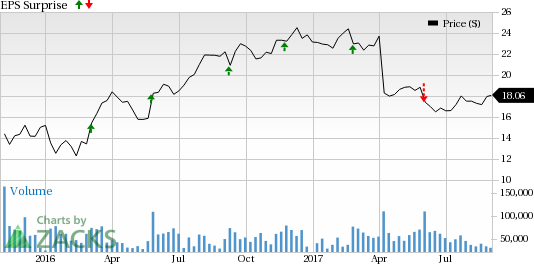

Hewlett Packard Enterprise Company (NYSE:HPE) is set to report third-quarter fiscal 2017 results on Sep 5. The company posted a negative earnings surprise of 28.6% in the last quarter. Notably, Hewlett Packard has a mixed surprise history, beating the Zacks Consensus Estimate twice, missing the same in one occasion and matching in the other. It has an average negative earnings surprise of 4.4%.

Factors to Consider

Lower demand for servers at the enterprise and SMB segments due to the presence of virtualization and cloud options makes us slightly cautious about Hewlett Packard’s near-term prospects. Notably, per the latest report from Gartner and IDC, server shipments declined for the fifth straight quarter in first-quarter 2017.

The declining trend in server shipments has been hurting Hewlett Packard’s revenues. It should be noted that per Gartner’s report, the company witnessed a year-over-year fall of 15.8% in server revenues and 14.3% in shipments during first-quarter 2017.

Moreover, citing preliminary statistics, Gartner, last month, hinted that server shipments may register another fall in second-quarter 2017. Therefore, we are concerned that the company’s to-be-reported quarterly results will be adversely affected by this persistent decline.

Furthermore, elevated commodities pricing and execution issues remain a major headwind, which are likely to thwart the company’s overall performance in the near term.

Also, macroeconomic challenges and tepid IT spending remain near-term concerns. Competition from peers adds to its woes.

Earnings Whispers

Our proven model does not conclusively show that Hewlett Packard will likely beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. This is not the case here, as you will see below.

Zacks ESP: Earnings ESP for Hewlett Packard Enterprise is -0.87%. This is so because the Most Accurate estimate of 25 cents is a penny lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Hewlett Packard carries a Zacks Rank #3. Though this increases the predictive power of ESP, the company’s negative ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock that Warrant a Look

Here are a couple of stock you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez Inc. (NASDAQ:ZUMZ) , scheduled to release earnings on Sep 7, currently has an Earnings ESP of +16.67% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Navistar International Corporation (NYSE:NAV) , expected to release earnings on Sep 6, currently has an Earnings ESP of +25% and a Zacks Rank #3.

G-III Apparel Group, LTD. (NASDAQ:GIII) , expected to release earnings on Sep 6, currently has an Earnings ESP of +4.76% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Navistar International Corporation (NAV): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post