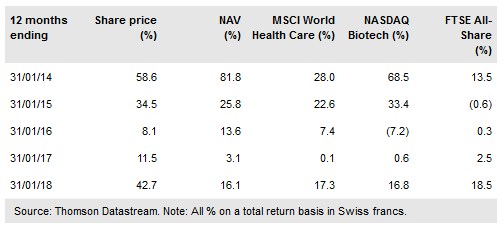

HBM Healthcare Investments (SIX:HBMN) reported profits of CHF72m for the third quarter of its financial year, buoyed by the takeover of long-term holding Advanced Accelerator Applications (AAA). The Switzerland-based fund invests globally in public and private healthcare companies and private equity funds, and is working to build its private company exposure back up towards long-term average levels following a strong period of IPOs and trade sales. The managers take a risk-aware approach to what can be a volatile sector, and have been taking profits on the back of clinical successes, as well as hedging c 20% of the listed equity exposure through a short position in an ETF tracking the NASDAQ Biotechnology index. The discount to NAV has narrowed in line with the general trend for investment companies, but remains wider than those of peers whose sole or main focus is listed equity markets. HBMN’s shares currently yield 4.3%.

Investment strategy: Long-term, risk-aware approach

HBM Partners’ investment professionals, most of whom have scientific backgrounds, are organised into two teams covering private and public healthcare companies globally. The managers use their extensive networks to source investments in early- and later-stage companies and private equity funds, diversified by clinical focus and geography. Many of the holdings in the public portfolio began as investments in private companies. Short positions may be used as a means of mitigating volatility in the listed portfolio.

To read the entire report Please click on the pdf File Below: