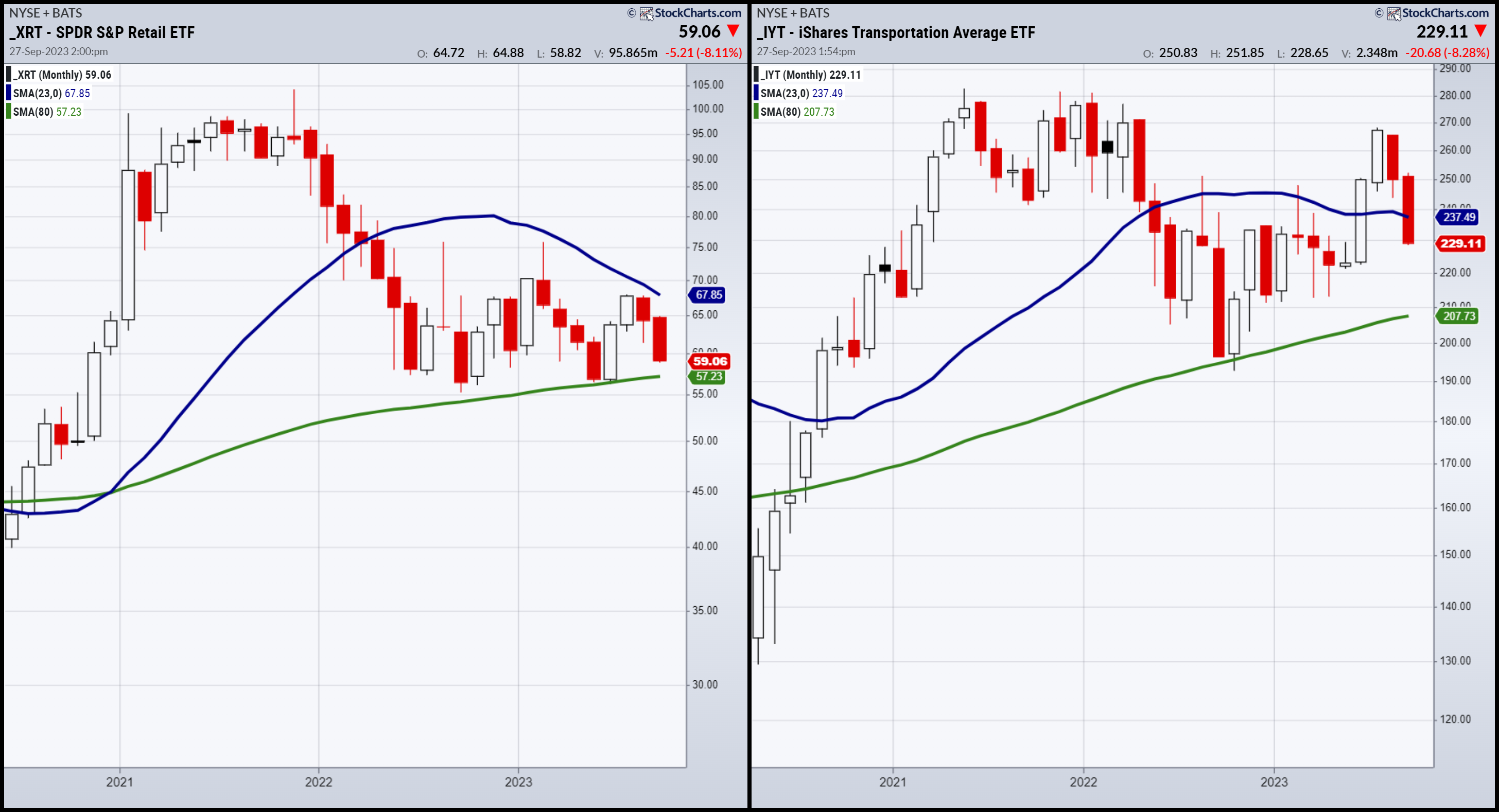

We started this year looking at the monthly charts and the 2 moving averages that depict business cycles.

Back in February, we wrote:

“All in all, the key sectors (retail, transportation) have more to prove especially by clearing the 23-month moving average or 2-year business cycle.

This is a significant level as these sectors proved recession was held off when they both held the 80-month moving average or their 6-7 year business cycle low.

So, after 2021 was a huge up year and 2022 was a huge down year, 2023, if it clears a 2-year cycle, looks way better for the economy and market.”

Subsequently, Retail (XRT) never cleared the 23-month MA while Transportation (IYT) did.

That prevented us from feeling too confident in a sustaining rally with retail weak. However, as you can see, the picture has changed.

Retail XRT threatens the 80-month moving average once again.

Transportation IYT failed the 23-month in September. That gives us two reliable indicators for moving ahead.

Can Retail hold the 80-month MA?

If not, here comes recession.

Or can IYT return over the 23-month engendering more confidence?

Perhaps the small-caps and Nasdaq index can shed more light.

Small-caps (IWM) fell below the 23-month MA after spending only one month above it.

The failure in August to hold above the blue line or 2-year business cycles is a pretty clear sign the higher rates are impacting the Granddaddy of the US economy.

Conversely, NASDAQ QQQ broke above the 2-year business cycle high in May 2023. Price ran from $328 to $388 in 3 months as AI and growth have been the winners for a long time.

This move lower can see a retracement in QQQ back to 328.

Then, so much depends on what happens with IWM XRT and IYT.

Nonetheless, one thing is safe to presume.

If XRT keeps the recession at bay and IYT can rebound back into some expansion, growth will continue to outperform.

And, if XRT indicates a recession is coming and IYT plus IWM fail their 80-month MAs, QQQ may still outperform.

But we would wait for a move down to 275 as the better buy opportunity in that index.

ETF Summary

- S&P 500 (SPY) There are multiple timeframe support levels round 420-415

- Russell 2000 (IWM) 170 huge

- Dow (DIA) 334 pivotal

- Nasdaq (QQQ) 330 possible if cant get back above 365

- Regional banks (KRE) 39.80 the July calendar range low

- Semiconductors (SMH) 133 the 200 DMA with 147 pivotal resistance

- Transportation (IYT) 225 next support

- Biotechnology (IBB) 125 if clears impressive

- Retail (XRT) 57 key support