Banking as a service company Green Dot (NYSE:GDOT) has transformed itself from just a prepaid debit card maker to a fully integrated fintech bank holding company in a few years. Shares are still outperforming the benchmark S&P 500 index. The growth of mainstream digital payment platforms has enabled this company to grow under-the-radar of investors. Convenient access to transfer, receive and use funds has been a staple pandemic play. The Company continues to grow and entrench its brand with major retailers with its whiteboard VISA card serving the underbanked demographic. With holiday shopping season upon us, prudent investors may want to get exposure on this banking as a service (BaaS) play at opportunistic pullback price levels.

Q3 FY 2020 Earnings Release

On Nov. 4, 2020, Green Dot released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an adjusted earnings-per-share (EPS) profit of $0.25 excluding non-recurring items versus consensus analyst estimates for $0.11, beating estimates by $0.14. Revenues grew by 21.1% year-over-year (YOY) to $291.1 million beating analyst estimates of $244.66 million.

The effects of COVID-19 accelerated its BaaS growth but also raised costs for its call centers due to the March 2020 Federal Reserve reduction in short-term rates. Lower marketing expenses were offset by higher partnership revenue share rates and compensation expenses grew by 18% due to incentive programs. The Company has $100 million available with its credit revolver.

Conference Call Takeaways

Green Dot CEO, Dan Henry, expounded on, “unlocking new opportunities and capitalizing on the accelerated shift from cash to digital banking and payments”. The Company is, “seeing benefits from the work-from-anywhere initiative in both cost savings and talent recruitment perspective.”

The Company commenced new partnerships with Intuit (NASDAQ:INTU) and Kabbage. Intuit will leverage Green Dot’s platform to rollout QuickBooks Cash Account service. Kabbage will rollout Kabbage Checking service. The Company plans to deepen their relationships to further penetrate the 30 million small businesses and entrepreneur in the U.S.

The Company also invested and lead the Series A funding round of start-up Gig Wage, which is a fast growing platform for servicing and providing financial solutions for 1099 workers and employers. Green Dot serves as their infrastructure banking partner. Henry reiterated their commitment to partnering with “Select high-impact and high potential companies, meaning they are highly respected brands with very impressive reach.” He teased that they will be announcing a few new partners soon.

They will also be rolling out Go-To Bank next year, which is the new direct-to-consumer bank product. The Company officially launched the wait-list for the Go-To Bank service which targets low to moderate-income consumers and the underbanked population directly.

Raised Full-Year Guidance

Green Dot raised its EPS guidance for full-year 2020 to a range of $1.95 to $2.00 from its $1.60 to $1.70 previous forecast, surpassing consensus analyst estimates for $1.82. Full-year 2020 non-GAAP revenues are projected between $1.175 billion to $1.185 billion.

Partnerships with Major Brands

Green Dot has entrenched itself serving 33 million customers through whiteboard partnerships with major brands like Walmart (NYSE:WMT) , Apple (NASDAQ:AAPL) and Uber (NYSE:UBER). It’s prepaid Visa (NYSE:V) cards dominate the shelves at major grocers like Kroger (NYSE:KR) and convenience stores across the nation.

The rollout of Go-To Bank in 2021 will parlay its network to accelerate growth and further solidify the Company as a dominate fintech that’s been around for two decades. Recently, shares spiked on the rumor of a potential partnership with Amazon (NASDAQ:AMZN). However, that strong spike was followed by a steep sell-off which may deliver prudent investors opportunistic pullback price levels to take exposure.

GDOT Opportunistic Pullback Levels

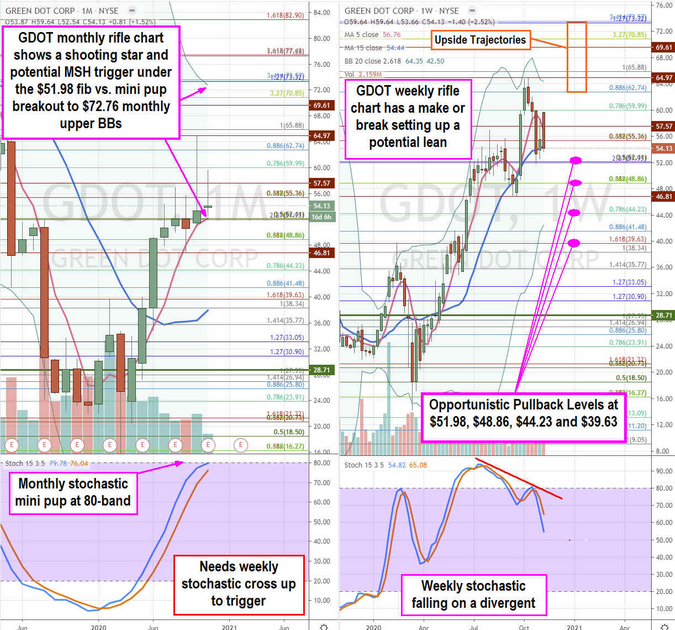

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for GDOT stock. The monthly rifle chart has been in a bullish stochastic mini pup breakout since bottoming in March 2020. The spike to the $64.97 is attributed to the Amazon partnership rumor and has the potential to be a shooting star candlestick reversal. However, the November monthly candlestick body high has already transcended October’s body high. This bodes well for a continuation only after the stochastic reverses back up.

The weekly rifle chart formed a market structure low (MSL) buy trigger above $28.71 in March. The weekly stochastic has peaked twice sequentially at lower bands which triggers a divergent top oscillation down towards testing the $51.98 Fibonacci (fib) level which also overlaps with the monthly 5-period moving average (MA) support. Prudent investors can look to take some exposure into the opportunistic pullback levels at the $51.98 fib, $48.86 fib, $44.23 fib and $39.63 fib. The upside trajectory range is the $62.74 fib to $73.32 monthly upper Bollinger Band and fib level.