As the market capitulation intensifies, Coinbase (NASDAQ:COIN) stock suffers blows caused by its dwindling revenue.

Goldman Sachs has demoted the ranking of US-based crypto exchange Coinbase Inc. to a “sell” rating. The investment banking firm revealed this information in a research report on Monday. Statistics also conveyed the behavioral change from market participants, adding credence to their position.

Crypto Winter Bashes Coinbase

Coinbase shares recorded an 11% drop from about $62 to $56.02 shortly after the announcement. Before this time, the digital currency exchange’s stock had slumped by over 75% since the beginning of the year. This sentiment correlates with the general crypto market, as Bitcoin’s price has also lost more than half its value since January 2022.

Last month, Twitter’s former boss, Jack Dorsey called the crypto exchange a “Casino” after losing 85% of its market cap since IPO. Goldman analyst, William Nance, pointed to the relentless downswing in the crypto market and the slowdown in trading activities. He also emphasized that the trading platform must enforce drastic measures to survive the harsh market conditions.

“We believe Coinbase will need to make substantial reductions in its cost base in order to stem the resulting cash burn as retail trading activity dries up.”

Last year, Coinbase enjoyed the booming crypto market and gained the spotlight in the equities market. The firm’s valuation went as high as $75 billion as Bitcoin price reached an all-time high.

After the rally, the crypto exchange has been inundated with numerous challenges. Given the loss of excitement in the market, trading activity slowed down significantly. The company’s valuation fell by over 81.3% from its peak, slipping below $14 billion.

This drop has translated into shrinking trade volumes and revenues for major crypto platforms, including exchanges. Data indicates that this selloff signals investors’ effort seeking to hedge their losses. In April 2021, Goldman Sachs (NYSE:GS) advised the trading platform on its direct listing.

On-Chain Data Corroborates Coinbase’s Dwindling Trading Activities

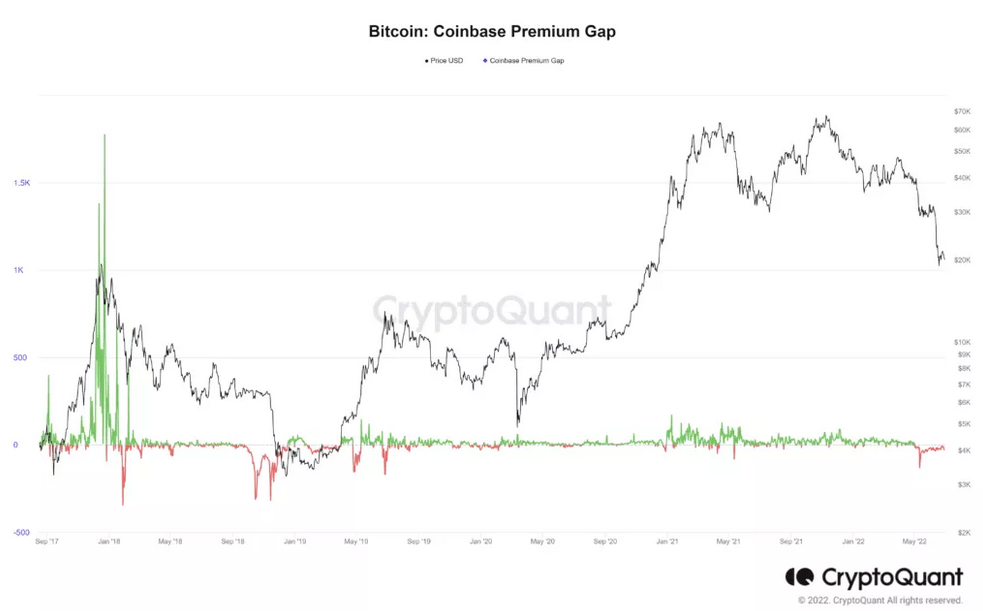

The sour disposition amongst investors has been reflected in the Coinbase premium gap. This metric measures the spread between Coinbase’s BTC-USD pair and Binance’s BTC-USDT pair. A negative premium value indicates weak buying pressure from US investors. On-chain data shows that this value tilted below the neutral level on April 29 and has remained there to date.

Coinbase Premium gap. Source: Cryptoquant

The Coinbase Premium gap fell as low as negative 87.8 before bouncing back to 17, still below the neutral level. The chart reveals that the last two months record the longest stretch with a negative spread.

Most negative premium gaps were in lockstep with a market downtrend. A closer observation reveals that this shift coincided with the price action that dragged Bitcoin price from $38,500 to $21,000. The exchange currently has twenty “buy” ratings, six “hold”, and five “sell” recommendations.

COIN was not spared from the chaos as the company’s stock plunged by 10% following the report from Goldman Sachs. The firm’s analysts dropped expectations of the price target to $45 from $70. Furthermore, the investment bank cited a potential loss of Coinbase’s revenue, stating that it could fall below 60% in the coming months. Trading experts believe darker days may be ahead as they predict that shares may tank further by 20%.

Trading fees constitute almost 90% of Coinbase’s revenue. This condition has left the exchange in a shaky position, as more investors may be looking to close their positions to avoid further losses.

Also, it appears competition may have become another source of concern for the digital asset exchange. Binance US has indicated an interest in latching on to Coinbase’s misfortunes to expand its user base in the United States. Earlier, this formidable rival announced a zero trading fee for BTC and intends to extend it to other cryptos.

After peaking at $353 in November 2021, Coinbase stock prices have suffered a significant loss. This figure hurtled down to the $50 price mark and has remained range-bound on this level. A daily chart of the tech stock shows another 4.78 points loss representing an 8.54% drop. At the time of writing, the COIN was trading at $51.18 and has been undulating within this level since May 11.