Gold hit a price low of approximately $1,140 in early November 2014. Since then it has rallied dramatically, possibly because of global fears about the financial system, the Swiss National Bank removing its peg to the euro, more QE, escalating war in the Ukraine, or simply that gold prices were over-extended and ready to rally.

In my opinion gold reached an important low in November, and in spite of a rising dollar, has rallied since then in dollar terms, and even more in most other fiat currencies.

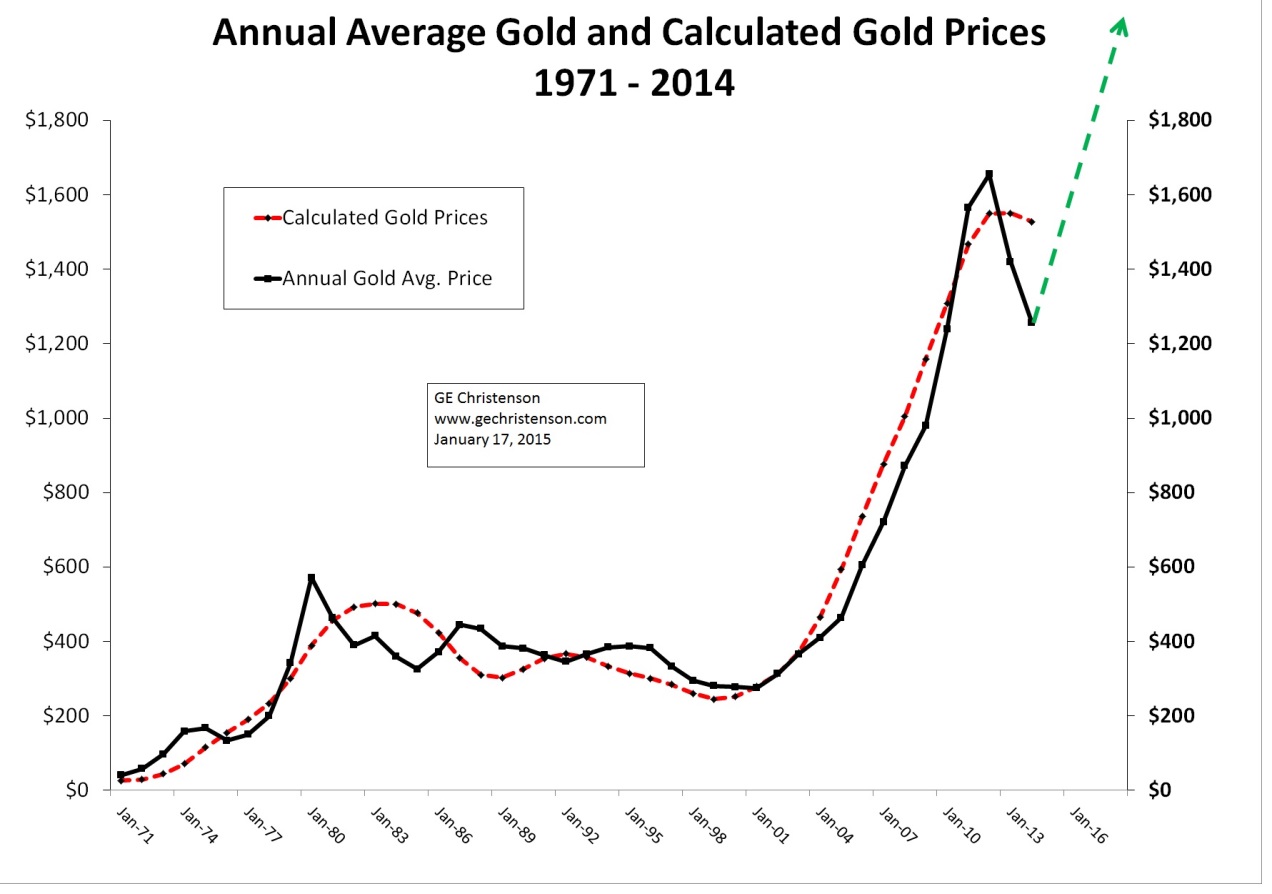

However gold is still undervalued by about 16% according to my long-term empirical model. Further, gold has potential to rally far higher and is likely to overshoot the 2014 equilibrium price of $1,527 calculated by the gold model. Gold could easily reach $2,000 by late 2015 or 2016.

Examine the graph of annual gold prices since 1971 versus the calculated gold prices from the empirical model. The correlation, as calculated by Excel, is 0.98 for 1971 – 2014.

My empirical model begins in 1971 when President Nixon “temporarily closed the gold window,” allowed the dollar to float freely and enabled currency in circulation to increase rapidly. The model uses only three macro-economic variables, which are discussed in detail in my book, “Gold Value and Gold Prices From 1971 – 2021”.

What does the model indicate for the next several years?

Since the model is based on two dominant variables and one minor variable we can ask how those two dominant variables are likely to change in the future. National debt is the first variable and has increased since 1913 at about 9% per year. Since 2008 it has risen approximately 10.0% per year. Based on one hundred years of history and current politics, we can safely assume that the U.S. national debt will continue rising, and that expenses for the United States government will substantially exceed revenues for the foreseeable future.

The second variable is the price of crude oil, which has fallen dramatically in the last 5 months. Many people have suggested that the price of crude will remain low for the balance of the decade and perhaps far longer because of weakening demand. While I understand the weak demand argument, I believe that the price of crude will erratically rise along with total currency in circulation and total debt, as it has since 1971.

Central banks will use their primary tools -- monetizing bonds or “printing money” -- to overcome deflationary influences in the global economic system. Japan has given us an indication of what to expect from central banks in Europe, the United States and Great Britain. In my opinion the current low price of crude, whether due to diminishing demand or price manipulation, is temporary and will increase considerably due to the inevitable rise in global debt and currency in circulation.

The two variables, debt and crude oil, will dominate in the calculation for future gold prices. My conclusion is that gold is still undervalued and that my model projects substantially higher prices for gold through the balance of the decade. The model uses plausible assumptions about increasing debt and the price of crude oil over the next six years and indicates that $5,000 gold and possibly $10,000 gold are reasonable and should be expected. Please note that certain events, such as hyperinflation in the United States, a nuclear war, or even a widening Ukrainian war could easily push the price of gold (in U. S. dollars) far higher than the model indicates.

If central banks fail in their efforts to increase inflation, and the world devolves into a global deflationary depression and possibly a nuclear winter, the dollar price of gold could be unpredictable, but the purchasing power of gold will almost certainly increase as paper assets and fiat currencies crash and burn in a deflationary depression.

In my opinion the deflationary depression scenario seems far less likely given that central banks have a one hundred year history demonstrating both their willingness and ability to devalue their currencies, create inflation, and to drastically increase the total debt and currency in circulation.

Conclusions

The price of gold closed on Friday, January 16 at approximately $1,276. My model indicates that price is still too low by about 16% and therefore the probability is that the price of gold will rally substantially in the next several years.