Most gold bugs agree that owning gold feels fantastic… on days when the price is up. Recent key reports and events have brought increased volatility to the market, and this has surprised a lot of investors.

The Chinese PBOC failed to buy any gold in May. While they typically only buy 15-20 tons each month, the failure to buy shocked futures market traders and they sold in a panic. Savvy Indian citizens likely have bought all the gold the PBOC failed to buy since then, but their action doesn’t get the headline news that the PBOC gets.

The PBOC fiasco was followed a few hours later with the US jobs report. While many gold bugs view this report as questionable at best (and completely fake at worst), the fact remains that it shocked investors and they panicked as gold fell violently, to a price they didn’t expect...

But that price was what I urged everyone in advance to be prepared to buy (the zone of $2300-$2265). Those who were prepared went into buy action with a yawn.

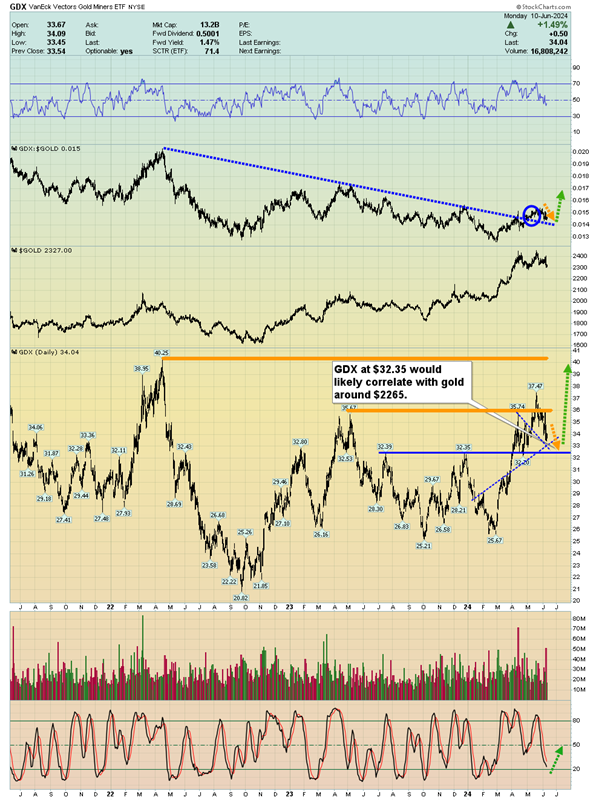

The important daily gold chart. Note the “tactical action” zones highlighted on the chart.

Gold bugs need to act like soldiers who are dealing with endless surprise in a war rather than as analysts in ivory towers trying (and mostly failing) to predict what’s next.

From a tactical standpoint, I laid out $2300 as a buy zone for gold (physical and ETFs) and $2265 for silver and mining stocks. Here’s the reason for the lower buy zone for silver and the mines:

The bottom of the $2300 area support zone is $2280. Highly leveraged hedge funds likely have a lot of stoplosses placed just under this price, while savvy commercial traders will be prepared to buy there.

Gold bugs should follow the commercial traders rather than gold gambler funds and ivory tower predictions.

The bottom line is that because silver and mining stocks are more volatile than gold, investors should show more patience with these before racing to buy.

Tomorrow (Wednesday) brings two more important events. The US CPI inflation report comes out in the morning, and in the afternoon the FOMC decision is announced. Volatility could be intense.

If these two events are bullish for gold, the low for the price likely occurred on Friday with the PBOC and jobs report “fiascos”, but if not, it should happen by the market close on Wednesday.

Regardless, the buy zones are clear, and silver and mining stock enthusiasts can expect to see fast price surges of about 20% from the low.

What about the US stock market? There’s currently a lot of synergy between gold and the Dow.

Gold bugs are wondering what would happen to gold if the stock market fell. The answer depends on why the market would fall. While the main cause of a US stock market tumble appears to be the fade in US growth and the loss of purchasing power of the average citizen…

A more dire (and increasingly likely) scenario would be a huge terrorist attack on US soil. A ceasefire in Gaza appears imminent, and terrorists won’t be happy about it.

About 2000-3000 illegal migrants cross into America each day. It’s likely that some are terrorists who didn’t come to vote blue so they can get free handouts. They probably came to kill innocent Americans, and the ceasefire could see them try to do it.

Regardless, the Aug1-Oct31 period is always the most dangerous time to be invested in the US stock market. All investors should be 100% comfortable buying gold at $2300, but much less comfortable with buying the stock market at Dow 38,000.

Even if there is no terrorist attack, the price action of “Doctor Copper” and other commodities suggests US economic weakness is rapidly intensifying.

Oil has rallied in recent days, but the price action is shaky at best. Both oil and copper stock investors need to show significant patience.

A look at silver. There’s a flag-like rectangular drift in play on this daily chart. Stochastics is almost oversold, and RSI sits in the momentum zone near 50. Gamblers could buy now, but investors should probably wait for a gold price of about $2265.

The important GDX (NYSE:GDX) daily chart. The $32.35 support zone seems to be in sync with a gold price of about $2265.

I refer to the miners as the “gold jewellery” of Western gold bugs. There’s an emotional attachment to miners and potential profit is huge. That profit can only happen if significant patience is exhibited before placing orders to buy. The $32.35 zone for GDX and the $2265 price for gold could be the next ticket to ride, for all investors who feel bold and are ready to handle tomorrow’s Fed and CPI… with a commitment to gold.