Gold Non-Commercial Speculator Positions:

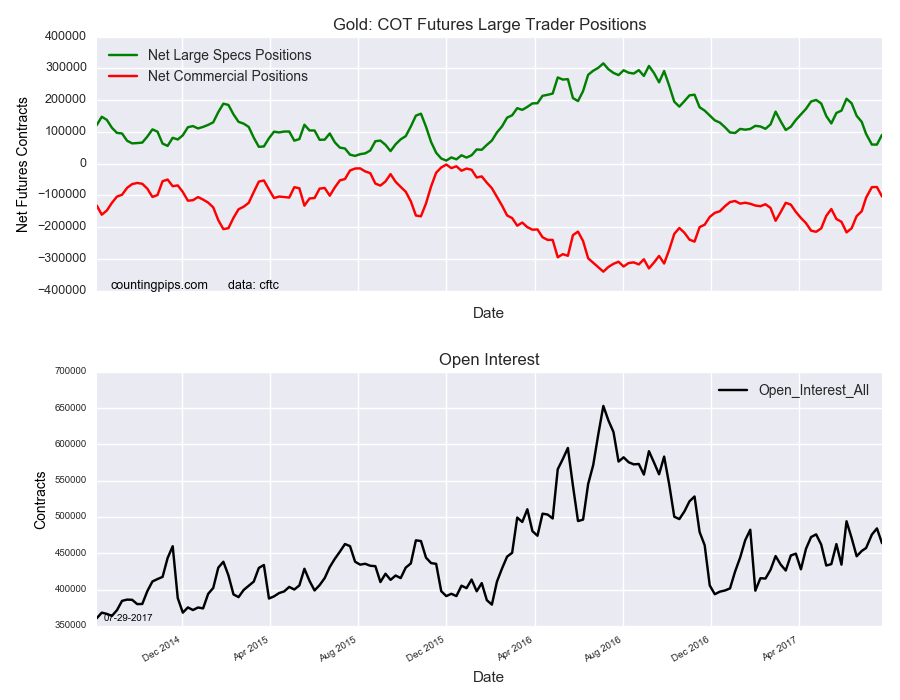

Large speculators sharply raised their bullish net positions in the Gold futures markets this week to a three week high following a decline of six straight weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 90,831 contracts in the data reported through Tuesday July 25th. This was a weekly rise of 30,693 contracts from the previous week which had a total of 60,138 net contracts.

Gold speculative bets had fallen by over -144,000 net contracts in the preceding six weeks before rebounding this week to back over +90,000 net contracts.

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -103,343 contracts on the week. This was a weekly loss of -29,708 contracts from the total net of -73,635 contracts reported the previous week.

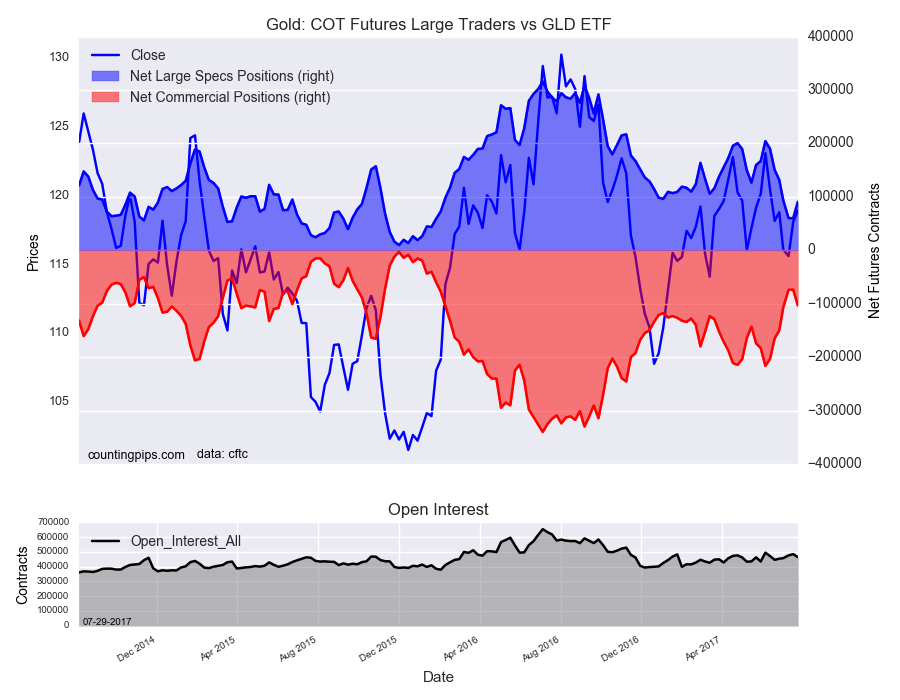

GLD (NYSE:GLD) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $118.92 which was an uptick of $0.81 from the previous close of $118.11, according to unofficial market data.