Gold is listless on Wednesday, continuing a week with little movement. The spot price stands at $1308.60 per ounce in the European session. On the release front, attention shifts to US retail sales data, with the release later today of Core Retail Sales and Retail Sales. The markets are expecting no change from last month's releases, but any surprises could affect the US dollar.

Gold hit a high of $1322 late last week, and has remained above the $1300 level since that time. The precious metal has benefited as the crises in Ukraine and the Middle East continue and could worsen at any time. The US has accused Russia of massing troops on its border with Ukraine, and tensions are high as the EU has slapped stronger sanctions on Russia, while Moscow has retaliated by banning many food imports from the West. In Iraq, Islamic State militants, who continue to make gains in Iraq, have attacked and displaced thousands of ethnic Kurds, which has resulted in a growing humanitarian crisis. US President Barak Obama has authorized air strikes against the militants in order to protect the Kurds and safeguard US interests. The situation in Iraq is volatile and could quickly destabilize even further. In Gaza, nerves are on edge, with a 72-hour ceasefire set to expire on Wednesday night.

In the US, employment indicators are under the market microscope, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate hike is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a rate move. There was positive news on Tuesday, as JOLTS Job Openings continued to improve and climbed to a 13-year high. We'll get a look at Unemployment Claims on Thursday.

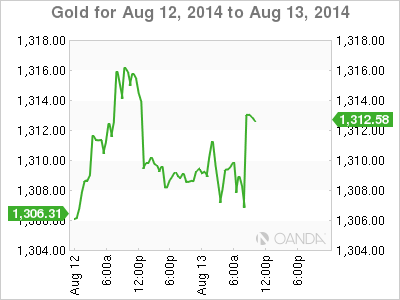

XAU/USD August 13 at 11:30 GMT

XAU/USD 1308.60 H: 1311.31 L: 1306.19

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1252 | 1275 | 1300 | 1315 | 1331 | 1345 |

- XAU/USD has shown very little movement in the Asian and European sessions.

- 1315 is an immediate resistance line. 1331 is stronger.

- 1300 is providing support. 1275 is next.

- Current range: 1300 to 1315.

Further levels in both directions:

- Below: 1300, 1275, 1252 and 1240

- Above: 1315, 1331, 1345 and 1361

OANDA's Open Positions Ratio

XAU/USD ratio is pointing to gains in short positions on Wednesday. This is not consistent with the movement of the pair, as gold is almost unchanged. The ratio continues to have a substantial majority of long positions, indicative of trader bias towards gold breaking out of range and posting gains.

XAU/USD Fundamentals

- 12:30 US Core Retail Sales. Estimate 0.4%.

- 12:30 US Retail Sales. Estimate 0.2%.

- 13:05 FOMC Member William Dudley Speaks.

- 14:00 US Business Inventories. Estimate 0.4%.

- 14:30 US Crude Oil Inventories. Estimate -0.8M.

- 17:01 US 10-year Bond Auction.

*Key releases are highlighted in bold

*All release times are GMT