After scoring impressive gains earlier this year, gold prices retreated in May.

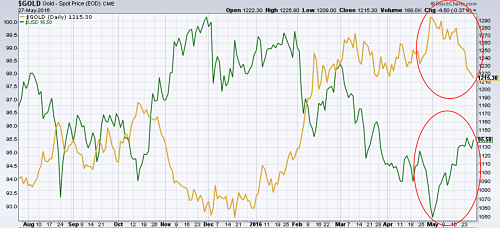

The US dollar strengthened amid new expectations that the Federal Reserve might be more aggressive than expected in raising interest rates. As we can see in the chart below, recent strength in the US dollar pulled gold down in May.

Higher rates in the U.S. usually strengthens the dollar, which is bearish for dollar-denominated commodities, like gold. Moreover, higher rates make it harder for gold to compete as an investment against debts that yield interest. Finally, fears that the global economy is heading into recession have momentarily waned, which didn’t help gold in May.

The recent pullback in gold prices seems normal after the big run seen in Q1, when we suggested that gold would need some time to digest those gains. So what could bring the bullish momentum back to gold?

Definitely not physical demand. Gold is the only commodity wherein physical annual demand is only a tiny fraction of total supply available and shortages of gold caused by physical demand never happen.

Gold investors should pay attention to other factors:

Potential Panic in Stock Markets

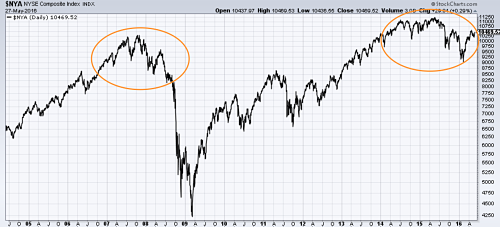

Although stock markets stopped the bleeding in May, there is no guarantee that the worst has passed. Indeed, so far we are just witnessing choppy action. U.S. stock indexes have shown only back-and-forth action for more than a year now.

This market action is typical of a market top. The smarter investors start to sell, while the not-so-savvy investors keep buying. This creates hesitation followed by up and down moves and some sharp declines.

Investors are still skeptical about China’s efforts to change, and with huge debts built up a Chinese recession would have global repercussions. This could trigger a significant sell-off in U.S. equities which, in turn, could bring some safe-haven money back into gold.

U.S. Dollar

Fed officials earlier this year warned that global economic and financial uncertainty posed risks to the domestic economy, which justified a slower pace of rate hikes. In their meeting at the end of April however, the Fed said that those risks had receded, keeping its options open for a rate increase in June.

However, global uncertainties are still there, and it’s yet to be seen if the Fed will actually increase rates two or three times this year as markets now expect. Now that expectations on future rate hikes are high, if they don’t materialize the U.S. dollar could get hit significantly. The dollar might have risen in May on new Fed comments, but those comments are yet to be proven by any real actions.

What This Means For Metal Buyers

Gold prices pulled back in May, but it’s too early to turn bearish on gold. Global stock markets are still troubled and the Fed has yet to prove those promised rate hikes. Gold buyers should keep a close eye on these markets.