The saying “once bitten, twice shy” doesn’t apply to gold bugs.

While it's fairly easy to understand that someone might not try something a second time because of a bad experience the first time around, it’s harder to empathize with the passion of gold bugs, who are bullish about bullion to the point of irrationality.

That said, with gold turning the corner again and attempting for higher $1,800 pricing, it is incumbent upon the average analyst and investor in the precious metals game to suss out the move to determine if it’s a breakout or fakeout.

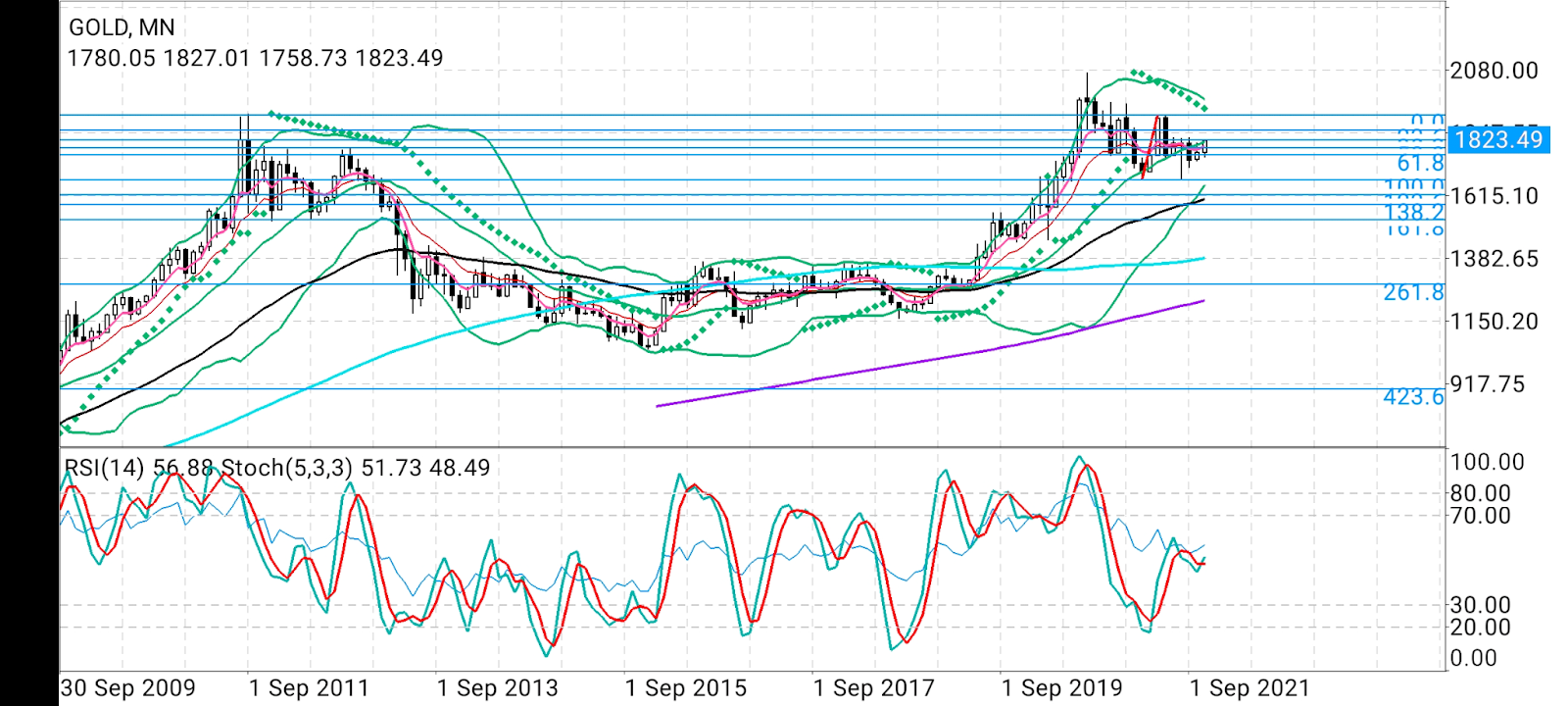

All charts courtesy of skcharting.com

A breakout indicates an upward move that conquers the resistance/ neckline/ selling pressure in gold. And bullion has certainly done that, in a clear snap above the previous $1,700 territory for a fourth day running.

A fakeout, meanwhile, is a market situation indicating an upward move that never materializes, with the opposite happening instead. Gold has done that umpteen times in the past year, often signaling the emergence of higher $1,800 pricing—or even $1,900—before a crash to $1,700 or worse, $1,600 levels.

There are lots of ideas on where gold needs to get to in order to preserve its current momentum, and I hope to draw a cogent picture from the different variables and thoughts in play.

Firstly on the fundamental front, one reason gold has been unable to live up to its billing as an inflation hedge over the past year is due to incessant hype that the Federal Reserve will be forced into an imminent rate hike to cool price pressures which are increasing at their fastest pace in 30 years.

This speculation is what drove US Treasury yields, including the benchmark 10-year note and the dollar constantly higher over the past 12 months, at the expense of bullion.

The good thing for gold longs is that this chatter has been somewhat silenced over the past week by Fed Chair Jerome Powell, who emphatically assured—again—that the central bank will be patient and a rate hike will only come after the middle of 2022 and most likely toward the end of the year.

Powell also maintained that the rate hike and the monthly $15 billion tapering of the Fed’s $120 billion-a-month stimulus won’t be tied to each other. That took the wind out of the dollar, which just on Friday hit September 2020 highs. Interestingly, gold has only reached highs of September 2021 since its breakout last week.

And even with a swoon in both the greenback and US Treasury yields, gold still started out softly in Tuesday’s early trade in Asia, hovering at $1,825. That could indeed change by the start of the New York session. The concern for gold bulls though will be the myriad of resistance spikes in their way, each likely to pose a more formidable test in $1,800 territory.

“The first-off resistance is $1,835 and that needs to be cleared convincingly,” said Phillip Streible, precious metals strategist at Blue Line Futures in Chicago.

“I’m advising my clients to go into options to avoid getting parlayed on the futures. I’m going to need a two-day close of $1,840 and above to tell them to buy.”

Daniel Dubrovsky, who blogs about gold on DailyFX.com, says that with the break of the $1,813–$1,808 resistance on the 4-hour chart, gold has exposed itself to the $1825–$1834 target—right where it was hovering.

“The latter is made up of peaks from July,” Dubrovsky wrote.

“A bullish Golden Cross between the 20- and 50-period Simple Moving Averages may form, opening the door to an upward technical bias. These lines may also come into play as key support in the event of a near-term decline.”

Dubrovsky also noted that according to the IG Client Sentiment that he tracked, roughly 66% of retail traders were net-long gold too.

“Downside exposure has increased by 10.30% and 48.34% over a daily and weekly basis respectively,” he wrote.

“We typically take a contrarian view to crowd sentiment. Since most traders are net-long, this suggests prices may fall. But, recent shifts in positioning are resulting in a bullish-contrarian trading bias.”

Haresh Menghani has a more cautious stance in a blog that runs on fxstreet.com.

“From a technical perspective, last week's sustained break through the $1,800 mark and acceptance above the $1,810 level favors bullish traders,” Menghani wrote.

“Hence, some follow-through strength towards testing a strong barrier, around the $1,832-34 heavy supply zone, remains a distinct possibility.”

“That said, weakness below the $1,800 mark might prompt some long-unwinding and drag gold back towards the $1,780 level en-route to the $1,770 support zone.”

Sunil Kumar Dixit said the next horizontal and static resistance for the spot price of gold, which he based his forecasts on, was in the $1,833-$1,835 area.

“Gold's resolve will be put to test whether it succeeds to sustain above this zone,” said Dixit, chief technical strategist at skcharting.com.

He said spot gold’s short-term daily chart showed an overbought state with a Stochastic Relative Strength Indicator of 95/95.

Added Dixit:

“An ability to adapt above $1,835 should be seen as a green signal for readiness to test the next 23.6% Fibonacci adapted at the $1,860 level.”

“Meanwhile, consolidation and correction can cause some limited downtime aiming at $1,810-$1,800-$1,795, which will be a good value buying.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.