Gold And Silver May Have Finally Topped

The first technical clues came after SPDR Gold Shares (NYSE:GLD) reversed all its incremental gains form the post-Brexit trade. I used that event and other indicators to posit a top for gold in late July. GLD promptly bounced from that support level. A month later, I reiterated the call for a top in gold. And just like the previous call for a top, GLD promptly bounced – soft economic data delivered the surprise at that time. I finally started to wonder whether GLD’s apparent resilience was the bigger story. I was compelled to state the following:

Instead of looking for buyers to prove the bull case, I should be looking for sellers to prove the bear case

I think sellers may have finally proved their case.

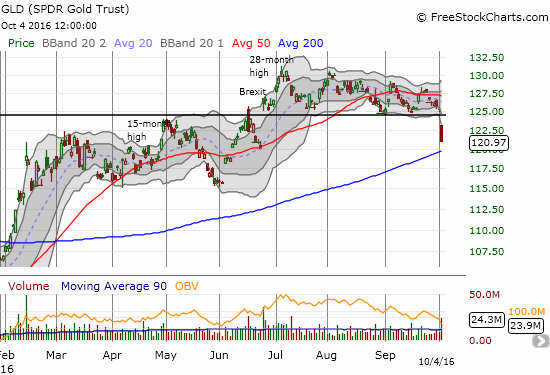

SPDR Gold Shares breaks down through recent support (thick, black horizontal line). As GLD completes a roundtrip from its major post-Brexit gap up, critical support at the 200-day moving average (DMA) looms large.

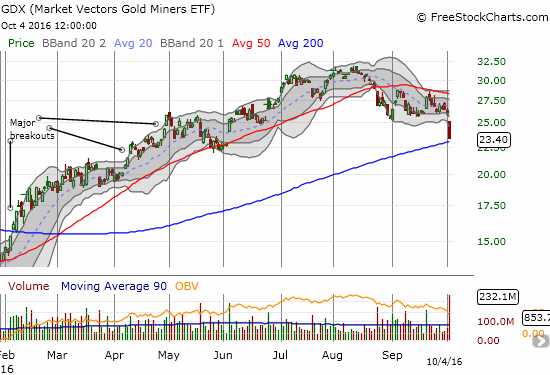

VanEck Vectors Gold Miners ETF (NYSE:GDX) reversed all its post-Brexit gains at the end of August. The current gap down confirms the end of the post-Brexit lift. Like GLD, now the 200-DMA looms large as critical support.

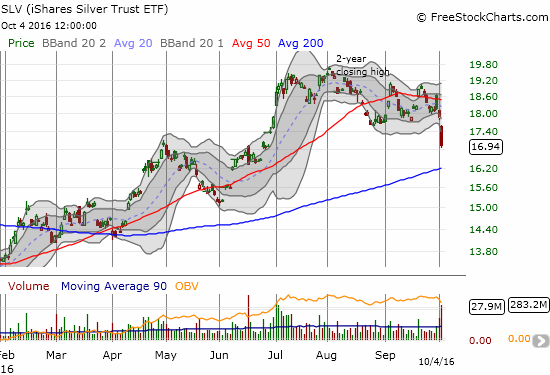

iShares Silver Trust (NYSE:SLV) has not yet reversed all its post-Brexit gains and a test of 200-DMA support is a little further away than the imminent gold-related tests.

The sellers were convincing. SPDR Gold Shares (GLD), VanEck Vectors Gold Miners ETF (GDX), iShares Silver Trust (SLV) all experienced major gap downs in losing 3.5%, 9.9% and 5.2% respectively. For GLD, the gains from the post-Brexit are essentially gone. GDX experienced that same roundtrip a little over a month ago. SLV has not quite finished its roundtrip.

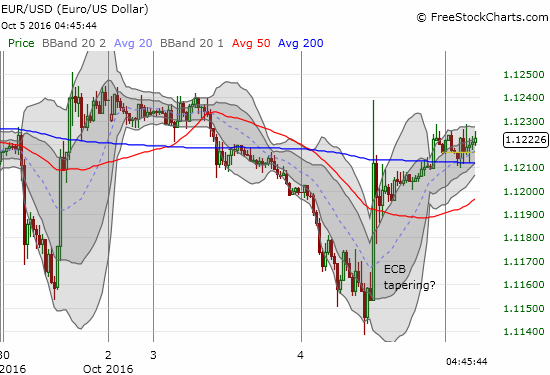

Given the relationship with post-Brexit trading, it is perhaps fitting that rumors from the eurozone provided the current catalyst to complete gold’s roundtrip. The approximate explanation for the sudden and abrupt downshift rested with rumors that the European Central Bank (ECB) is ready to taper its bond purchases. The ECB’s machinery for quantitative easing (QE) has acted like soothing background music: it is now only noticeable by the threat of its imminent absence. The euro also spiked higher on the news, and the move seemingly gave the ECB rumors more credibility. I am using a 30-minute chart to make the pop clear since it came on the heels of a pressing bout of euro selling that hides the move on the daily chart. Interestingly, the momentum ended quickly.

The euro spikes higher on the prospects of the end of easy money from the ECB

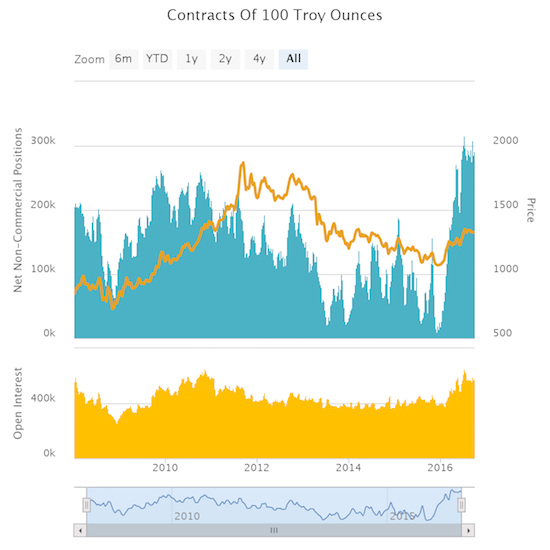

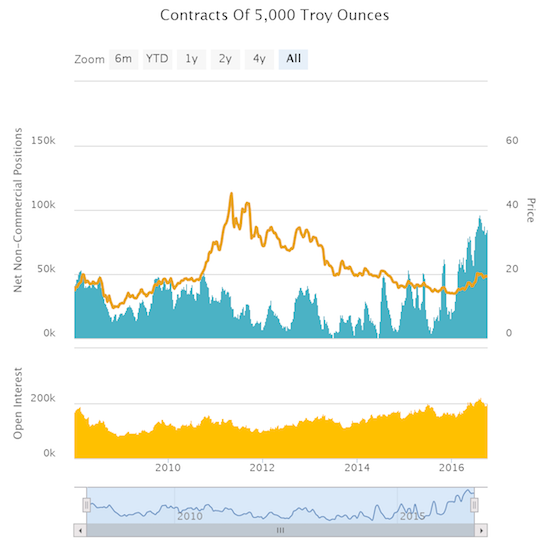

I am very skeptical of this news, especially since the last thing the ECB needs is to give traders yet one more reason to keep propping up the euro. Yet, I am not prepared to trade on my doubts. I am content for now to watch for follow-through and further confirmation of the technical breakdowns. This is an extremely important juncture because, as I have pointed out in several related posts, the long gold and silver trades are extremely crowded. For a reminder, here are the latest charts on speculator positioning. Note the historic levels of net longs, including high open interest levels.

Gold speculators are holding net longs at a level unseen since at least 2008. The surge in gold interest has been the story of 2016.

At one point during the current surge in net long positions in silver, speculators held levels almost double the previous 2008 peak levels.

If speculators take further cues from the technicals, the rush for the exits will continue to grow and likely feed on itself. Note that gold speculators have been roughly holding onto recent peak levels whereas silver speculators have “quietly” backed down a bit for over two months.

Going forward, I am staying committed to my core positions in GLD and SLV per my long-term strategy. My previous calls for a top ended my complementary strategy of speculating around my core position with short-term positions in gold and gold miners. I did dabble in SLV call options as a play in combination with the September Federal Reserve meeting. My profits on that position were very fleeting. The current breakdown have ended any hope of salvaging that position!

Next up, 200-DMA tests.

Be careful out there!

Full disclosure: long GLD, SLV, short EUR/USD