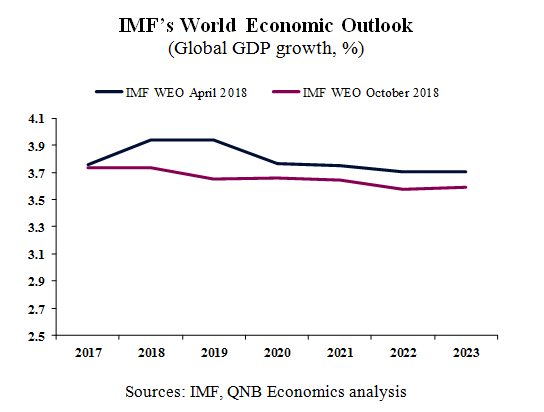

In its latest World Economic Outlook, the International Monetary Fund (IMF) downgraded near-term global growth prospects to 3.7% from 3.9% for both 2018 and 2019. While the new projections still suggest a robust performance, specially when compared to the last decade, the outlook is less promising.Global growth seems to have peaked as downside risks continue to rise and materialize. Additionally, there is less potential for upside surprises and the expansion has become less synchronized across countries. Four key factors contributed to the recent mark down in projections for global activity.

First, recent economic data and key business surveys suggest that the global economy has already begun to lose momentum. The latest global Purchasing Managers Index (PMI) survey, released at the beginning of October, was the weakest in 24 months. While the index of 52.8 is still in expansion territory (above 50), it is below the 53.8 average in 2017. Activity has particularly disappointed in key advanced economies, such as the Euro area and the United Kingdom, where growth projections were downgraded respectively to 2.0% from 2.4% and to 1.4% from 1.6%.

Softer growth in Europe seems to have been caused by both temporary and more lasting cyclical factors, including weather conditions, high levels of sick leaves, industrial strikes, and lower export and investment growth.

Second, to mitigate an overheating of the US economy, the US Federal Reserve has started to tighten monetary policy. Four more 25bp rate hikes are expected until the end of 2019, which would harness US growth from a boom-like 2.9% in 2018 to around 2.5% in 2019, more in line with the estimated potential growth rate of c.2.0%. TheEuro-area growth is expected to cool off more in 2019 as the ECB finally winds down quantitative easing by year-end and mulls a rate hike by end-2019.

Importantly, interest rate hikes in key advanced economies are expected to add pressure to emerging markets (EM) with large external financing requirements. Portfolio capital outflows and the threat of disorderly FX depreciations are already forcing several EM central banks to pro-cyclically tighten their monetary policy settings,reining in growth. In fact, EM growth projections were revised to 4.7% for both this year and next, down from 4.9% for 2018 and 5.1% for 2019.

IMF’s World Economic Outlook (Global GDP growth, %)

Sources: IMF, QNB Economics analysis

Third, higher oil prices are contributing to reduce discretionary spending, weakening consumption and dragging on growth, especially in countries that are net oil importers. As several countries lifted fuel subsidies during the last period of low oil prices in 2015-16, consumers are even more exposed to higher oil prices this time around. Brent crude prices averaged USD55/b in 2017 and USD73/b so far this year.

Fourth, policy uncertainty and trade tensions are high and rising. The Global Economic Policy Uncertainty Index, which measures uncertainty based on newspaper coverage frequency in 20 major economies, is up 76.7% year-to-date and close to an all time high.

The mounting trade dispute between the US and China, the world’s two largest economies, is denting consumer and business confidence. The US has already imposed tariffs on USD 250Bn of Chinese imports with the Chinese retaliating with tariffs on USD 110Bn of US exports. With the US threatening to impose tariffs on a further USD 260Bn of Chinese imports by early next year and talks between the two countries currently stalled, a further escalation is expected. This should create additional pressure on Chinese authorities as they struggle to deliver on their policy targets of fast growth and financial deleveraging. While the IMF maintained its 6.6% projection for growth in China over 2018, the forecast for next year was revised down to 6.2% from 6.4%.

Risks are tilted to the downside. China is the largest contributor to global growth and a ‘harder’ landing in China would likely have knock-on effects in a number of other economies, particularly net commodity exporters and highly competitive Asian exporters of manufacturing products.

The potential for a ‘no-deal Brexit’ and a disorderly exit of the United Kingdom from the European Union next March could further affect growth prospects in advanced economies next year.

On the upside, the US economy is running at full speed and potential surprises to the downside seem rather unlikely. Despite idiosyncratic problems in more vulnerable economies, overall EM growth is set to be healthy and unlikely to change further in the absence of severe shocks. In short, global growth is still robust, but the peak seems to be behind us and risks are mounting.