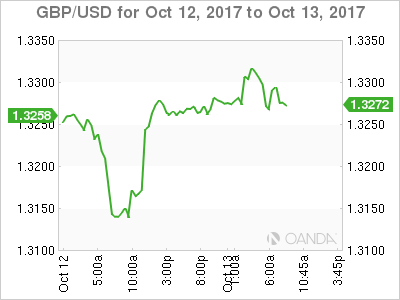

The British pound has posted small gains in the Friday session. Currently, GBP/USD is trading at 1.3291, up 0.18% on the day. On the release front, there are no major British events on the schedule. In the US, we’ll get a look at CPI and retail sales, as well as UoM Consumer Sentiment.

After three losing weekly sessions, the British pound appears to have reversed the trend, and is headed for considerable gains this week. Currently, GBP is trading close to the 1.32 line, up 1.6 percent this week. Still, the currency could face rough waters, as there are reports that that the Brexit talks are deadlocked. British and European negotiators remain far apart on a range of key issues, such as the amount that Britain will pay to the EU when it leaves the European Union.

The sides haven’t discussed this thorny point, but the Europeans have insisted that significant progress must first be made on this issue before they will discuss a new trade agreement with Britain. The Europeans have little interest in rewarding Britain with favorable divorce terms, but this strategy could lead to Britain simply picking up and leaving the club without a deal. With senior British ministers openly divided on how tough a stance Britain should take over Brexit, it will not come as a surprise if the negotiations simply grind to a halt.

The markets remain very optimistic that a December rate hike is on the way, and this sentiment hasn’t changed after the release of the Federal Reserve minutes. The minutes indicated that many policymakers felt that a December hike “was likely to be warranted”. However, some policymakers remain concerned about low inflation levels and said that inflation would be a consideration in their decision on a rate hike.

The odds of a December hike have increased dramatically in the past few weeks, mostly in response to Fed Chair Yellen and other FOMC members expressing optimism that inflation will move upwards. On Wednesday, Kansas City Fed President Esther George went event further, saying that low inflation did not pose a problem, as the US economy was strong and the labor market was at full capacity. Investors will be carefully monitoring Friday’s CPI reports as well as the Fed reaction. Currently, fed futures have priced in a December hike at 87 percent.

GBP/USD Fundamentals

Friday (October 13)

- 8:30 US CPI. Estimate 0.6%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Core Retail Sales. Estimate 0.9%

- 8:30 US Retail Sales. Estimate 1.7%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 95.1

- 10:00 US Business Inventories. Estimate 0.7%

- 10:00 US Preliminary UoM Inflation Expectations

- Day 1 – IMF Meetings

- 10:25 US FOMC Member Charles Evans Speaks

- 10:25 US FOMC Member Robert Kaplan Speaks

- Tentative – US Federal Budget Balance. Estimate -1.0B

*All release times are GMT

*Key events are in bold

GBP/USD for Friday, October 13, 2017

GBP/USD October 13 at 7:45 EDT

Open: 1.3261 High: 1.3224 Low: 1.3247 Close: 1.3291

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3022 | 1.3122 | 1.3224 | 1.3347 | 1.3514 | 1.3514 |

GBP/USD has showed limited movement in the Asian and European sessions

- 1.3224 is providing support

- 1.3347 is the next resistance line

Further levels in both directions:

- Below: 1.3224, 1.3121, 1.3022 and 1.2904

- Above: 1.3347, 1.3444, 1.3514 and 1.3655

- Current range: 1.3224 to 1.3347

OANDA’s Open Positions Ratio

In the Friday session, GBP/USD ratio is showing long positions with a majority (55%). This is indicative of trader bias towards GBP/USD moving to higher ground.