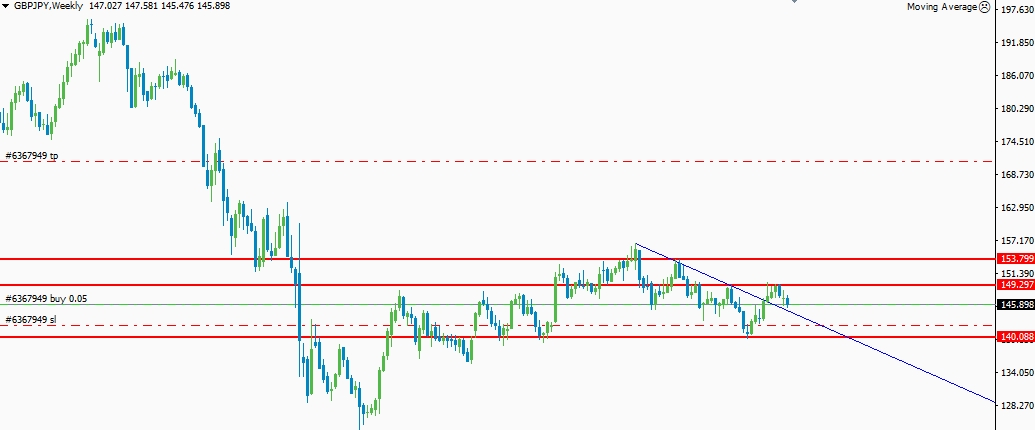

The recent bearish trend of the GBP/JPY pair has come to an end after the pair broke above the medium-term bearish trend line resistance at 146.50. Most of the aggressive traders already went love in the GBP/JPY pair but the long-term conservative traders are still waiting for a clear breakout of the weekly bullish pin bar top at 148.10. A daily closing of the price above the critical resistance level at 148.10 will open the door towards the next major resistance level at 153.79. However, we might see some several retests of the major support level at 145.65(broken trend line support). If the bears manage to clear the critical support level at 145.65, the recent bullish surge will be termed as the false bullish breakout. So, the traders are advised to be very careful while taking long-term trades at the present price action scenario.

GBP/JPY technical chart analysis

From the above figure, you can clearly see the sellers are slowly losing control of this market. The bulls have already created new higher highs in the daily chart which strongly suggest an imminent change in the long-term bearish trend. However, a clear break of the price below the major support level at 140.08 will push this pair significantly lower in the global market. This will eventually lead this pair towards the next major 140.08. This level is going to provide a significant amount of bullish support to this pair and any bullish price action confirmation signal will be an excellent opportunity to execute long orders. However, the weekly closing of the price below that major support level will eventually lead this pair towards the low of 2nd October 2016.

On the upside, we need to clear the minor resistance level at 149.29 to execute fresh long orders in the global market. However, some of the leading analysts of the reputed Forex broker suggest ranging market movement in the upcoming week before we finally see a strong extended movement in the global market. A clear break of the major resistance level at 153.79 will confirm the initial bottom formation at 146.50. Once we have a clear break of 153.79, the bulls will eventually lead this pair towards the next major resistance level at 156.70. This level is very crucial for the long-term buyers and clearing out this major resistance level will require strong positive news in favor of the great British pound. As long as the major resistance level at 156.70 holds, the bears will try their best to drive the price down.

Fundamental factors

Fundamentally, the recent performance of the Great British economy is showing significant improvement after the Brexit loss. The CPI (Consumer Price Index) data of the British economy is also showing great deal improvement in the consumer sentiment. But the price of the GBP/JPY pair is most likely to stay in a confined region this week since we don’t have any high impact news to trigger an extended bullish movement. Most of the senior traders are waiting for BOJ (Bank of Japan) monetary policy statement to execute long-term trend in this market. The low Yielding Japanese Yen is trading significantly higher against most of its major rivals in the global market which strongly suggest the strong performance of the Japanese economy. If the outlook of the Japanese economy reveals the addition of more job sectors, there is a strong chance to see an extended bearish rally in the GBP/JPY pair. However, a neutral statement will eventually refuel the GBP/JPY bulls in the global market.

Considering the technical and fundamental factors, the overall bias for the GBP/JPY pair is still neutral. However, the short-term traders might make some decent profit by executing long orders. If the bulls bump up the GBP/JPY pair, using trailing stops will be an excellent step to maximize your profit in favor of the market trend.