Eyes on Eurozone CPI data.

Fed’s policymakers agreed a fall in longer-term inflation expectations would be undesirable. They disagree on whether inflation expectations were well-anchored. Most of them expected inflation to pick up in next few years, but many saw rising chances of inflation remaining below target (2%).

Another hit to U.S. administration following an exodus from and eventual disbanding of U.S. President Donald Trump's manufacturing council and strategic policy forum.

German GDP (Preliminary release) worse than expected.

U.S. Retail Sales increased more than expected after 4 months of figures disappointing the forecasts.

U.S. Core Inflation figures ticked down again (for the fourth time in a row). Also, U.S. PPI (another Inflation data) worse than expected.

Geopolitical tensions deepened, and tensions between Pyongyang and Washington continue to escalate.

The ECB's big dilemma is that while the euro zone economy has grown for 17th straight quarters and employment is rising faster than expected, wage growth remains anemic, keeping a lid on consumer prices. Economists are now trying to figure out whether wages are showing an unexpectedly delayed response or whether wage setting dynamics may have fundamentally changed in the post-crisis, globalized economy.

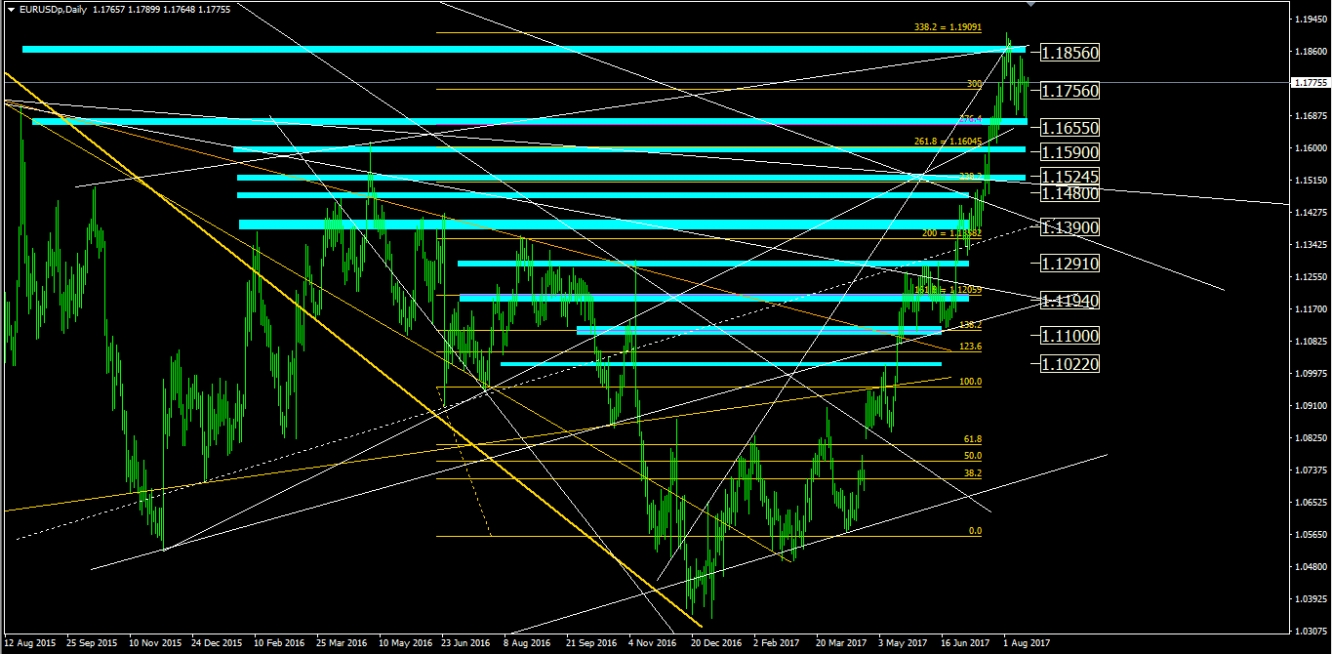

As we wrote previously, we expected first a re-test back to 1.1756, and it happened both the 7th and the 15th of August. Now eyes on the continuation of this retracement down to 1.1655 (First important Support).

Our special Fibo Retracement is confirming the following S/R levels against the Monthly and Weekly Trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Overbought

1st Resistance: 1.1756

2nd Resistance: 1.1856

1st Support: 1.1655

2nd Support: 1.1590

Eyes on today UK Retail Sales.

UK Job Market better than expected: UK unemployment falls to lowest since 1975.

On the other hand, the greenback fell following the announcement from Trump via Twitter about the eventual disbanding of U.S. President Donald Trump's manufacturing council and strategic policy forum.

Furthermore, Federal Reserve policymakers were split on the outlook for future rate hikes, as Fed members struggled to balance concerns about the slowdown in inflation with the growth in the labor market.

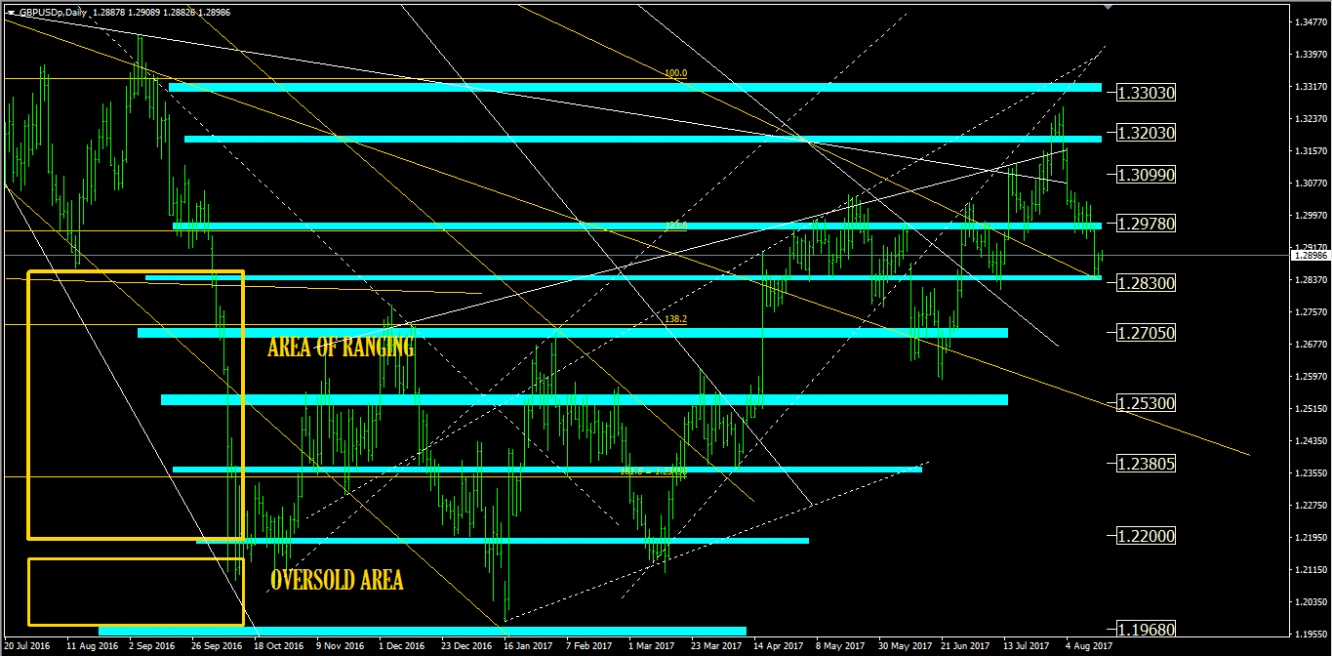

As we expected, the consolidation below 1.2978 led GBP/USD straight down to our Support 1.2830. We still are bearish until 1.27 area.

Our special Fibo Retracement is confirming the following S/R levels against the Monthly and Weekly Trendlines obtained by connecting the relevant highs and lows back to 2001:

Weekly Trend: Bearish

1st Resistance: 1.2978

2nd Resistance: 1.3099

1st Support: 1.2830

2nd Support: 1.2705

Australia Employment Change better than Expected but Full Employment Change negative.

The Reserve Bank of Australia minutes painted a possible stronger than expected growth spurt in the coming year in an otherwise light data day with North Korea a bit toned down on firing missiles at or near U.S. territory Guam.

A nearly twelve-month low for Chinese refinery activity come against concerns that a glut of refined fuel products could lessen demand for oil, reducing the prospect of oil inventories falling below the five-year average, adding pressure on oil prices. AUD weakened as well.

China Industrial Production disappointed expectations.

U.S. Core Inflation figures ticked down again (for the fourth time in a row). Also, U.S. PPI (another Inflation data) worse than expected.

The dollar suffered as geopolitical tensions between the U.S. and North Korea intensified. On the other hand, Australia home loans data rose 0.5% for June, compared with a 1.5% gain expected. China consumer and producer prices ticked down.

The Reserve Bank of New Zealand held its official cash rate at a record low 1.75% as expected and said that it expects a neutral view to persist with inflation projections well anchored around 2%. Australia Retail Sales were better than expected. Australia Trade Balance was again on the downbeat but building approvals for June jumped 10.9%, far outpacing a 1.5% gain seen month-on-month.

On the other hand, the dollar fell also amid expanding investigations into allegations that Russia meddled in the 2016 U.S. presidential election (investors are afraid that would sidetrack the implementation of Trump’s fiscal and economic policies) and after repeated failure of Trumps’s healthcare bill, not able to garner enough votes for replacing Obamacare.

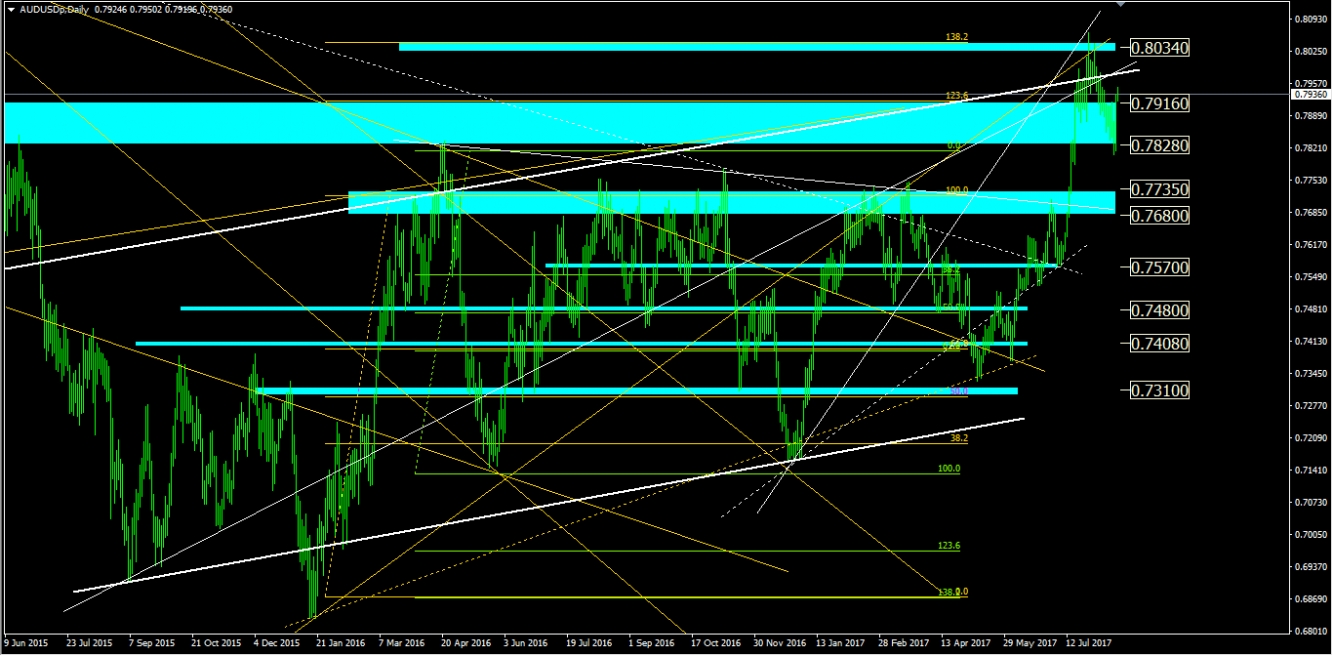

As we wrote previously, breakout of 0.7916, important level, led down to 0.783 area, our first target. We are still bearish until 0.774 area.

Our special Fibo Retracements are confirming the following S/R levels against the Monthly and Weekly Trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Bearish

1st Resistance: 0.7916

2nd Resistance: 0.8034

1st Support: 0.7828

2nd Support: 0.7735