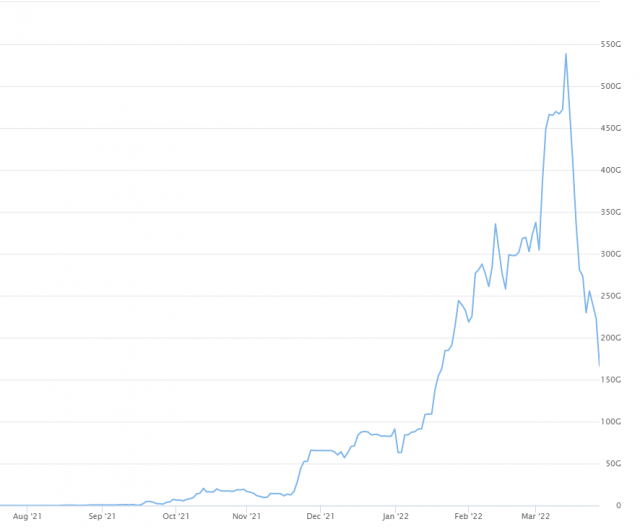

I think my Virtual Trading Equity Curve pretty much tells the story: I peaked on March 14th and am down 70% since then (or about $400 billion). Hey, easy come, easy go. At least it’s fake! Let’s just say my real portfolio isn’t quite as aggressive.

The thirty-two days since the February 24th bottom have left me somewhat shell-shocked, so I think I’m just going to now present an avalanche of futures charts. Below are fifteen interesting long-term continuous contracts, with a few words on each in the captions section. See you Tuesday!

Corn continues to rage higher, peace or no peace. This is indicative of how much inflation is on the way (of course, the government conveniently leaves food out of their calculations).

Crude oil peaked on March 7th, and between peace in Ukraine and a deal with Iran, it seems the world may find itself drowning in oil in the months ahead, with a collapse in prices forthcoming.

Cotton is another good example of how inflation for everyday things is alive and well.

European equity markets, including Germany's DAX, look absolutely toppy which, paradoxically, may line up perfectly with newfound peace.

The U.S. market is a much tougher read; if the /ES futures cross above that horizontal, it spells yet more bad news for the two or three surviving bears on the planet.

France's CAC 40 is looking rock-solid toppy.

As is Germany.

Here are the STOXX 50 Futures, which has the same topping pattern as just about every other European bourse.

Gold has had about $200 blown off its shiny balls, but the bullish setup is unharmed.

And, measured in yen terms, gold is raging to lifetime highs (the Japanese yen is getting destroyed).

Lumber failed to beat its earlier top and is starting to weaken, probably coincident with bad prospects for homebuilding.

Here’s an umpteenth example of toppy European equities, above the MSCI EAFE Index futures.

And, likewise, an umpteenth example of food inflation, this time for oats, on the way.

US Treasury Bonds, including 30-year futures may have broken a long-term uptrend, which could be a huge deal (and indicate vastly higher interest rates to come)

Finally, volatility has been smothered to death in its own crib. Pretty sad!

I moved into more cash (and more gloom) and am standing at 26% now. I have morphed from “let ’em burn” mode to “let’s wait and see.” I continue to be shocked that the beginning of the war marked the precise bottom of the equity market, and I must wonder out loud if an official cease-fire deal will mark the top. Markets love throwing paradoxes.