Formycon AG (DE:FYB)'s partner Bioeq IP AG (Bioeq) plans to file FYB201, its Lucentis biosimilar, to treat neovascular age-related macular degeneration (nAMD) with the FDA in early Q419. The Phase III met its key primary endpoint. The US launch could be in 2021 and the EU in 2022. FY18 revenues were €43m, which includes €34.5m in payments from partnered projects. Bioeq is the partner on FYB201, Santo on FYB203 (an Eylea biosimilar) and there is a joint venture with Aristo Pharma on FYB202 (a Stelara biosimilar). FYB202 could enter a Phase I trial in mid-2019. Formycon guides for FY19 revenues of about €34m. Liquid cash at end-FY18 was €12.31m. There was a private placing of €17.3m in March 2019, implying Q119 cash of about €29m.

FYB201 and FYB203 target the major nAMD markets

Formycon has two biosimilar projects targeting the nAMD market. In May 2018, the COLUMBUS-AMD Phase III study of FYB201 met its primary endpoints. The global exclusive partner, Bioeq, plans to make regulatory filings in the US in early Q419 and in the EU in Q120. Bioeq aims to launch the product in 2021 (US) and 2022 (EU) and is developing its marketing strategy. Global 2018 Lucentis sales rose 9% to US$3.7bn. Formycon’s preclinical Eylea biosimilar FYB203, also for nAMD, is licensed to Santo; Formycon notes that the total payments from development compensation and sales participation should be over €100m. Global sales of Eylea were $6.7bn in 2018; core patents expire in 2023 (US) and 2025 (EU). One Eylea biosimilar consortium (Momenta plus Mylan is in Phase III. With the cost pressures on healthcare, Formycon assumes a very valuable nAMD market for biosimilars.

A stellar opportunity through a JV

Formycon has made significant progress on FYB202 (a Stelara biosimilar for Crohn’s disease and psoriasis) through a joint venture deal with Aristo Pharma; Formycon owns 24.9%. Stelara (2018 sales $5.2bn) has a different mode of action to anti-TNF agents (lead product Humira, $19.9bn in 2018) so should be protected from the fierce competitive environment developing in the anti-TNF area. The project should enter Phase I in mid-2019 with Phase III possible in 2020 in our estimate. Formycon needs to fund its share of the costs but then shares the profits so this could be very lucrative. Stelara patents expire in 2023 (US) and 2025 (EU).

Valuation: Starting to reflect clinical progress

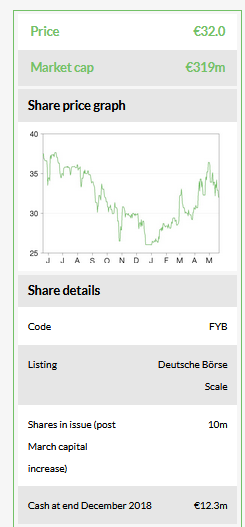

Formycon’s market cap is about €319m with an EV of €310m. Regulatory review of FYB201 and the clinical progression of FYB202 will be key to adding value in 2019.

Business description

Formycon is a biotechnology company focused on biosimilars. The lead product is FYB201, a Lucentis biosimilar that has completed Phase III; FYB203 is an Eylea biosimilar in preclinical. They are both out licensed. FYB202, a biosimilar candidate of Stelara, is being developed in a joint venture with Aristo Pharma and enters Phase I in mid-2019.

Bull

Leading biosimilars company addressing markets worth $15.6bn in 2018.

Two partnered products plus JV deal.

Potential first-to-market advantage for FYB201.

Bear

No EMA guidance for intraocular biosimilars.

US biosimilar market still immature.

No apparent Bioeq sales capability yet.

Financials: FY18 results review

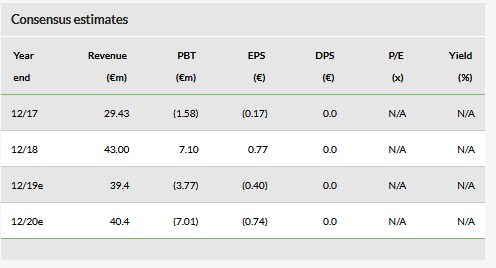

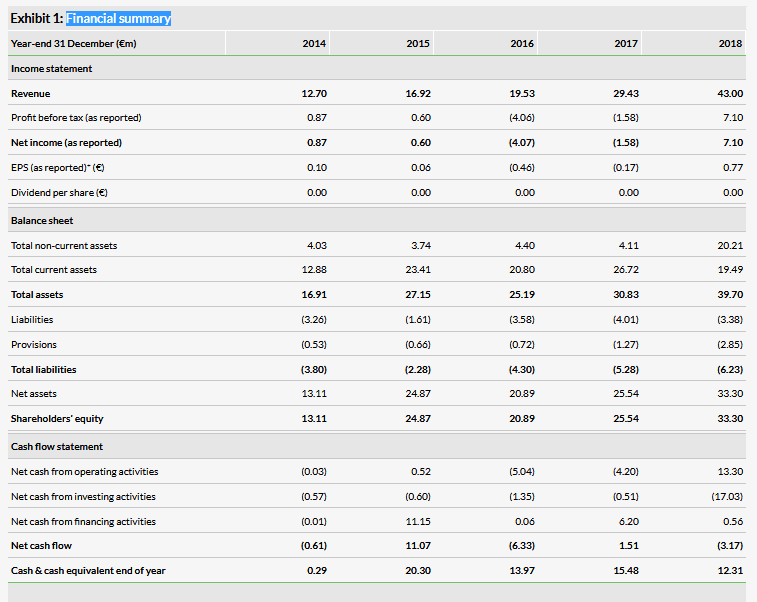

Formycon reported revenues of €43.00m in 2018 driven by licensing deals and milestones for out-licensed projects. These comprised cash income of €34.5m (vs €29.43m in FY17) plus a non-cash recognition of €8.5m from the H118 deal with Aristo Pharma to create a joint venture on FYB202. The company had guided to FY18 cash revenues of €32m. The headline FY18 revenue figure gave an accounting profit of €7.1m (vs a loss of €1.58m in FY17; Exhibit 1), although on cash revenues alone this would have been a loss of about €1.4m.

Investments on the balance sheet rose from €0.25m in FY17 to €15.97m in December 2018 due to the FYB202 JV. The cash outflow after investments was €3.17m so cash reduced to €12.31m in December 2018 from €15.48m in FY17. Formycon had €5.22m in receivables at the year-end (€10.97m FY17) so effective cash was €17.53m (FY17 26.45m). Formycon made a placing on 22 March 2019 with the strategic Swiss investor M&H Equity AG (M&H) and Formycon’s share capital of €9.4m increased to €10m after issuing 577,397 new shares. The investment was €17.26m at €29.90 per share. Formycon states that the funds will be used for proprietary biosimilar developments.

Management has guided that 2019 revenues will be around €34m. If operating cash flows are similar to 2018, then Formycon will make yearly small loses or a minor profit up to the potential FYB201 2021 US launch.

Bioeq funds the FYB201 project but has no sales operations, so marketing partners will be needed in Europe and, especially in the US. Formycon expects that a commercialisation partner will be agreed during 2019; this could add to overall value.

Three key projects

The lead project is FYB201, a biosimilar to Lucentis and licensed to Bioeq. The project on Stelara has completed a pilot phase and is due to enter Phase I and the Eylea biosimilar, FYB203 is preclinical. Each of these is in a deal or joint venture. Although we cite the reference product sales for each project, the in-market biosimilar price will be typically lower by c 15–20% initially and possibly 30–50% if competition is tough. One element is these markets is that switching rates from established reference products to slightly cheaper, but not necessarily identical, biosimilars has often been slow. For approval, a biosimilar must show comparable safety, efficacy and immunogenicity to the original “reference” products so, technically, there is no reason for prescribers not to switch. In May 2019 the FDA set out guidelines to establish full interchangeability with reference products. This might mean further clinical trials are needed but, if followed, it could enable routine switching and so faster penetration to give higher biosimilar shares.

A new set of EU rules, due to start in summer 2019, will allow potential competitors to manufacture biosimilars in Europe from six months before the patent and any supplementary protection expires. Formycon does not expect this, in practice, to accelerate the launch of FYB201, but it may enable more rapid launches for other products, for example FYB202 in 2023.

FYB201: Viewing a competitive space

Lucentis (ranibizumab, Roche (US) Novartis (EU)) had 2018 sales of $3.7bn. Ranibizumab is a humanised monoclonal antibody fragment produced in Escherichia coli cells by recombinant DNA technology; it binds vascular endothelial growth factor-A (VEGF-A). The later competitor product Eylea (Regeneron) initially took sales and market growth from Lucentis due to a longer dosing interval. The position has now stabilised and Lucentis sales grew 9% in 2018. Lucentis patents expire in 2020 in the US and 2022 in Europe.

Formycon licensed FYB201 to Bioeq based in Zürich. Bioeq comprises a joint venture between Polpharma (a Polish pharmaceutical company) and the Strüngmann family’s investment company. The clinical studies for FYB201 are run by a Bioeq subsidiary, Bioeq GmbH, based in Germany.

The Phase III study, COLUMBUS-AMD (NCT02611778), reported its primary endpoint in May 2018, which confirmed comparable efficacy between FYB201 and Lucentis in patients with nAMD (included in wet AMD). The clinical primary endpoint measured the change in the best corrected visual acuity after eight weeks. All secondary endpoints were also met. The Phase III is now completed with no issues about the safety and immunogenicity of FYB201 observed.

Competitors include:

■

Samsung (KS:005930) Bioepis (Korea, sales via Biogen (NASDAQ:BIIB)) with a Phase III (NCT03150589) completing in Q419; the primary endpoint may have been reached with the follow-up safety phase ongoing.

■

Xbrane (Sweden) is partnered with STADA, a privately-owned German-based generics and OTC company that sells (some) in-licensed biosimilars. The global Phase III (NCT03805100, XPLORE) has a primary endpoint due in May 2020. Xbrane management expect sales from Q122; STADA currently has no US distribution at all and selective EU and Asian coverage.

■

Roche has a novel antibody, faricimab, entering Phase III after excellent Phase II performance with one injection every 16 weeks; this might compete in the premium market after 2023. Roche is also trialling a Lucentis medical device delivery system to protect its core franchise.

■

Novartis has filed brolucizumab, a scFv antibody fragment against VEGF-A, with the FDA and this will potentially have an H220 launch. It claims a dosing interval of up to every 12 weeks.

A market complication will be biosimilar versions of Avastin. Avastin has the same mode of action as Lucentis but is a large monoclonal rather than a smaller fragment. Avastin is used off label for nAMD as it is cheaper; generic versions could accentuate this gap. This use is believed to be decreasing because the larger Avastin pack size gives handling and sterility issues.

FYB202: A stellar project

Formycon is developing a biosimilar, FYB202, to Stelara (ustekinumab, Jansen). The product is an antibody that binds interleukin-12 (IL-12) and IL-23. These potent cytokines drive the immune response so neutralising them controls autoimmune diseases such as Crohn’s and psoriasis. It is not used for rheumatoid arthritis (a massive market) but is effective for psoriatic arthritis (Veale and Fearon, 2015) . Stelara has its main US patent expiry in September 2023 in the US and in January 2024 in Europe. Sales were $5.2bn in 2018 driven by the 2017 approval in Crohn’s disease.

The general market for these anti-inflammatory therapies targeting cytokines such as IL-12 and tumour necrosis factor (TNF) is likely to be competitive with the patent expiries of huge ($19.9bn) global franchises such as Humira (adalimumab, an anti-TNF monoclonal), mainly used for rheumatoid arthritis, but also Crohn’s disease and psoriatic arthritis. Stelara has a different mode of action to anti-TNF therapies as it binds a different set of inflammatory messenger proteins. This different approach might be better for some patients.

In Europe, the Humira patent expired in October 2018 and four Humira biosimilars are sold: Amgevita (Amgen (NASDAQ:AMGN)), Hyrimoz (Sandoz), Hulio (Mylan/Fujifilm Kyowa Kirin Biologics) and Imraldi (Biogen/Samsung Bioepis). International (mainly European) 2018 Humira sales were $6.3bn after a 14.8% Q4 decline due to European patent expiry.

In the US, 2018 sales were $13.7bn, up 9%. The primary patent expired in 2016 and three biosimilars are already approved: Amjevita (adalimumab-atto, Amgen), Hyrimoz (adalimumab-adaz, Sandoz) and Cyltezo (adalimumab-adbm, Boehringer Ingelheim), with Imraldi (Biogen/Samsung Bioepis) under FDA review. However, so far patents and agreements with Amgen mean that these biosimilar launches will be delayed and then phased over 2023.

FYB202 has been licensed to privately owned Aristo Pharma through a joint venture vehicle, FYB202 GmbH & co KD. Formycon holds 24.9% and will therefore fund this proportion of the clinical and development costs, amount undisclosed, but receive that share of profits. The pilot phase of the project has ended. After FDA meetings, Phase I is planned to start in mid-2019. This implies Phase III starting in 2020, which Formycon indicates could lead to a 2023 launch. There are no clinical trials disclosed. Others such as Icelandic company Alvotech and Australian Neuclone are in preclinical development of Stelara biosimilars; no trials are listed.

FYB203: An eye on the future

FYB203 is a preclinical project to develop an Eylea biosimilar. Regeneron had 2018 Eylea sales of US$6.7bn (split $4bn US and $2.7bn international). Eylea is used in a similar way to Lucentis but has a different mode of action as it binds both VEGF-A and placental growth factor; Lucentis binds only VEGF-A. The Eylea maintenance dose interval is every eight weeks, double that of Lucentis although Formycon notes that in reality clinical surveys show that the use patterns are similar. US Eylea patents start to expire in 2020 but there seem to be patent extensions (Sharma et al., 2018) that will prevent biosimilar competition in the US until 2023. European patents expire in 2025. In addition, Eylea formulation patents do not expire till 2027–2028. Formycon has filed patents for an alternative formulation which has shown preclinical intraocular bioequivalence.

Formycon has a global licensing deal with Santo Holding and gains sales-related royalties. Preclinical work is underway and a Phase I/III trial might start in 2020, according to management.

Competitors include a joint development programme between Momenta Pharmaceuticals and Mylan (NASDAQ:MYL) NV on the Eylea biosimilar, M710. A Phase III trial (NCT03610646) in 324 patients is underway and due to report primary data in Q120. Alteogen (South Korea) has a preclinical project: ALT-L9, so it might be a potential future competitor.

Valuation: Clear pipeline and solid financial position

Formycon’s market cap (14 May 2019) is €319m. Adding liabilities and subtracting cash gives an EV of about €310m. The current base value is set by the M&H investment at €29.90 per share. Value progression depends on the likely royalties from FYB201 and FYB203 and the 24.9% profit share from the joint venture on FYB202. So far, the biosimilar business has been less aggressive than small molecule generics. This is because the technology is complex and the production costs of biologicals are high, which sustains margins but reduces the incentive to switch unless products are proved interchangeable.

Formycon is in a strong position on Lucentis biosimilar development with a completed, positive Phase III and planned early Q419 BLA application to the FDA with EMA submission in Q120. However, Samsung Bioepis is not far behind in the US and both Samsung Bioepsis and Xbrane might be ready for the European patent expiry in 2022, making the market competitive. Bioeq has no stated plans for marketing, a crucial aspect. However, Formycon expects Bioeq to announce its US and European marketing partners during 2019 to add value to the investment case.

The other projects are further behind but FYB202 could develop quickly through the JV. Formycon’s 24.9% share of costs will need funding; this is worthwhile as it gives increased profit share. The Stelara franchise itself appears not to be targeted by many developers but the related Humira EU market is a battleground, with the US protected until 2023 after which competitors are queuing to pile in. Stelara might be a good, more protected market as not all Crohn’s and psoriasis patients will use anti-TNF products, which might protect volume and margins.

It is harder to assess FYB203. An Eylea biosimilar should sell very well but competitors seem, oddly, very limited to date given high sales and relatively close US patent expiry in mid-2023. The Momenta Pharmaceuticals and Mylan joint venture is the clear leader so far. We would expect further entrants over the next few years. The market will also be complicated by new, long-acting antibody fragment products from Novartis and Roche at premium prices. However, while the new products may be more convenient, if approved, neither of them has shown clinical superiority over Lucentis and Eylea so the biosimilar market will be substantial and very valuable.

Investment case summary

Formycon has a robust financial position with high revenues, cash for investment and a strong product pipeline targeting major global markets. It can now develop its own proprietary pipeline, which should add further value.

Although there are always technical risks and delays in development, these are manageable and much lower than mainstream therapeutic development. The main uncertainties are on exact product launch dates, competition and the ability of partners to market effectively in large, complex global markets. Assuming these aspects are resolved, as we expect, Formycon should become a leading and very profitable biosimilar company.