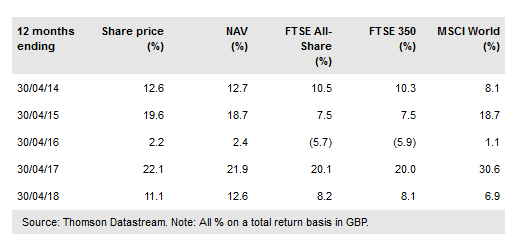

Finsbury Growth & Income Trust (LON:FGT) is managed by Nick Train, who runs a concentrated portfolio of primarily UK equities, aiming to generate long-term capital and income growth. A key feature is the trust’s low portfolio turnover – initiating a new holding or a complete disposal of a position happens very infrequently. FGT is invested in just four out of 10 sectors of its benchmark FTSE All-Share index. Shareholders have benefited from the manager’s focused, long-term investment approach, with the trust having significantly outperformed its benchmark over the last one, three, five and 10 years. Train remains optimistic on the outlook for FGT’s portfolio companies and has been taking advantage of individual share price pullbacks, adding to some of his largest positions, such as Burberry (OTC:BURBY).

Investment strategy: Very stock-specific approach

Train employs a bottom-up approach to stock selection, seeking companies that can grow over the long term, with low capital intensity, that generate high returns and cash flow. He rarely initiates new positions, but does so when he is able to identify attractive companies that are trading below their estimated intrinsic worth. Essentially, the manager aims to buy quality companies that he can “hold forever”. FGT’s portfolio is made up of companies producing branded consumer goods; own media/software intellectual property; or provide retail financial services. At end-March 2018, there was a modest 2.0% level of gearing.

To read the entire report Please click here