The Fed’s QE is officially over. As we noted in our recent Daily Market Commentary:

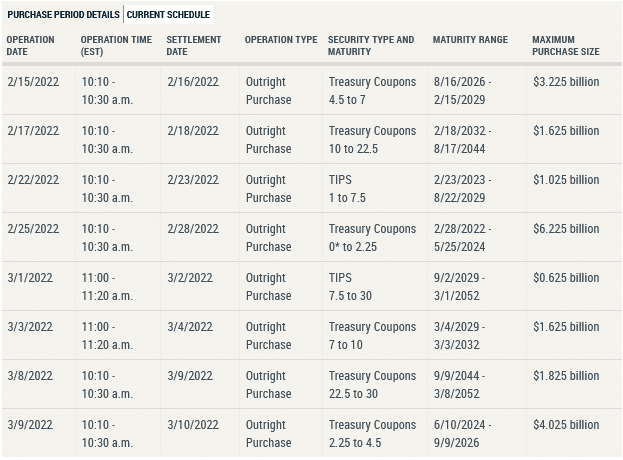

“The Fed will officially end the latest round of QE on Wednesday. The schedule below shows that on March 9th, the Fed will make its last QE purchase of about $4 billion of shorter-term Treasury notes. Since March 2020, the Fed’s balance sheet has risen by nearly $5 trillion due to QE. The Fed will still purchase bonds but only to offset maturing bonds and keep its balance sheet stable. Given the new monetary policy regime, we must focus beyond the Russian conflict. This entails better risk management as a key source of liquidity is now officially ending.”

Why is this important?

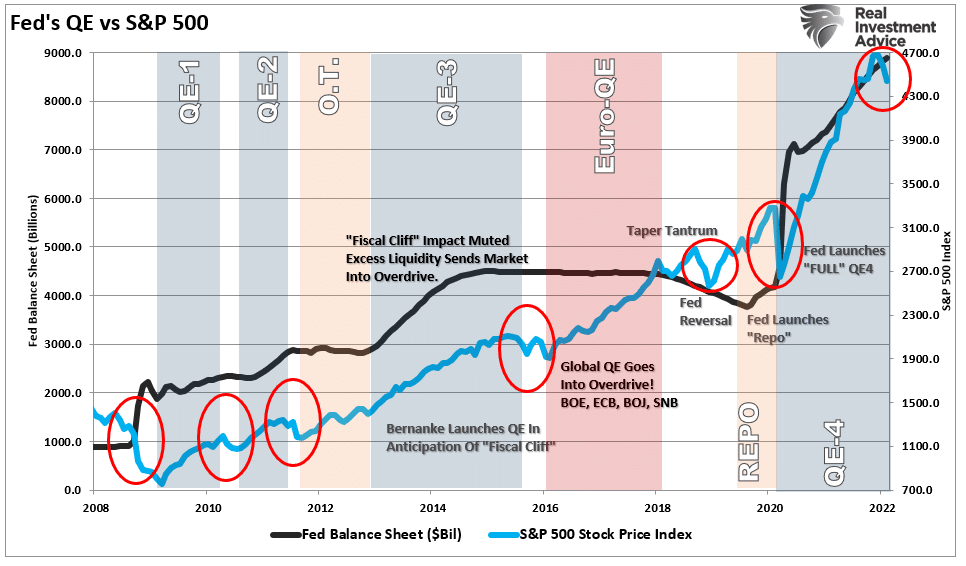

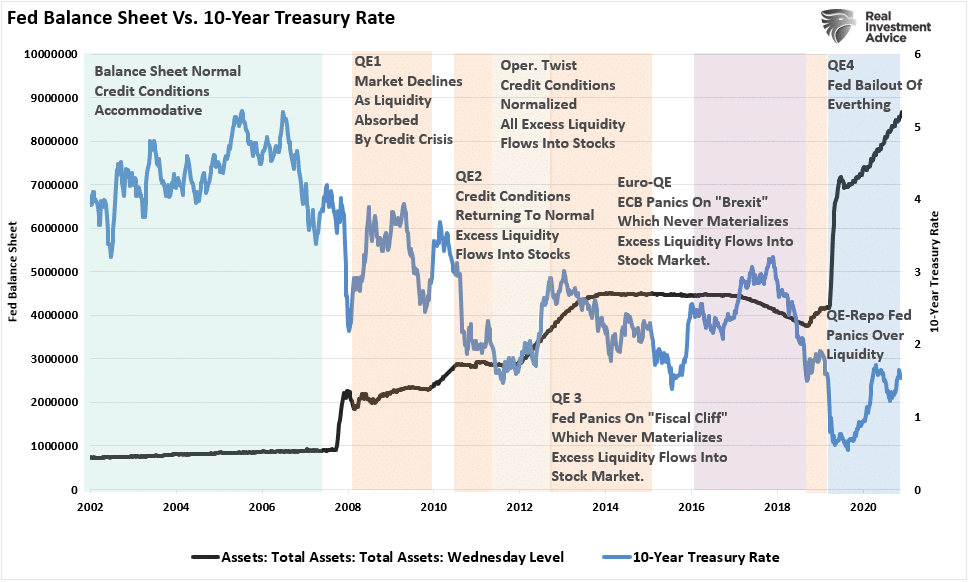

As we discussed in “Don’t Fight The Fed,” the Fed’s QE has been the primary driver of asset prices since the financial crisis.

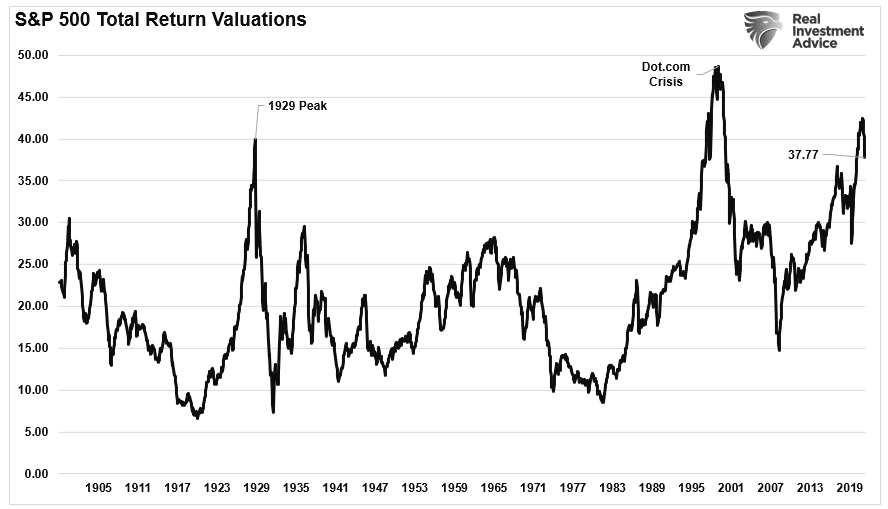

The primary bullish argument for owning stocks over the last decade is that low-interest rates [the Fed’s QE programs] support high valuations.

However, if low rates and the Fed’s QE programs drive asset prices higher, then the reversal of those policies can NOT also be supportive.

With valuations still high by all historical measures, removing accommodative policy will challenge those justifications for overpaying for assets.

Fed’s QE Boosted Asset Prices And Crushed Savers

Minneapolis Fed President Neel Kashkari once stated that the Fed’s QE program has no impact on the financial markets.

“QE conspiracists can say this is all about balance sheet growth. Someone explain how swapping one short-term risk-free instrument (reserves) for another short-term risk-free instrument (t-bills) leads to equity repricing. I don’t see it.”

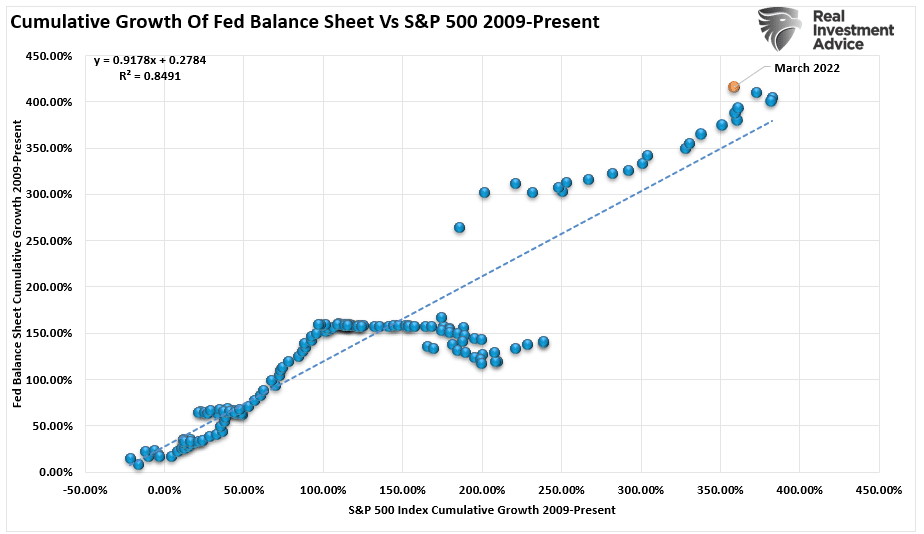

While he may be “technically correct,” as noted, there is ample evidence of a direct impact on financial markets. As discussed in “Past Performance Is A Guarantee:”

“Given the high correlation between the financial markets and the Federal Reserve interventions, there is credence to Minsky’s theory. With an R-Square of nearly 85%, the Fed is impacting financial markets.“

Given such a high correlation to asset prices, logic would state that any contraction of the Fed’s balance sheet will negatively impact markets. As shown below, such has repeatedly been the case each time QE programs have concluded.

For the last 12-years, the investing mantra was simple “Don’t fight the Fed.” As long as the Fed pushed liquidity into the financial system, there was no reason not to own equities.

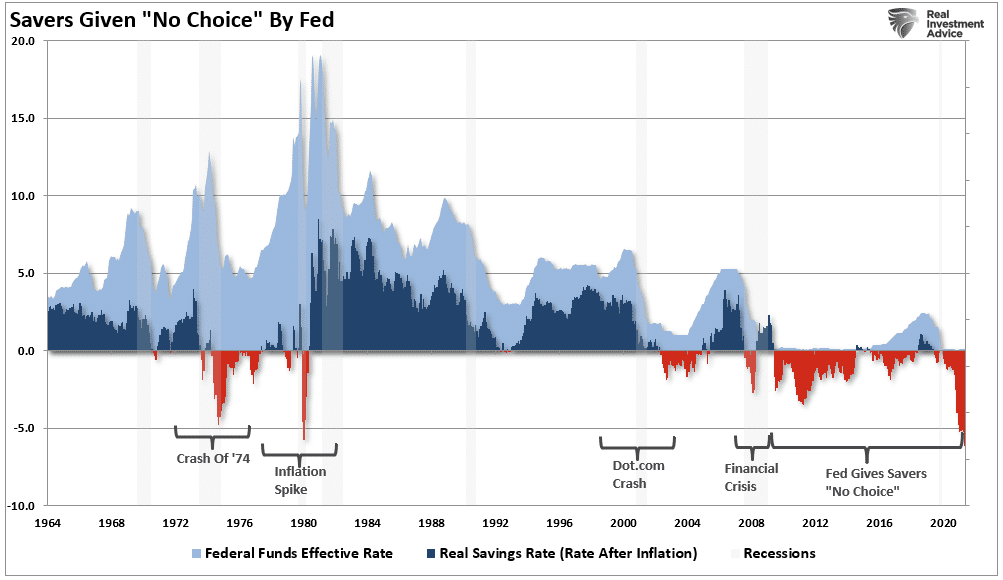

The problem lies directly with the Fed’s monetary policy decisions implemented since the turn of the century, and notably, the Financial Crisis. As each bailout of the financial system occurred, yields fell along with inflationary pressures and economic growth.

The Fed’s monetary policy forced “savers” into “risk” assets and out of cash. Such, the Fed believed, would increase confidence and support economic growth. However, the opposite occurred as economic growth rates, inflation, and interest rates fell. Unfortunately, savers were the victims.

Since 2009, the Fed’s QE programs boosted asset prices but crushed savers. The reversal of those policies negatively impacted investors.

But, until now, the Fed never faced inflation.

High Inflation Is The Difference

Since Paul Volker, the Fed faces a tough choice for the first time. With the Fed’s QE program ended, they now want to start hiking rates to combat the highest inflation levels since the 70s. However, inflation is already tightening monetary policy very quickly. To wit:

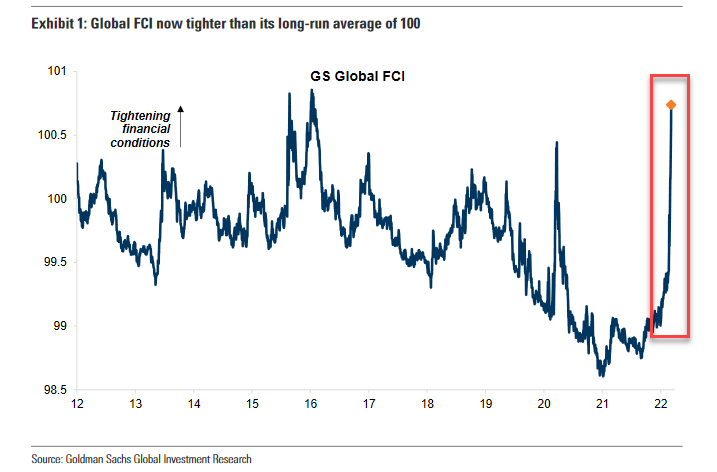

“The following chart from Goldman Sachs compiles the most widely used financial conditions indexes. As shown, financial conditions are at the tightest in two years. Such is driven by soaring energy prices, sliding stocks, and the market fallout from the Ukraine-Russia conflict. Excluding March 2020, the last time financial conditions were this tight, the Fed Funds rate was about to hit the past cycle high of 2.50%.” – Zerohedge

The problem for the Fed is they are currently still at ZERO. Therefore, with the Fed’s QE removed, any hikes to interest rates will exacerbate substantially tighter monetary policy.

The surge in inflation was already problematic for consumers before oil prices surged to $120/bbl. Furthermore, with wheat prices skyrocketing, higher costs of living for consumers are also extracting monetary liquidity from the economy. Such leaves the Fed very little room to hike rates before the economy slips into a recession.

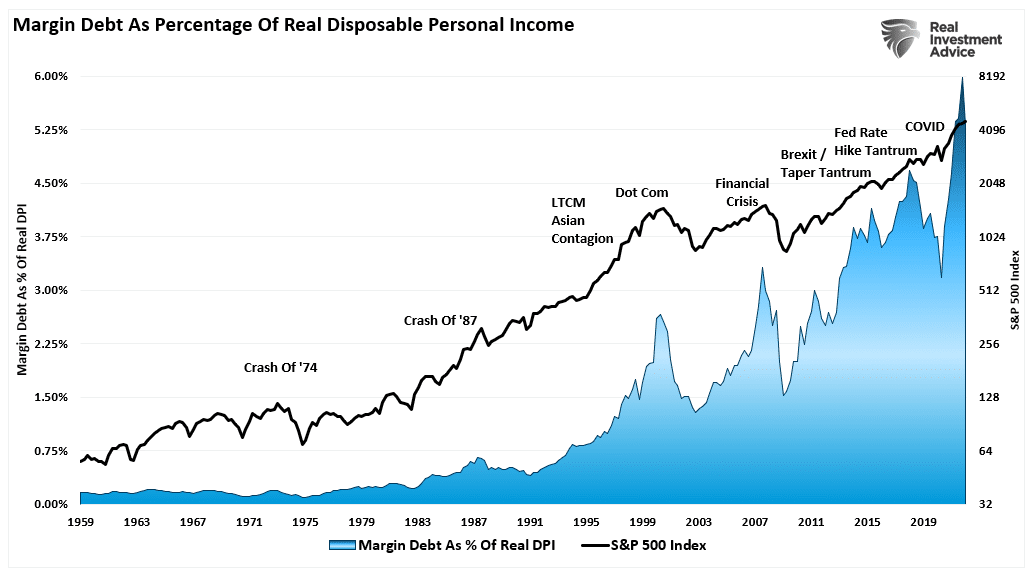

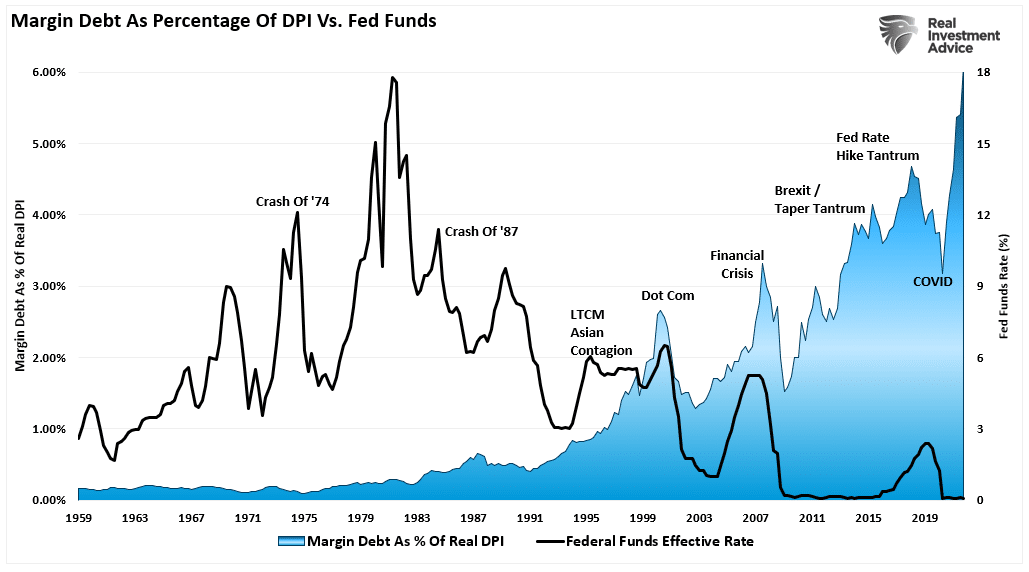

The most significant risk to the Federal Reserve is “financial stability.” Such is particularly the case with the entirety of the financial ecosystem now more levered than ever.

The Fed’s “financial stability stress tests” suggest “banks are well-capitalized” and can withstand a downturn in the economy and the markets. However, each time “financial stability” arises, the Fed rushes to bail out the banks once again.

This time likely won’t be any different with record leverage and credit in the economy.

The Fed’s QE Is Dead. Long Live The Fed’s QE

“The Federal Reserve has done more in the past 25 years than its founding legislators ever conceived. With that in mind, one wonders what the end game is, especially in light of two facts.

- First, the inclination of monetary authorities the world over is toward lower and lower thresholds for intervention.

- Second, fiscal and monetary policies have a way of suddenly finding limits when the tax-payers are on the receiving end.

If there is a component of the growing disposition for risk inspired by the idea that the Fed will swoop in to save retail investors from failed ETFs, collapsed SPAC prices, a wave of microcap stock delistings, or any other consequence of their understandable but reluctant march up the risk curve, it is ill-advised.

Any lasting solution is far more likely to come from markets themselves.” – American Institute

I would carefully consider the last sentence.

While financial underpinnings seem stable currently, they historically tend to become “unstable” quickly. Such is the case when the Fed hikes rates to the point it creates an issue concerning leverage.

While the Fed is likely to hike rates and reduce monetary accommodation in their quest to battle inflation, that fight will end quickly when “instability” arises.

How would such a dramatic turn occur?

- At 20% margin calls will begin to rise put pressure on asset and high-yield credit markets.

- When the market declines 25%, yield curves will be fully inverted as economic growth crashes.

- At 30%, corporations will be laying off workers and moving to protect profitability.

I suspect, as noted above that somewhere between a 20-30% decline, we will see the Fed return their focus to “market stability.”

Have no fear; QE will be back.