Equity markets rose as the Federal Reserve Bank left interest rates unchanged. The central bank only tweaked its language noting that it was closely monitoring the developments in the markets.

There was one dissenting vote against leaving rates unchanged at yesterday’s meeting. The Fed’s dot plot also showed that members widely expect rates to remain unchanged for the rest of the year.

Sterling Gains ahead of the BoE meeting

The pound sterling, which initially slipped to a five-month low recovered on the day on Wednesday. The UK’s inflation report saw consumer prices rising 2.0% on the year ending May, while the core inflation rate also rose 1.7% on the year. The Bank of England will be holding its monetary policy meeting later today. No changes are expected from the central bank.

Will the GBP/USD Continue to Trend Higher?

The currency pair was initially trading within the range of 1.2716 and 1.2606. Price broke the downside of the range before settling back inside. The current gains in prices have pushed GBP/USD closer to the upper range of 1.2716. A breakout above this level is required to confirm the recent gains. This will leave GBP/USD to test the next main target at 1.2897.

Oil Prices Steady as API Inventory Shows a Drawdown

WTI crude oil prices held steady on Wednesday, trading near the 54.24 handle. The weekly crude oil inventory report from the American Petroleum Institute showed a drawdown of 812,000 barrels. This was smaller than the forecasts of a 1 million barrel drawdown. However, the commodity managed to keep the gains from earlier this week.

Can WTI Break the Resistance at 54.24?

The gains in crude oil prices have pushed the price to the resistance area of 54.24. Price action is expected to consolidate near this level in the short term. The weekly EIA inventory report is due later today, which could be a short term catalyst. A strong close above 54.24 will signal further gains in oil prices. This would make the next resistance area of 57.50 the next key target.

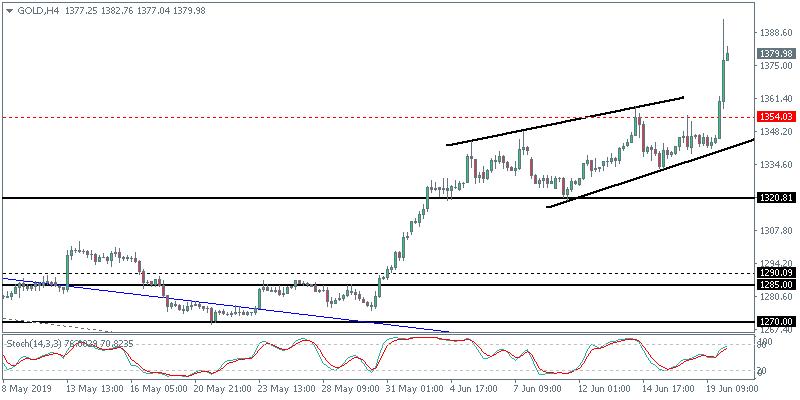

Gold Surges to Fresh 5-year High

The precious metal resumed its strong gains as the upside trend remains intact. Gold prices are testing a fresh 5-year high. At the time of writing, gold is trading at 1379.90 an ounce. The gains came partly due to the dovish Fed statement and partly because of the reports of Tehran shooting down a US drone. Rising tensions between Iran and the US have kept global sentiment somewhat in check.

Will Gold Continue to Ride Higher?

As gold prices broke past the 1350 handle, the precious metal continues to trend higher With the current momentum, it is likely that gold will continue to push higher, targeting the 1400 an ounce level. The immediate support is likely to be formed at the 1350 handle which could be tested on a dip.