Last week, the U.S. Federal Reserve reiterated statements in support of continued easy money policies and support for a recovering U.S. economy. Additionally, Fed Chair Jerome Powell made a statement suggesting tightening too early could be much more damaging than waiting until sufficient headwinds are behind us. I interpret this as stating the current inflationary concerns are less important than the current global market expectations. We can likely weather moderate inflationary concerns if the economy continues to strengthen – whereas tightening right now may not reduce inflationary concerns and may prompt a broad market slowdown within the U.S. and globally.

In short, traders and investors perceived these comments as “Here we go off to the races again,” and the U.S. markets rallied sharply on Friday and in early trading on Monday, Aug. 30, 2021.

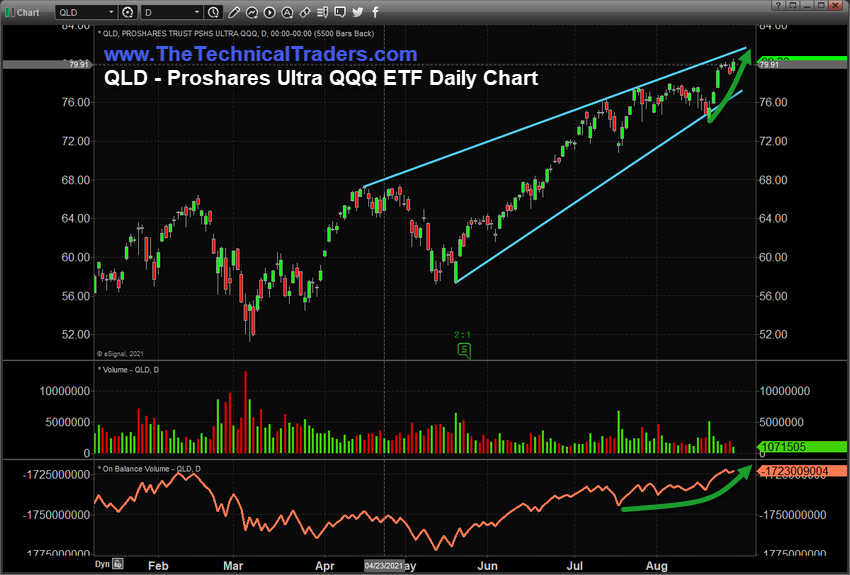

NASDAQ/Technology Leading The Rally Charge

This ProShares Ultra QQQ (NYSE:QLD) ETF daily chart highlights the extended rally phase of the NASDAQ/QQQ. With the current Fed statements, we expect $80 to be broken as this new rally phase attempts to target $82 to $84 – another 5% higher (or more).

IWM Breaks Above Dual-Pennant/Flag Formations.

This iShares Russell 2000 ETF (NYSE:IWM) daily chart clearly illustrate a very strong dual-pennant/flag breakout that has taken place with Friday's rally attempt. The move above $222.50 is very clearly an attempt to break above the dual-pennant/flag channels and to break into a new bullish price trend.

Once resistance near $227.50 is broken, the Russell 2000 ETF, IWM, should attempt a bigger rally attempt targeting $233 to $235.

We need to see this momentum carry forward through the end of September as the end of Q3:2021 should continue to trend higher with the Federal Reserve's recent statements. Additionally, traders should be positioning capital ahead of the end of Q3:2021 expecting another round of strong earnings and profits in October/November – pushing the Christmas Rally into high gear.