- Yen hits 10-month low, triggers intervention warning

- Dollar traders turn attention to ISM non-mfg PMI

- Equities pull back, but stay in an uptrend mode

- BoC expected to stand pat, focus to turn on guidance

Japanese official warns as dollar/yen gets closer to 148

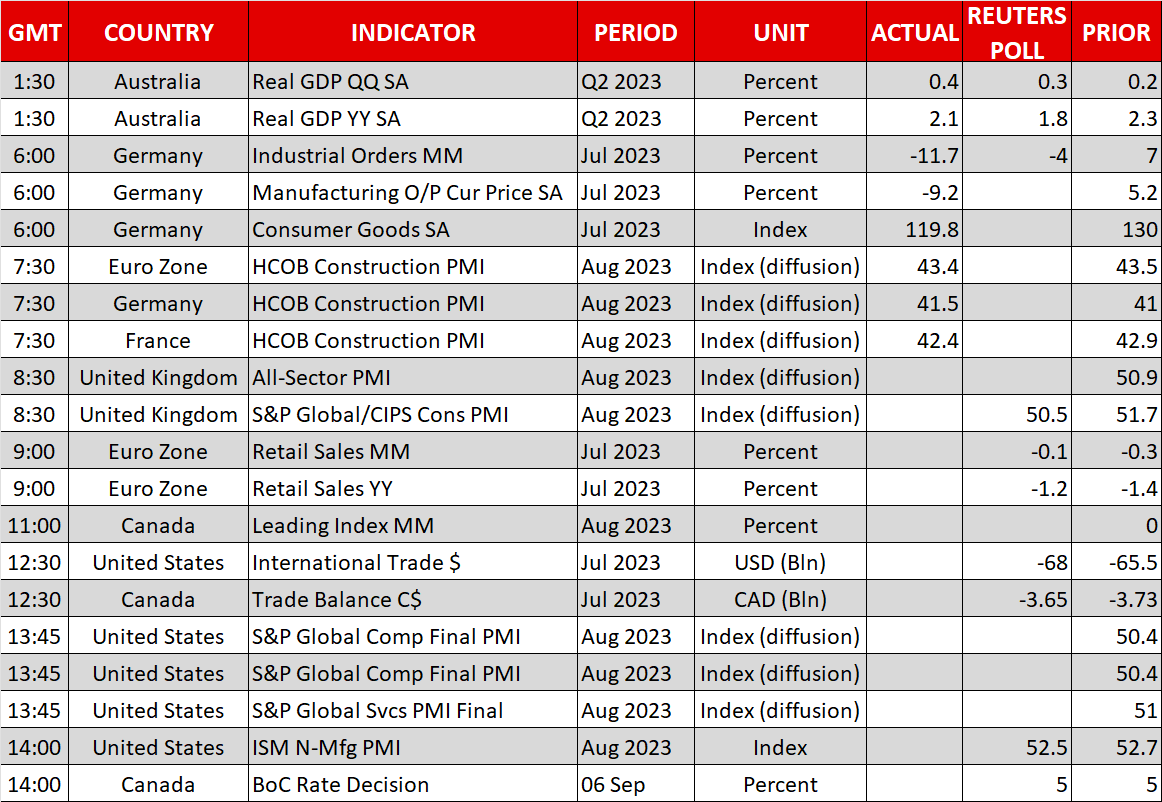

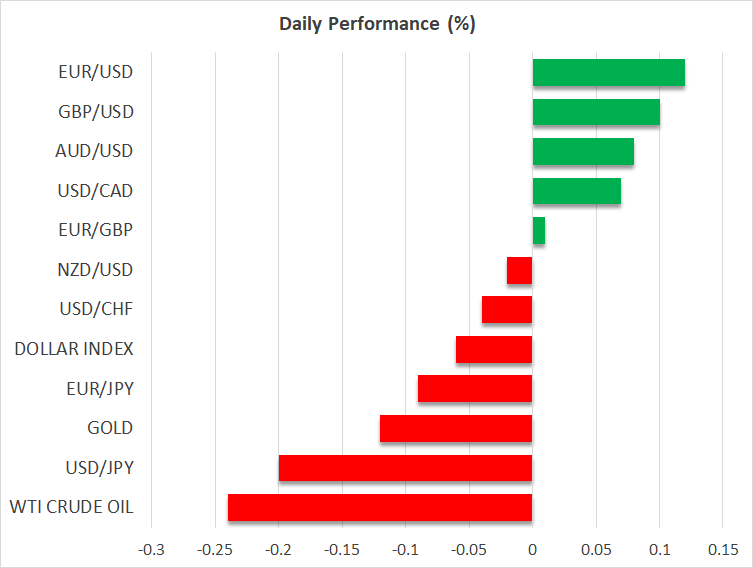

The US dollar traded higher against all the other major currencies on Tuesday, perhaps as increasing concerns about the performance of the Chinese economy after the disappointing Caixin services PMI resulted in a flight to safety.

The currencies that were beaten the most by the greenback were the aussie and the kiwi as both Australia and New Zealand have strong trade ties with the world’s second largest economy. That said, the Japanese yen was not far behind as yield differentials continued to haunt it. With US Treasury yields climbing higher and the BoJ keeping a lid on Japanese government bond (JGB) yields, the gap continues to widen, thereby pushing dollar/yen higher.

Dollar/yen closed Tuesday above the 147 mark for the first time since November, prompting a strong intervention warning from Japan’s vice minister of finance for international affairs, Masato Kanda. Speaking to reporters, Kanda said that they will not rule out any options if speculative moves persist, adding that the currency moves need to reflect fundamentals.

After approaching 20 pips from testing the 148 level, the pair started to pull back, perhaps as Kanda’s warnings prompted traders to liquidate some of their short yen positions. Now, it remains to be seen whether they will resume pushing the pair higher and risk an actual intervention episode, or whether they will allow it to correct lower as they did back in July after the pair flirted with the 145 territory.

ISM non-mfg PMI could impact Fed pricing

China’s worrying economic performance may not be the only source of fuel in the dollar’s engine tanks. The downside revisions in the euro area PMIs for August rang the recession alarm bells louder, fanning fears of slowing global growth, while the steep rally in oil prices may have allowed some traders to reconsider the likelihood of another hike by the Fed, as it could result in higher inflation in the months to come.

Although investors remain largely convinced that the Fed will not act at its upcoming gathering, the probability for a November hike stands at around 45%. That number could have been higher if it wasn’t for comments by Fed Governor Waller, who said that the latest round of US economic data allows the Committee space to see whether it needs to raise rates further.

With all that in mind, the ISM non-manufacturing PMI for August, due out today, may attract special attention. Expectations are for a minor decline but given that the preliminary services PMI from S&P Global pointed to a more notable decline, the risks surrounding the ISM index may be titled to the downside. That said, whether the probability of another Fed hike will decline or increase may also depend on the new orders and prices subindices. If the subcomponents hint at inflation being stickier than previously thought, Treasury yields and the US dollar may continue marching higher.

Wall Street closes in the red, BoC decides on rates

The reduced risk appetite forced all three of Wall Street indices to close in the red yesterday. However, the price action is far from suggesting a negative outlook. The pullback may continue today if the ISM PMI increases the probability for another hike by the Fed before the end credits of this tightening crusade roll, but as long as investors continue to anticipate a decent amount of rate cuts throughout 2024, any setback may just prove to be just a correction within the broader uptrend.

Apart from the ISM non-manufacturing PMI, today’s agenda also includes a Bank of Canada decision. Traders are largely expecting the Bank to stand pat, and indeed, with underlying inflation close to the upper bound of the Bank’s 1-3% flexibility band, policymakers may have the luxury to wait for a while before deciding whether more tightening is needed or not.

However, bearing in mind that oil prices are rising at a fast pace, closing the door to future hikes may be an unwise choice. Thus, with the probability of another hike resting at only 35%, should policymakers remain willing to act if deemed necessary, the wounded loonie may gain some ground.