JPMorgan Chase (NYSE:JPM) reports quarterly earnings this coming Wednesday during pre-market hours. Investor reaction to this particular report is positioned to have a significant influence on the price of the stock.

JPM's outspoken and high profile CEO Jamie Dimon already has warned us that changing (i.e., deteriorating) macroeconomic and geopolitical conditions are making business more challenging for the bank, despite the fact that interest rates have backed up sharply in recent weeks, which usually is a prescription for stronger bank earnings.

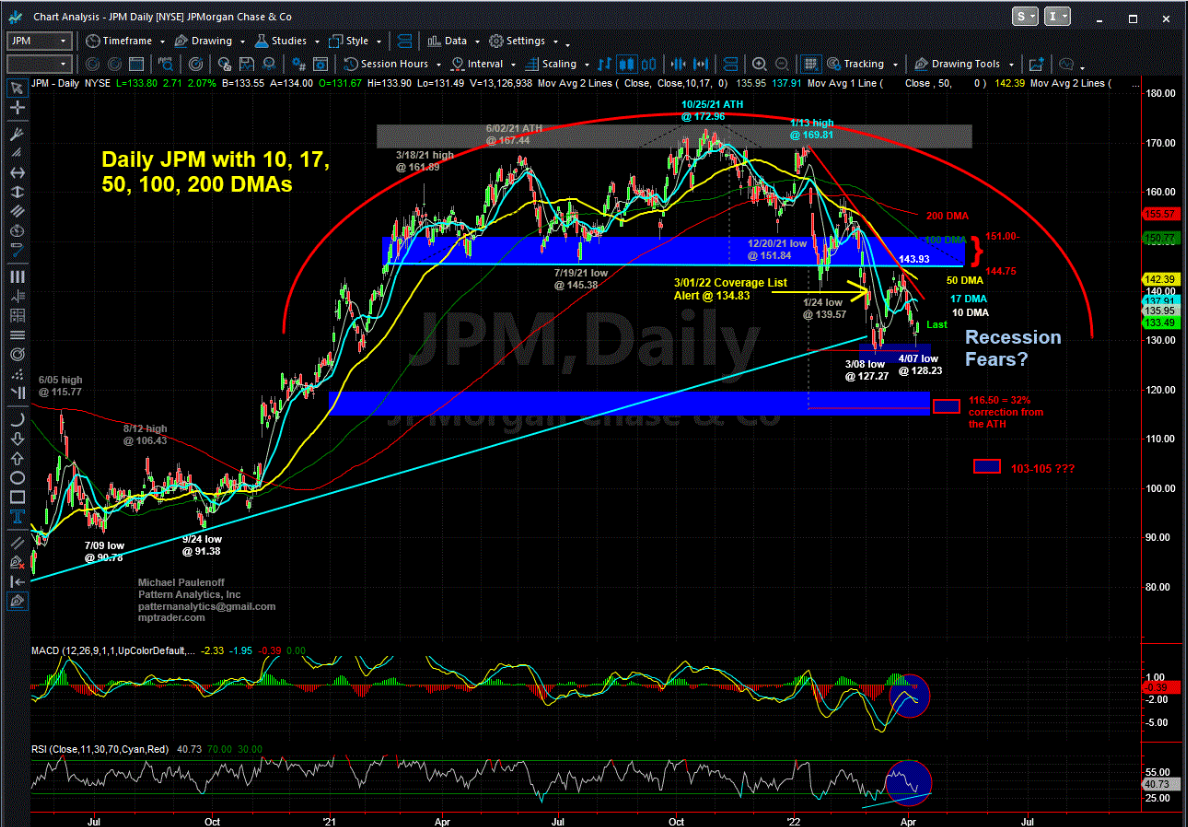

One look the daily chart of JPM certainly indicates something else is on the mind of investors that is outweighing the traditionally positive influence of rising interest rates on JPM's bottom line.

Five weeks ago, on March 1, we alerted members to a potentially serious technical breakdown in the stock, writing:

"JPM has broken down in glaring fashion from a 12 month Top Formation that my pattern work addressed four weeks ago in case JPM sustained beneath 139-140... Today's low at 134.15 violated my shallowest target zone of 135.50-137.50, and points next to 128-130, with an outlier target zone in the vicinity of 115. With XLF amounting to 12% of the S&P 500, judging from the ugly setup in JPM (10% of the XLF), I doubt we will be seeing XLF leading or making a major contribution to SPX index strength anytime soon."

Trading at 134.83 at the time, JPM subsequently pressed to a 127.27 low on March 8, satisfying our next lower target zone (128-130). For the past month JPM has been locked in a trading range beneath its multi-month breakdown plateau (142 to 150) on the one hand and its March-April lows at 127.27 and 128.23 on the other hand, treading water within an otherwise ominous 14-month Top Formation that theoretically has unfinished technical business on the downside into the 115-117 target zone.

Will this coming Wednesday's earnings report produce a positive or a negative investor reaction? Our technical work argues that any positive reaction to the news will need to propel JPM above its down-sloping 50 DMA (now at 142.39) on a closing basis to neutralize the otherwise very negative intermediate-term setup. Such a response is a very tall order for a stock that is behaving as if it is more concerned with the growing likelihood of recession than it is with the positive influence of rising interest rates on bank earnings.