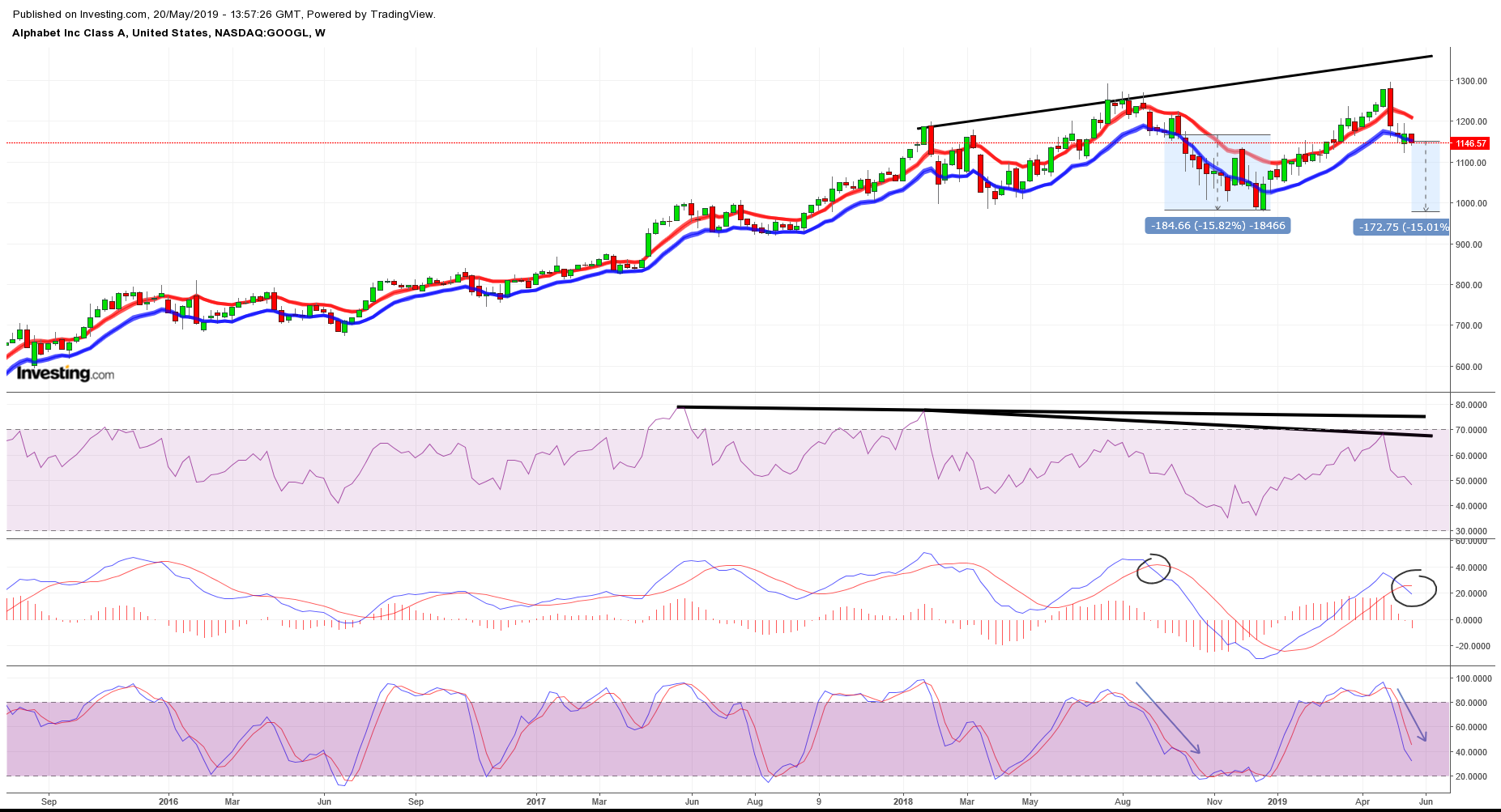

I see a pattern repeating in GOOG U.S. that tells me we should expect the share price to fall towards $1,000 and lower as long as the price is below $1,210. Now traded at $1,146, a weekly close below $1,123 will increase the chances of success of this bearish scenario. The stochastic is downward sloping, MACD is crossing down and the price is moving below my two MAs telling me a sell signal is coming.

The recent highs have been giving bearish divergence signs in the RSI and I believe we will see at least a similar decline to that of the last couple of months of 2018 if not something bigger. If I was short I would not want a weekly close above $1,210. If I was long I would not want to see a weekly close below $1,1120.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.