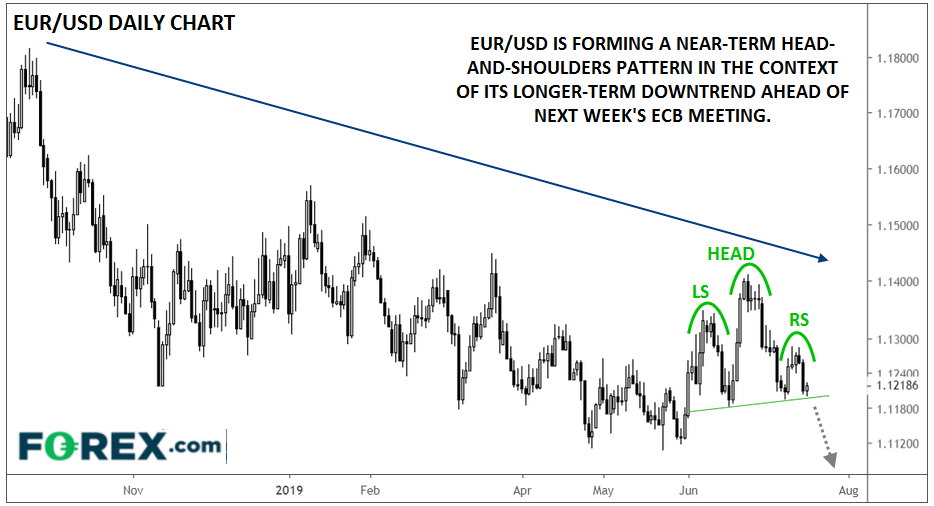

While it’s at no risk of losing its title as the world’s most widely traded currency pair, even the most diehard EUR/USD traders are getting fed up with the pair’s lack of volatility. Over the last nine months, EUR/USD has been contained to a miniscule 400-pip range between 1.1100 and 1.1500 (barring a two-day foray above 1.15 at the start of the year). That said, the current technical setup points to an elevated risk of a potential breakdown in the coming days.

Specifically, rates have carved out a continuation head-and-shoulders pattern over the last six weeks and the pair is now testing the “neckline” of that pattern. A breakdown below support in the 1.1200 area could project a 200-pip continuation lower, potentially taking the pair down toward the 1.1000 handle, though bears would obviously have to overcome support in the 1.1100 area first.

Source: TradingView, FOREX.com

In terms of fundamental catalysts, next week’s ECB meeting looms large. On Tuesday, Goldman Sachs (NYSE:GS) noted that the market had discounted around EUR 100-150B in quantitative easing (QE) at the central bank’s September meeting, and that there was a risk of a larger EUR 200-250B QE announcement.

If the ECB uses next week’s meeting to lay the groundwork for a big dovish shift later this year, EUR/USD may finally wake from its slumber and resume its longer-term downtrend.