After posting five losing days last week, the trend continues as EUR/USD has started the week in the red. On Monday, the pair is trading at 1.1307, down 0.13% on the day. It’s a slow day for fundamentals, with no data events in the eurozone or the United States. On Tuesday, the U.S. releases JOLTS Jobs Openings and Federal Reserve Chair Powell speaks at an event in Washington.

The euro suffered its worst week since late September, falling 1.1 percent. Investors responded negatively to disappointing data out of the eurozone and Germany. Eurozone retail sales plunged 1.6% in January, its worst reading since December 2013. German manufacturing reports headed lower, raising concerns about the health of the eurozone’s largest economy. Factory orders slipped 1.6%, a second straight decline. Industrial production declined 0.4%, its sixth decline in seven months. German consumer indicators have also stumbled, raising concerns about the health of the eurozone’s largest economy. CPI declined by 0.8% in January and retail sales plunged 4.3% in December. If the soft numbers continue, the euro slide could continue.

The Federal Reserve does not hold its policy meeting until mid-March, so investors will be left to focus on remarks from Fed Chair Jerome Powell and his colleagues. The Fed raised interest rates four times last year, but economic conditions are very different in 2019. The U.S.-China trade war has dampened global growth and rocked the equity markets. With the U.S. unlikely to replicate the sparkling growth we saw in 2018, the Fed is projecting just two rate increases this year. The markets, however, are predicting no rate moves, and some analysts are even talking about the possibility of a rate cut late in 2019.

EUR/USD Fundamentals

Monday (February 11)

- All Day – Eurogroup Meetings

- 11:15 FOMC Member Bowman Speaks

Tuesday (February 12)

- 10:00 US JOLTS Job Openings

- 12:45 Fed Chair Powell Speaks

*All release times are EST

*Key events are in bold

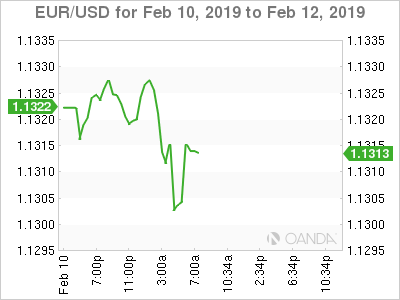

EUR/USD for Monday, February 11, 2019

EUR/USD for February 11 at 6:20 EST

Open: 1.1322 High: 1.1330 Low: 1.1297 Close: 1.1307

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1120 | 1.1212 | 1.1300 | 1.1434 | 1.1553 | 1.1685 |

EUR/USD showed limited movement in the Asian session and has ticked lower in European trade

- 1.1300 was tested earlier in support and is a weak line

- 1.1434 is the next resistance line

- Current range: 1.1300 to 1.1434

Further levels in both directions:

- Below: 1.1300, 1.1212 and 1.1120

- Above: 1.1434, 1.1553, 1.1685 and 1.1803