Whether at Thursday’s meeting or further down the line, the Riksbank will inevitably have to become more hawkish as the impact of COVID begins to fade. But there are many moving parts to consider when the central bank meets tomorrow. Look out for two specific aspects of the decision.

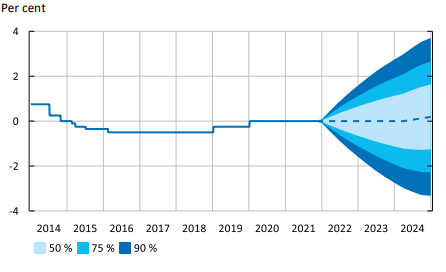

Firstly, will the central bank revise its guidance regarding when it will conduct its first interest rate hike? Previously, the Riksbank had indicated the first interest rate would occur at the end of 2024. But that already puts the central bank behind the curve of the BoE, Fed, and possibly even the European Central Bank. So, there is every possibility that forward guidance on the first-rate is brought to mid-2024 or even the end of 2023.

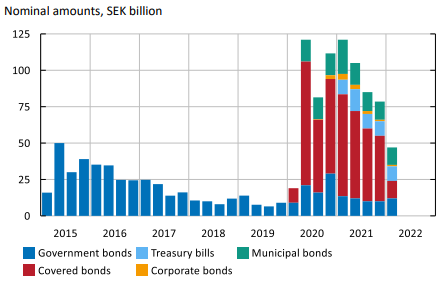

Secondly, November’s minutes showed that the Riksbank has been warming to reduce its balance sheet size this year. So, there is every chance it announces a faster than expected reduction in asset reinvestment, either in government or corporate bonds. This would send a stronger signal to the market as it would solidify the possibility of even earlier interest rate hikes.

The Impact On EUR/SEK

EUR/SEK has followed an interesting path over the last two years. Aside from the exceptional move higher in March 2020, due to the Swedish krona’s high susceptibility to global risk and the low established as the Riksbank upgraded its economic growth forecasts at its last meeting in November 2021, EUR/SEK, for the most part, has been rangebound between 10.70815 and 10.1101.

The rangebound nature of EUR/SEK should not be a surprise given the economic linkages between Sweden and the euro area. But any downside reaction in EUR/SEK from the upcoming meeting will likely be temporary and limited.

Global economic conditions and monetary policy have drifted from the last time the Riksbank last met. Therefore, any downside in EUR/SEK is likely to be suppressed at the 10.1101 level. However, a more hawkish central bank does increase the chance it remains closer to the bottom of its previous range.