Markets buoyed by U.S. rate cut hints

Stock markets are ending the week on a high and once again we have the Fed to thank for it.

Equities in the U.S. enjoyed a nice rebound on Thursday when New York Fed President John Williams claimed that given the more limited resources at their disposal than in the past, preventative rate cuts would be more suitable than waiting for disaster, a clear nod to what we can expect at the upcoming meeting later this month.

Of course, a rate cut was already fully priced in but those comments – some of which were later shared by Fed Vice Chair Clarida – prompted a surge in the odds of a 50 basis point cut, to the point that it’s now viewed as a coin toss.

This further highlights that while the fundamentals are showing pockets of weakness, highlighted by a rocky start to earnings season, investors are becoming increasingly reliant on the Fed to keep the party going. While that shouldn’t be the Fed’s concern, the argument for preventative cuts is fair, although 50 basis points to get things going seems quite drastic when the economy is still very healthy.

Gold pares gains after surge on weaker dollar

As you’d expect, the comments reverberated around the rest of the market as well, with the dollar taking another tumble on the prospect of more aggressive easing than the Fed had previously signaled. This has brought some relief to some other currencies like the pound which has suffered in recent months. That said, sterling is back in the red today so the joy was short-lived.

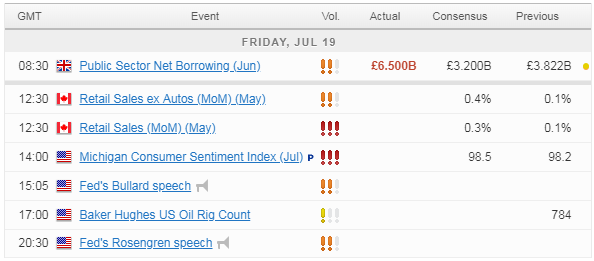

Gold Daily Chart

Gold was given a strong boost by the news, surging beyond its recent peaks to break $1,450 although that little shot of adrenaline hasn’t been enough to sustain the rally, with the yellow metal trading back around $1,440. A more accommodative Fed is of course good for gold though so more joy may lie ahead.

Oil higher after US shoots down Iranian drone

It was a strange day for oil prices on Thursday and while they are trading higher today, they look like they don’t know what to do with themselves. The news of the US shooting down an Iranian drone may another time have caused prices to spike aggressively but instead traders took it in their stride. Perhaps this just isn’t enough of an escalation any more to spark traders interest, which would be a sign of how bad things have got.

Brent Daily Chart

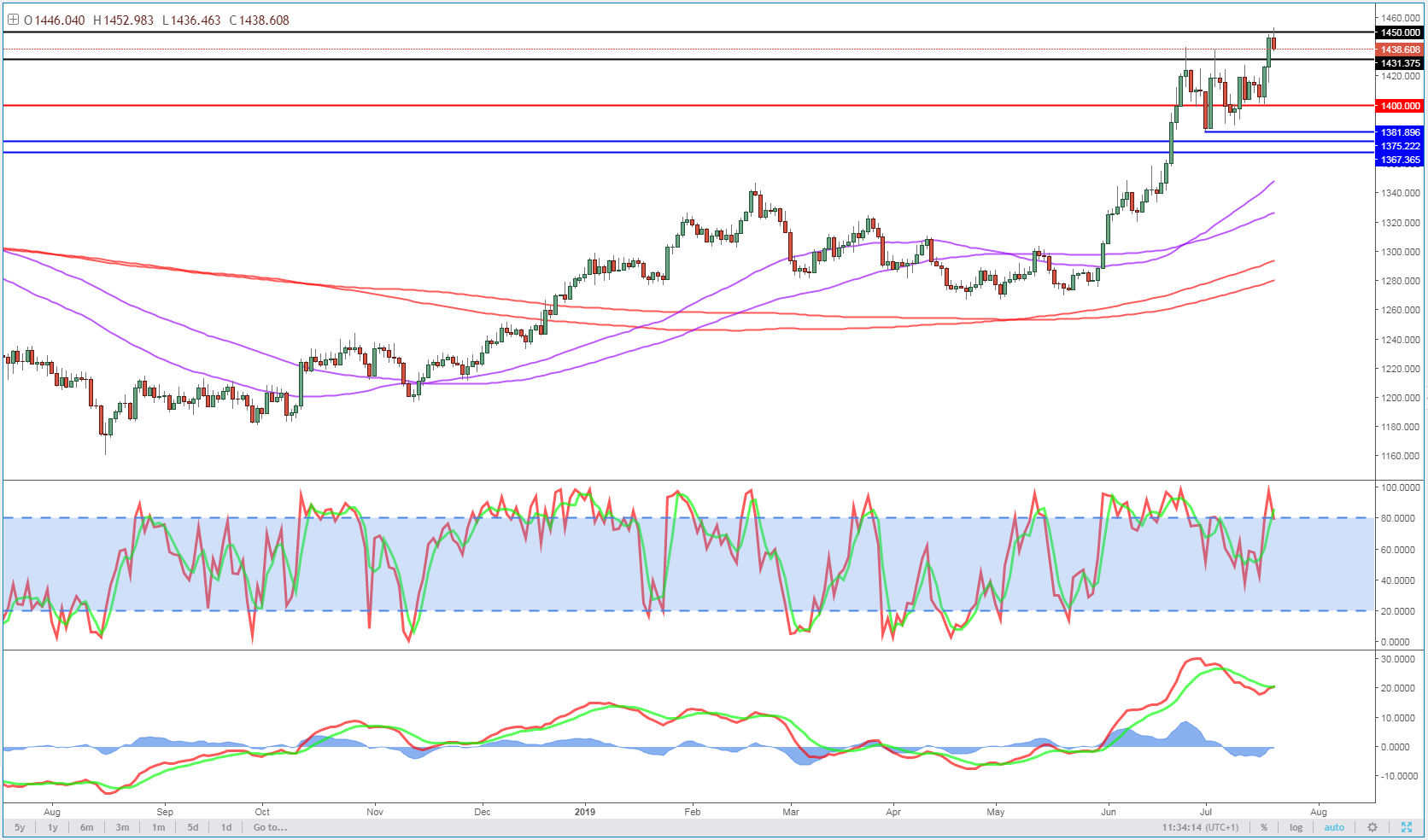

Bitcoin pares gains after Thursday’s spike

Cryptos are unusually one of the more relaxed instruments on Friday, perhaps taking a well deserved break after weeks of chaos. Needless to say, they’ve spent plenty of time in the headlines recently and have been a hot topic in Washington. Bitcoin spiked yesterday on an apparent good news story for the space, with one lawmaker claiming it can’t be killed. This is hardly worthy of a 10% turnaround but after a period of such negative attention, perhaps it was just the kind of headline enthusiasts were craving.

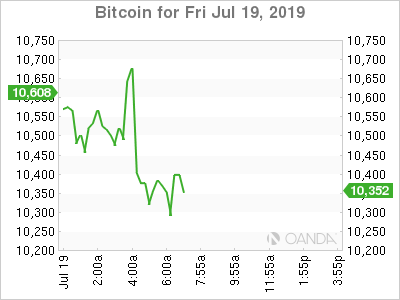

Economic Calendar