GROWTHACES.COM Trading Positions

USD/JPY: long at 119.50, target 121.80, stop-loss 119.50

USD/CAD: long at 1.1600, target 1.1740, stop-loss 1.1600

EUR/JPY: long at 145.10, target 147.00, stop-loss 144.10

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

GBP/JPY: long at 186.00, target 188.70, stop-loss 185.20

GROWTHACES.COM Pending Orders

EUR/USD: sell at 1.2180, if filled target 1.1950, stop-loss 1.2270

USD/CHF: buy at 0.9870, if filled target 1.0070, stop-loss 0.9790

EUR/GBP: sell at 0.7850, if filled target 0.7700, stop-loss 0.7880

AUD/NZD: sell at 1.0530, if filled target 1.0320, stop-loss 1.0580

AUD/JPY: buy at 96.80, if filled target 99.0, stop-loss 96.10

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading positions summary.

EUR/USD: Draghi Strengthened QE Bets

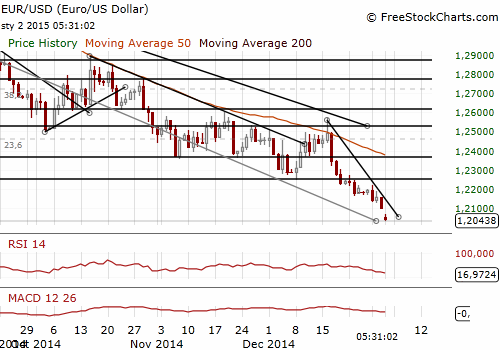

(sell at 1.2180)

- European Central Bank President Mario Draghi said the risk of the central bank not fulfilling its mandate of preserving price stability was higher now than half a year ago, and reiterated its readiness to act early this year should it become necessary. Eurozone inflation stands at 0.3%, far below the ECB's target of just under 2%. Draghi said:

“We are in technical preparations to adjust the size, speed and compositions of our measures early 2015, should it become necessary to react to a too long period of low inflation. There is unanimity within the Governing Council on this.”

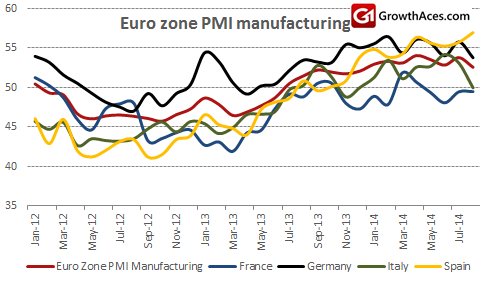

He added that government bond purchases were among the tools the ECB could use to fulfill its mandate. - December eurozone’s manufacturing PMI stood at 50.6, down from an earlier flash reading of 50.8 but beating November's 17-month low of 50.1. That is above the 50 mark that separates growth from contraction, but there was little sign of any improvement this month. December saw the slowest output growth during the current one-and-a-half year period of sustained expansion. However, there was a mild improvement in new order inflows. The growth rate of new export orders rose to a three-month high.

- PMI data showed that the performance of Germany remained subdued, although there were some positive signs as its PMI rose back above the 50.0 no-change mark. Ireland, Spain and the Netherlands all reported solid improvements in performance, while Austria and Greece saw modest deteriorations. The lowest reading was recorded in France. The Italian PMI meanwhile dipped to a 19-month low.

- The overall weakness of the eurozone PMI supports the case for more stimulus from the European Central Bank. On the other hand, there are some positive signs in Ireland and Spain showing that existing policy measures are already taking effect and more patience is needed before new measures are launched.

- The EUR/USD fell to 1.2035 after Draghi strengthened expectations for quantitative easing in the eurozone. That was the lowest level since June 2010. We were looking for a correction in the EUR/USD. However, breaking below the level of 1.2100 fueled bearish sentiment. Our strategy now is to sell EUR/USD at 1.2180. If our order is filled the target will be 1.1950 (just below daily low on June 6, 2010).

Significant technical analysis' levels:

Resistance: 1.2170 (high Dec 31, 2014), 1.2188 (high Dec 30, 2014), 1.2220 (high Dec 29, 2014)

Support: 1.2000 (psychological level), 1.1957 (low Jun 6, 2010), 1.1901 (low Jun 8, 2010)

GBP/USD: Weak UK PMI But Strong Consumer Lending Data

(looking to get short on upticks)

- British manufacturing expanded at a much weaker pace than expected in December. The PMI fell to 52.5 pts from 53.3 pts in November and below the median forecast of 53.7. Rates of expansion in production and new orders eased to the second slowest for over one-and-a-half years. Price pressures also remained subdued, as input costs fell at a faster pace and selling prices moved only slightly higher.

- On the other hand, Friday brought us quite good data on lending. The Bank of England said that consumer lending rose by 8.3% yoy in the three months to November, a pace last seen in October 2005. Mortgage approvals for house purchase dropped to 59,029 in November, from 59,511 in October, the lowest level since June 2013 when Britain's housing market was starting to pick up. A fall to 58,500 was forecast.

- The Bank of England data are in line with official national accounts data last month, which showed household spending rising at its fastest pace since the second quarter of 2010 in the three months to September, as well as private-sector surveys showing strong appetite for big purchases.

- The central bank also showed signs that businesses' reluctance to borrow from eased in November, particularly in smaller firms which have historically found it hardest to get credit. Net lending to businesses dropped by GBP 149 mn, the smallest decline since August, and lending to small businesses rose by GBP 286 mn, the biggest increase since records started in May 2011.

- The GBP/USD fell under 1.5500 after lower-than-expected PMI reading in December. We stay sideways on the GBP/USD. The short-term outlook is bearish and our strategy will be to sell on upticks, in anticipation for a continuation of downward trend. The nearest support level is 1.5427 (low August 28, 2013)

Significant technical analysis' levels:

Resistance: 1.5613 (21-dma), 1.5621 (high Dec 31, 2014), 1.5753 (high Dec 17, 2014)

Support: 1.5427 (low Aug 28, 2013), 1.5207 (low Aug 7, 2013), 1.5166 (low Aug 5, 2014)

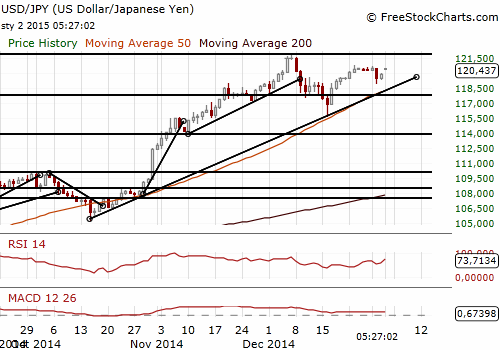

USD/JPY: BOJ’s Kuroda Supported Our Long Position

(stay long for 121.80)

- Bank of Japan Governor Haruhiko Kuroda said the bank has various tools left if it were to ease monetary policy again. Kuroda has voiced confidence that Japan will see inflation hit 2% as targeted in 2015. He added: “If the BOJ loosens its commitment just because it's difficult to achieve the price target, that in itself will make it impossible to meet the price target.”

- The USD/JPY opened the Asian session at 119.80 and started tracking higher towards 120.00. Dovish comments from BOJ chief Kuroda added fuel to the USD/JPY move higher. The rate rose to 120.50 in the morning of the European session. The market in Asia was thin today due to bank holiday in Tokyo.

- GrowthAces.com stays long with the target at 121.80 (just below 2014 high of 121.86).

Significant technical analysis' levels:

Resistance: 120.82 (high Dec 23, 2014), 121.00 (high Dec 9, 2014), 121.86 (high Dec 8, 2014)

Support: 119.75 (session low Jan 2), 119.25 (low Dec 42, 2014), 118.82 (low Dec 19, 2014)