EUR/USD posted losses on Friday, as the pair trades at 1.0680 in the European session. In economic news, German PPI disappointed with a reading of -0.4%. We’ll also get a look at Eurozone Consumer Confidence, and ECB President Mario Draghi speaks in Frankfurt. In the US, there are no economic releases on the schedule. FOMC Member William Dudley, who has sounded positive about a rate hike in December, will deliver remarks at an event in New York.

Eurozone inflation levels remain anemic, and this was underscored on Friday, as Germany released PPI for October. The manufacturing inflation index came in at -0.4%, missing the estimate of -0.2%. The struggling indicator posted its fourth decline in five months, and has not posted a gain above 0.1% in all of 2015. The ECB remains very concerned about deflation, as indicated in the minutes of its recent November policy meeting. The central bank has revised downwards its inflation outlook, and the markets are keeping a close eye on the next policy meeting on December 3. At that time, the ECB could cut rates and/or expand the present asset-purchasing program in order to combat deflation. The euro’s sharp slide has led to growing talk about the US dollar achieving parity with the continental currency, and Goldman Sachs (N:GS) issued a report which projects the euro dropping to parity by the end of 2015, and EUR/USD falling to 0.95 by the end of March 2016.

Although the Fed minutes did not confirm a December rate hike, most analysts concur that the long-awaited move will indeed occur next month. Market expectations have risen to 66% that the Fed will make a move next month. Chris Rupkey, chief financial economist at Bank of Tokyo Mitsubishi, Japan’s largest bank, said he would be “astounded” if the Fed did not raise rates at their next meeting on December 16, especially in light of the strong Nonfarm Payrolls report in October. One major weak spot in the economy is that of weak inflation levels, and the Fed has repeatedly stated that inflation is a prime factor in its decision-making process. Last week’s PPI was awful, posting a second straight decline. On Tuesday, CPI and Core CPI posted small gains of 0.2%, matching the forecast. Are these lukewarm readings enough to convince a majority of Fed members to vote in favor of a hike? Time will tell. Another important factor, which must be remembered is that the markets now seem prepared for a small hike of 0.25% or 0.50%, and there is a growing view that a modest move would not cause unwanted turbulence on the global markets.

The US economy continues to show improvement in most areas, but the manufacturing sector continues to lag behind. There was some positive news on Thursday, as the Philly Fed Manufacturing Index posted a small gain of 1.9 points, beating the estimate of 0.1 points. It marked the indicator’s first gain after two consecutive declines. Earlier this week, the Empire State Manufacturing Index posted its fourth straight decline, underlining worsening conditions in the manufacturing sector. In November, the indicator came in at -10.7 points, weaker than the forecast of -5.3 points.

EUR/USD Fundamentals

Friday (Nov. 20)

- 7:00 German PPI. Estimate -0.2%. Actual -0.4%

- 8:00 ECB President Mario Draghi Speaks

- 10:15 German Buba President Jens Weidmann Speaks

- 15:00 Eurozone Consumer Confidence. Estimate -7 points

- 16:15 FOMC Member Dennis William Dudley Speaks

Upcoming Key Events

Monday (Nov. 23)

- 8:00 French Flash Manufacturing PMI

- 8:30 German Flash Manufacturing PMI

*Key releases are highlighted in bold

*All release times are GMT

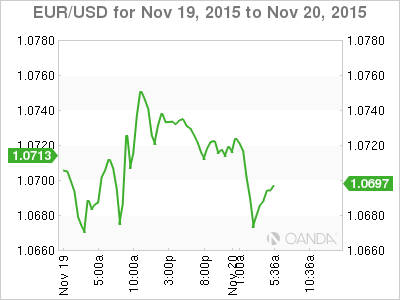

EUR/USD for Friday, November 20, 2015

EUR/USD November 20 at 9:20 GMT

EUR/USD 1.0696 H: 1.0717 L: 1.0667

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0359 | 1.05 | 1.0659 | 1.0732 | 1.0847 | 1.0941 |

- EUR/USD was flat in the Asian session and has weakened in European trading.

- 1.0732 is a weak resistance line.

- On the downside, 1.0659 is under pressure.

- Current range: 1.0659 to 1.0732

Further levels in both directions:

- Below: 1.0659, 1.05, 1.0359 and 1.0287

- Above: 1.0732, 1.0847 and 1.0941

OANDA’s Open Positions Ratio

EUR/USD ratio remains evenly split between long and short positions. This indicates a lack of trader bias as to what direction the pair will take next.