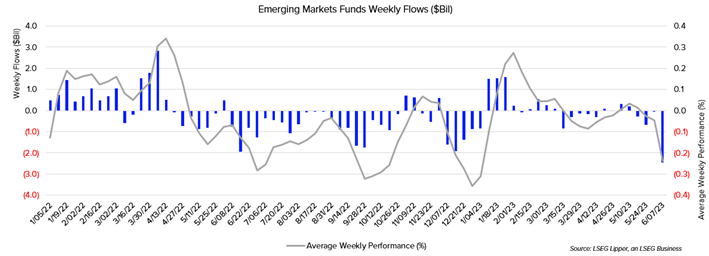

Emerging Market Funds had a strong start to the calendar year, attracting $4.4 billion in January and $1.3 billion in February. This led to their largest quarterly intake in a year (+$6.0 billion). Recent months have not been too kind, however. The Lipper Emerging Market Funds classification has suffered four straight weeks and 11 of the last 13 weeks of outflows. For the fund-flows week ending June 7, 2023, this classification saw an outflow of $2.5 billion—marking its tenth largest weekly outflow on record and largest since the week ending December 15, 2021.

Second-quarter preliminary outflows have the classification at negative $5.1 billion, which would be the classification’s fourth quarterly outflow in five.

Emerging Markets Funds are made up of funds that seek long-term capital appreciation by investing at least 65% of total assets in securities where “emerging market” is defined by a country’s GNP per capita or other economic measures. The classification on average realized solid gains to start the year, through the first quarter of 2023 Emerging Market Funds returned a positive 4.99%, which outperformed the average returns of classifications that make up the Sector Equity (+4.48%), Alternative Equity (-0.87%), and Commodities (-2.04%) macro-groups. Emerging Markets Funds gave some of the gains back in April (-0.63%) and May (-1.20%), leading to a year-to-date average return through May month end of positive 3.05%.

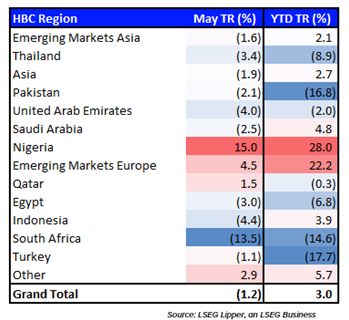

Emerging markets cover a large group of countries, but if we look at the holdings of the funds within the classification, we can paint a better picture of where the flows have primarily been heading and where gains have been found.

Of the funds that make up the classification, we looked at a field that populates a country or region based on whether they have 70% or more of their holdings invested there. Nigeria and Emerging Markets Europe have been the two areas that have seen the highest year-to-date and May returns. Funds that primarily invest in Turkey and Pakistan have struggled the most since the start of the year and funds with more than a 70% allocation to securities in South Africa were put on blast in May (-13.5%.)

In terms of flows, the emerging markets Asia region was the primary winner of receiving net new capital. Since the beginning of the year, funds with primary investments in emerging markets in Asia saw $3.6 billion of inflows, led by the iShares Core MSCI Emerging Markets ETF and Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO). While the year-to-date flows remain positive, the trend is downward. During May funds with heavy allocations to emerging markets in Asia saw $1.2 billion in outflows, led here by the Fidelity Strategic Advisers Emerging Markets Fund.

So, what is driving the outflows?

Today we saw the release of the May consumer price index (CPI) which rose 0.1% in May with the year-over-year rate of inflation decreasing from 4.9% to 4.0%—marking the lowest level since March 2021. CPI-core, which excludes volatile energy and food, increased 0.4% from last month and 5.3% over the last 12 months. With a better-than-expected CPI print, the CME FedWatch Tool now has a rate hiking pause dialed in at 97.6%—just one day ago the tool had a 20.9% of a 0.25% hike.

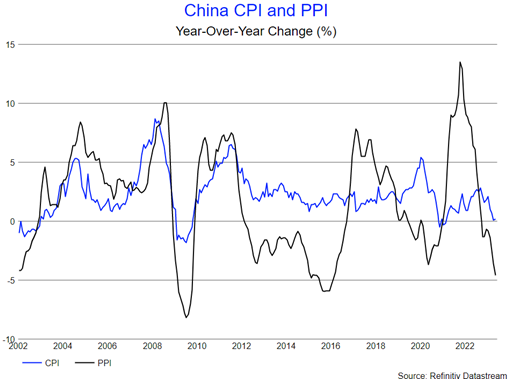

Meanwhile of the 160 funds in the Emerging Markets Funds classification that are primarily invested in emerging markets Asia region, 135 (84.4%) of them have China as leading country allocation with an average of 28.2% of the portfolio. China’s central bank lowered its short-term lending rate for the first time in 10 months. The move was an effort to stimulate a slowing economy. Just last week, China’s factory gate prices fell at the fasted pace in seven years as the country fights deflationary pressures with falling demand and prices.

China’s May producer price index (PPI) fell for the eighth straight month (-4.6%), the fastest decline since February 2016. Both the country’s manufacturing and non-manufacturing purchasing managers index (PMI) indicated that activity slowed month over month, with the new orders index signaling contraction for both.

As tensions between the U.S. and China rise on top of slowing economic growth, risk-averse investors are withdrawing capital from the region. With the U.S. is looking to pause rate hikes, we may see inflows coming back to domestic funds.