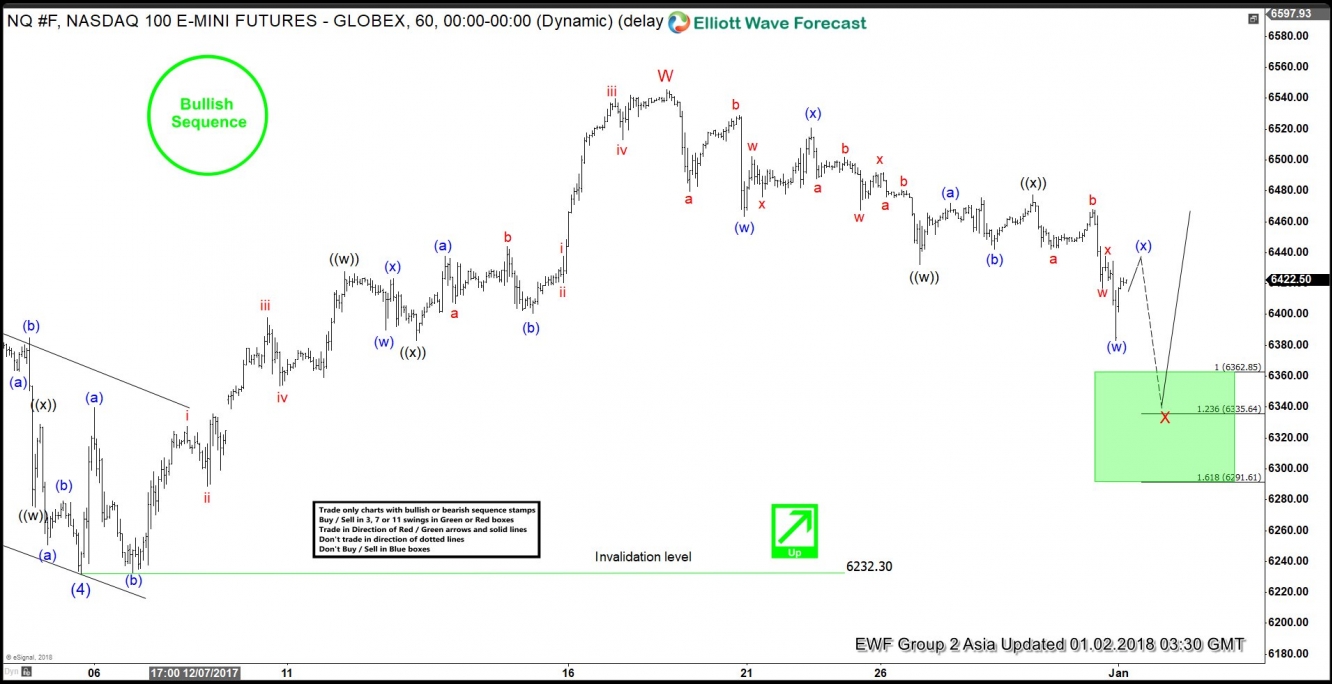

NASDAQ Short Term Elliott Wave view suggests that the Index is correcting the rally from 12/5 low (6232.3). While dips remain above Intermediate wave (4) at 6232.3, expect Index to extend higher. Rally from Intermediate wave (4) low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is in progress towards 6335.64 – 6362.85 green box area before the rally resumes. Internal of Minor wave W unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at 6383, and Minute wave ((y)) of W ended at 6545.75.

Internal of Minor wave X unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6432.25, Minute wave ((x)) ended at 6477.50, and Minute wave ((y)) of X remains in progress towards 6335.64 – 6362.85. We don’t like selling the Index and expect buyers to appear from 6335.64 – 6362.85 green box area for at least a 3 waves bounce as far as pivot at 12/5 low (6232.3) stays intact.

Alternatively, Minor wave X correction from 12/19 peak can take the form of a triple three Elliott Wave structure. In this scenario, minor wave X may have ended already at the last low at 6383.25 and thus Index does not need to make a new low and could have already resumed higher. In any case, we do not like selling any proposed pullback and expect more upside as far as pivot at 6232.3 low stays intact.