Yesterday, the FOMC released the minutes for the meeting, which was held on June 15-16. The minutes stated what was already known after the June meeting, that the Federal Reserve is ready to act, if necessary, in order to support the economy. Today, it will be the turn for the ECB to release their meeting minutes from their previous gathering.

FOMC Meeting Minutes

Yesterday, the FOMC released the minutes for the meeting, which was held on June 15-16. The minutes stated what was already known after the June meeting, that the Federal Reserve is ready to act, if necessary, in order to support the economy. The Fed mentioned that “substantial further progress” is yet to be met, which means that the current monetary support will stay for a while. Most of the Fed officials see inflation risks as “tilted to the upside”, which means that if those risks start to materialise, then the FOMC committee would have to review the possibility of raising rates earlier.

ECB’s Turn To Deliver The Minutes

Today, it will be the turn for the ECB to release their meeting minutes from their previous gathering. In June, the Bank decided to keep all its monetary policy settings unchanged, noting that its PEPP (Pandemic Emergency Purchase Programme) will continue to run at a “significant higher pace”. The Bank raised its 2021 and 2022 GDP and inflation forecasts, but at the press conference following the decision, ECB President Lagarde clarified that headline inflation will remain below target over the forecast horizon. She admitted that they were somewhat more optimistic about the economic outlook than three months ago, but highlighted that the decision statement was unanimously supported, suggesting that tapering is not on any official’s mind, at the moment.

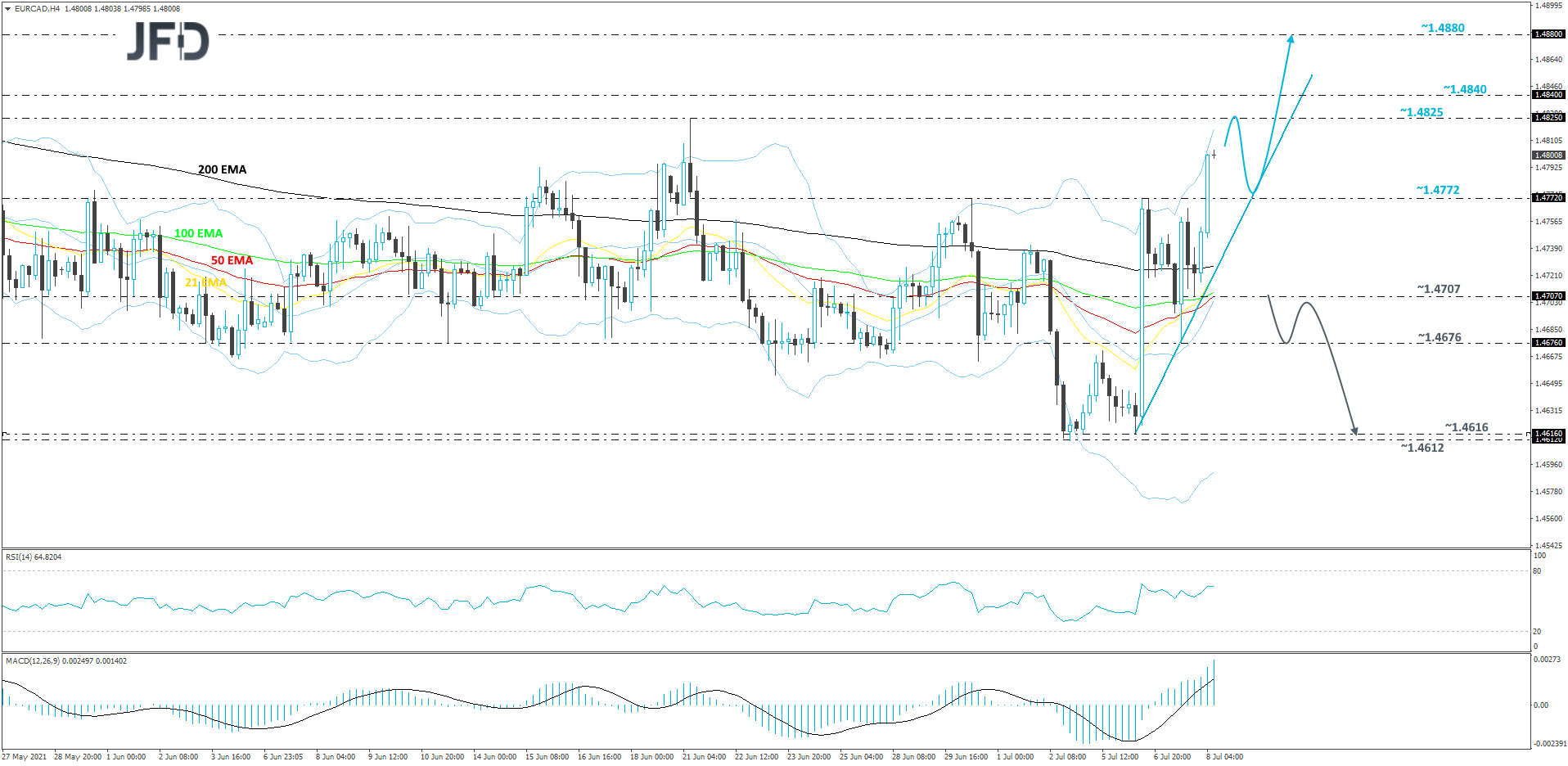

EUR/CAD Technical Outlook

EUR/CAD reversed higher on Tuesday, as oil started feeling the heat, helping the pair to make its way higher again. This morning, the rate broke above yesterday’s high, at 1.4772, and continues to trade above a short-term tentative upside line taken from the low of July 6. As long as the pair continues to balance above that line, we will stay positive, at least for now.

A further push north could bring the rate to the highest point of June, at 1.4825 barrier, where a temporary hold-up might occur. Even if the pair retraces back down, as long as it stays above that upside line, the near-term outlook may remain positive. This could result in another move higher, potentially bringing EUR/CAD to the 1.4840 obstacle, or even to the 1.4880 level, marked by an intraday swing high of Apr. 30.

Alternatively, if the rate breaks the aforementioned upside line breaks and then falls below the 1.4707 zone, marked by yesterday’s intraday swing low, that could send EUR/CAD for further declines. The pair could then drift to the 1.4676 obstacle, a break of which may lead to the next potential support area between the 1.4612 and 1.4616 levels, marked by the lows of July 2 and 6 respectively.

Economic Data

In regards to today’s economic data, the European morning will kick-off with the unemployment rate figures from Switzerland, both seasonally and non-seasonally adjusted readings for June. The current forecast for the two readings is to see improvements in the numbers, meaning that the actual readings are expected to come out at 2.9%. The actual numbers showed up slightly mixed. The seasonally adjusted figure appeared at 3.1%, but the non-seasonally adjusted number came out 2.8%, which was better than the initial forecast.

The US will deliver their initial and continuing jobless claims numbers for the previous week. Last week, the initial claims number improved, managing to beat its forecast and coming out lower. However, the amount of people continuing to claim was on the higher side. This time, the expectations are for the actual numbers to beat its expectations and come out lower. However, it seems that once again the forecasts are on the better side. But will that be the case? It seems that it might be the case. Certainly, the US economy seems to be getting back to normal, however, the government officials keep warning everyone about new virus variants, which are spreading very quickly. This means that businesses may try and maximise their production outputs now, as they fear that further lockdowns could follow. This would result in more people getting employed, which would improve the claim statistics.

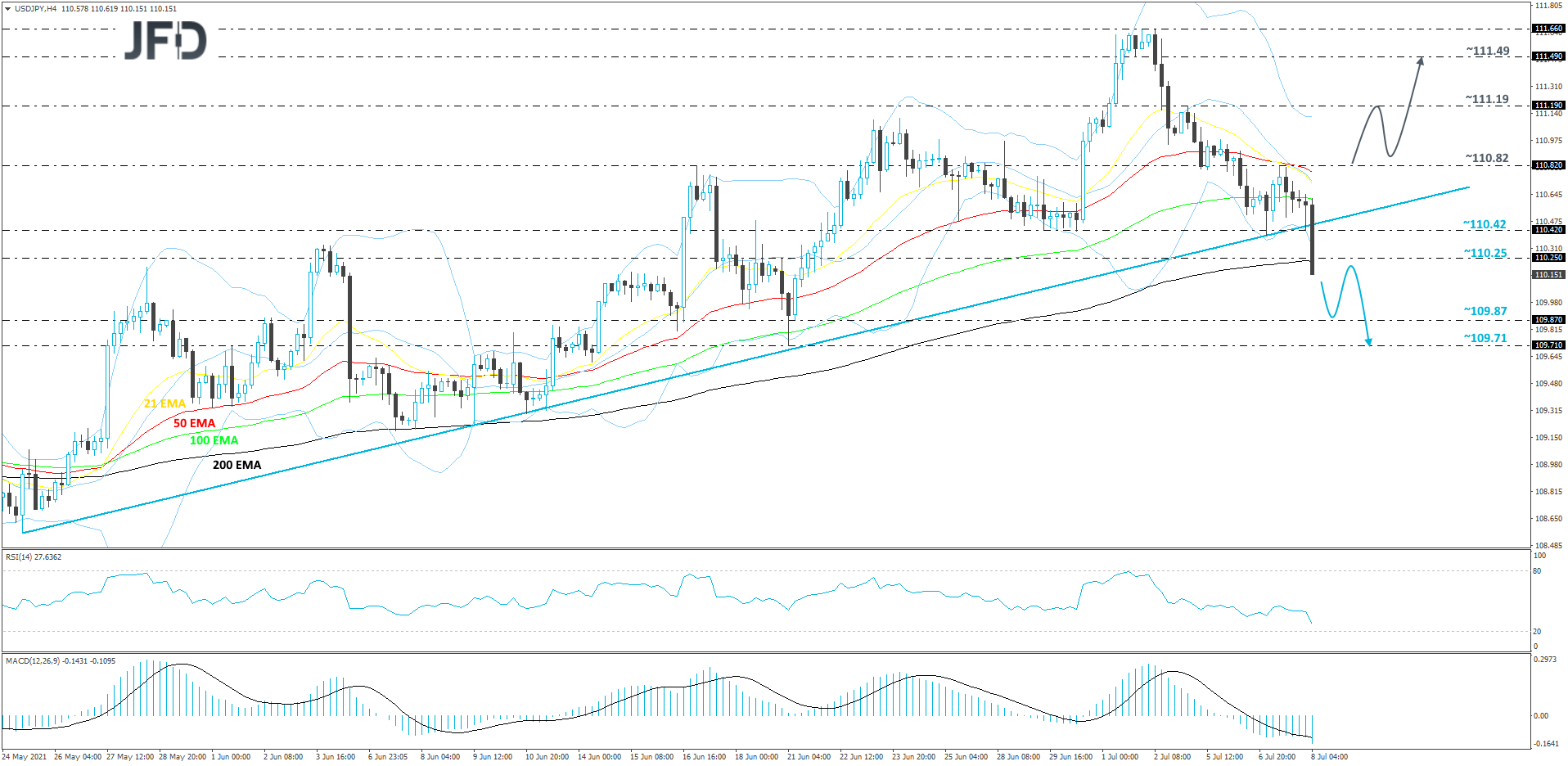

USD/JPY Technical Outlook

After a couple of months of trading above a short-term upside support line taken from the low of May 25, USD/JPY finally broke it and rushed further south. Now the pair is seen trading below the 200 EMA on our 4-hour char, which might be considered as an additional bearish indication. As long as the pair remains below that 200 EMA, we will aim lower.

A further move south could bring the rate closer to the 109.87 hurdle, marked by an intraday swing low of June 21, where the rate may stall for a bit. Even if USD/JPY rebounds, as long as it stays somewhere below that 200 EMA, another decline could be possible. If so, the pair might drift to the 109.71 zone, marked by the low of June 21.

On the upside, if the rate manages to get back above the previously discussed upside line and then also pushes through the 110.82 barrier, marked by yesterday’s high, that might attract more buyers into the game, possibly clearing the way towards higher areas. USD/JPY could then rise to the 111.19 obstacle, which if broken may lead the pair to the 111.49 level, marked by an intraday swing low of July 1.

As for the rest of today’s events

The US will deliver its crude oil inventories. There is no forecast available, but we know that for the past 7 weeks, the actual figure was coming out below its initial forecast, meaning that the demand is still there. This, of course, we have seen being reflected in the price of oil.