It has been a lackluster week for the euro, and the trend has continued on Thursday, ahead of the ECB rate decision. In the European session, EUR/USD has inched lower and is trading at 1.1240. In economic news, German Industrial Production bounced back in April with a strong gain of 0.8%, which beat the forecast of 0.6%. There was more good news from Eurozone Revised GDP, which improved to 0.6%, edging above the estimate of 0.5%. Today’s highlight is the ECB rate meeting, with the markets expecting the benchmark rate to remain at a flat 0.00%. The US releases unemployment claims, which is expected to drop to 241 thousand.

All eyes are on the ECB, which holds it monthly rate meeting later in the day. The central bank is not expected to announce any changes to current monetary policy. The benchmark rate has been pegged at 0.00% since March 2016, and no change is expected. As well, policymakers are unlikely to make any changes to the quantitative easing program, which ends in December. However, the euro could still move if there are any surprises in the rate statement or from Mario Draghi, who will hold a follow-up press conference.

On Wednesday, the euro briefly lost ground on reports that the ECB was planning to downgrade its inflation forecast to 1.5% annually for 2017, 2018 and 2019. In a March forecast, the bank predicted inflation at 1.7%, 1.6% and 1.7%, respectively. The forecast of weaker inflation is being attributed to lower energy prices. Earlier in the year, inflation reached the ECB’s target of 2.0%, but this didn’t last long, and the May figure of 1.4% was well of this goal.

Mario Draghi has preached caution and patience, and will reluctant to tighten policy without stronger inflation levels. Still, with the euro-area economy showing improved growth in 2017, the markets would like to see the ECB at least acknowledge that the economic picture has brightened, and will be looking for a more hawkish tone from the central bank, such as a removal of the bias towards easing. If there are some nuances in the rate statement or Draghi’s comments that point to a more hawkish stance, the euro could move higher.

In Washington, the hottest ticket in town is the Senate Intelligence Committee hearing of former FBI director James Comey. On Wednesday, the committee released a written statement from Comey which discussed his meeting with President Trump. There are accusations that Trump asked Comey to close an investigation into Trump’s alleged ties with Moscow, and the committee will grill Comey on this key issue.

The media is in a feeding frenzy ahead of Comey’s testimony, but it is doubtful that his testimony will be the “smoking gun” that leads to charges of obstruction of justice against President Trump. At the same time, Comey’s testimony could complicate matters for a beleaguered Trump administration, and any dramatic revelations could shake up the markets. Investors are growing more skeptical that Trump, who seems to be spending most of his time in damage control mode, will be able to deliver on key campaign planks, such as tax reform. If Trump appears even more vulnerable after Comey’s day on the stand, the dollar could weaken.

Super Thursday – Politics and Monetary Policy Take Center Stage

Little fallout from Comey so far

EUR/USD Fundamentals

Thursday (June 8)

- 2:00 German Industrial Production. Estimate 0.6%. Actual 0.8%

- 2:45 French Trade Balance. Estimate -5.9B. Actual -5.5B

- 5:00 Eurozone Revised GDP. Estimate 0.5%. Actual 0.6%

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Unemployment Claims. Estimate 241K

- 10:30 US Natural Gas Storage. Estimate 99B

*All release times are EDT

*Key events are in bold

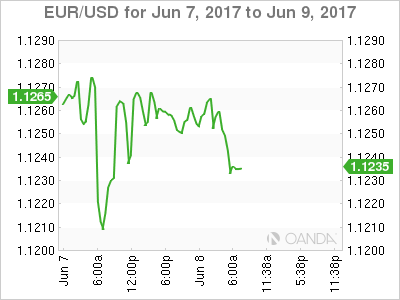

EUR/USD for Thursday, June 8, 2017

EUR/USD Thursday, June 8 at 6:35 EDT

Open: 1.1257 High: 1.1270 Low: 1.1230 Close: 1.1236

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0985 | 1.1122 | 1.1242 | 1.1366 | 1.1465 | 1.1534 |

EUR/USD was flat in the Asian session and has posted small losses in European trade.

- 1.1242 was tested in support earlier and is under pressure

- 1.1366 is the next resistance line

Further levels in both directions:

- Below: 1.1242, 1.1122, 1.0985 and 1.0873

- Above: 1.1366, 1.1465 and 1.1534

- Current range: 1.1242 to 1.1366

OANDA’s Open Positions Ratio

EUR/USD ratio remains unchanged this week. In the Thursday session, short positions have a majority (71%), indicative of EUR/USD continuing to move lower.