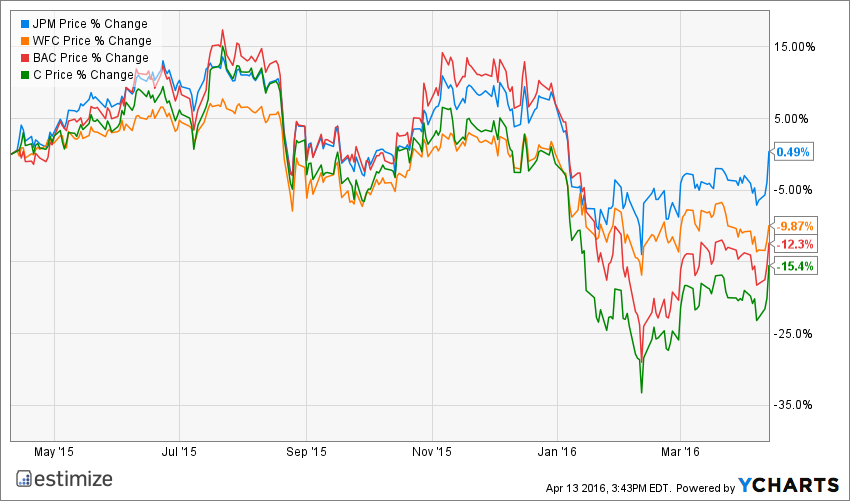

America’s biggest retail banks are reporting first quarter earnings over the course of this week and analysts are predicting mostly misfortune. Troubles in China, weak commodity prices and a cloud of skepticism surrounding interest rates have brought uncertainty to Wall Street's financial titans.

Fortunately, JPMorgan Chase (NYSE:JPM) reported first quarter earnings yesterday that easily beat expectations, setting a favorable tone to the start of bank earnings season. Following Chase, today we'll hear from Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC), set to report today, with an additional report coming from Citigroup (NYSE:C) tomorrow, Friday, to cap off the week.

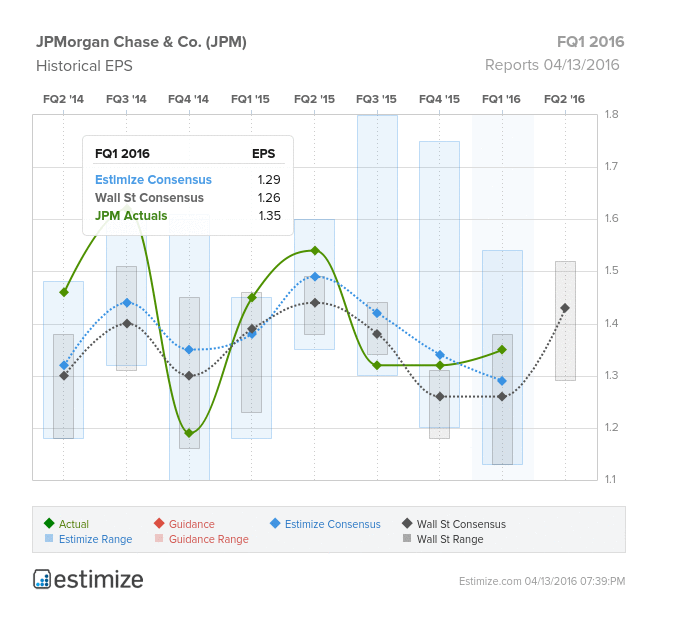

Yesterday, Chase kicked things off for banks with better than expected first quarter earnings. The bank posted earnings per share of $1.35 on 24.08 billion in revenue, beating the Estimize consensus by 5 cents. Shares traded higher by nearly 3%, helping to cut into year-to-date declines.

The bank’s consumer facing business lines reported stable earnings. Net interest income was $11.7 billion, up $723 million, driven by strong loan growth and the impact of higher lending rates. The Fed's decisions to raise rates in December has paid off sooner than initially expected.

Still, first quarter results were muddled with declines in key metrics. On a per share basis, earnings fell 7% on a 3% decline in net revenue. Moreover, the bank’s net income fell 7% to $5.434 billion from a year earlier due to volatile oil prices and a slowdown in investment banking. Investment banking has been Chases’ most volatile business, falling 15% to $8.135 billion.

Chase also raised loan loss reserves to $1.8 billion, compared to $959 million from the same period last year. The increase was primarily driven by a $519 million increase to cover energy loans and an additional $162 million for metals and mining. Wells Fargo, Bank of America and Citigroup also have large exposure to energy which will make loan loss reserves a common theme this week.

Today we get earnings from Wells Fargo and Bank of America.

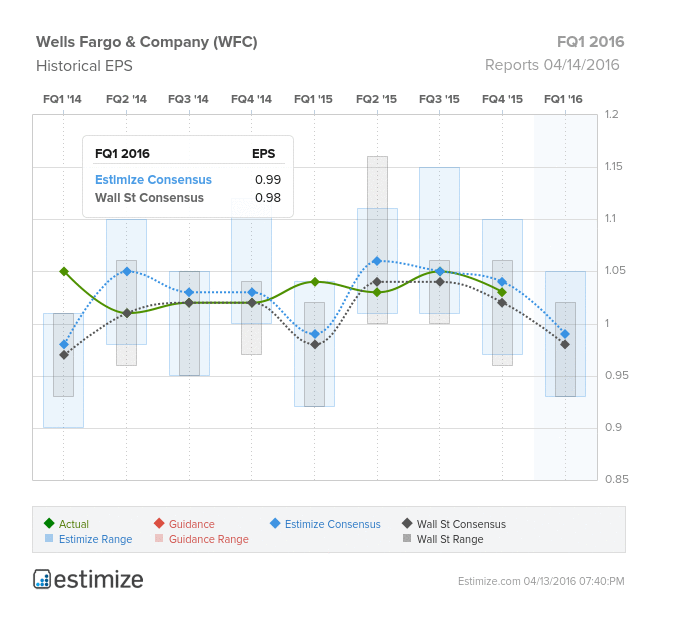

Wells Fargo has been one of the most stable banks, maintaining decent EPS and steadily rising revenue. In fact, the bank has topped expectations in three of the four quarters of 2015. Still, shares have plunged, falling 10.5% in the past 12 months and 10.6% in 2016 alone.

Strong earnings can hopefully turn around this downward spiral. Analysts are expecting earnings per share of $0.99 on revenue expectations of $21.66 billion according to the crowdsourced data. Unlike other retail banks, Wells Fargo has preserved relatively flat year-over-year growth. Plunging oil prices has been one of its biggest concerns, leaving Wells Fargo’s energy sector loans exposed to an exorbitant $42 billion.

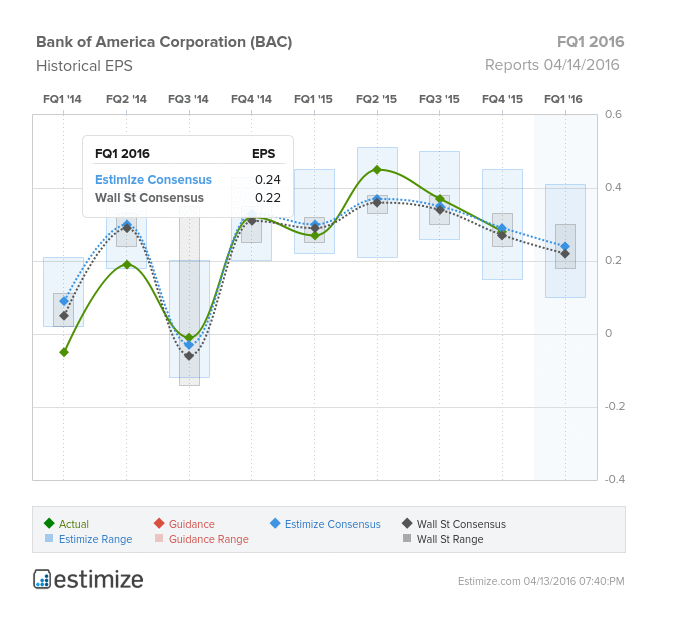

Bank of America, on the other hand, might be in the worst position of the retail banks. The stock has been in a tailspin lately, falling 18.6% since the start of the year. Even though the bank topped its earnings expectations, they managed to miss revenue by approximately $500 million.

This trend should continue to be troubling as BOA is expecting weakness in its trading and investment banking revenues. Projected year-over-year declines in these segments are predicted to outpace the losses of its peers. Meanwhile, Bank of America’s volatile net interest income, increased expenses, larger capital deployment and a deteriorating energy sector will hamper earnings this quarter.

Analyst are offering per share estimates of $0.24 on $20.68 billion in revenue according to the crowd data. Estimates have been feverishly cut ahead of its earnings call, falling 23% in the past 3 months, reflecting a 2% decline on a year over year basis.

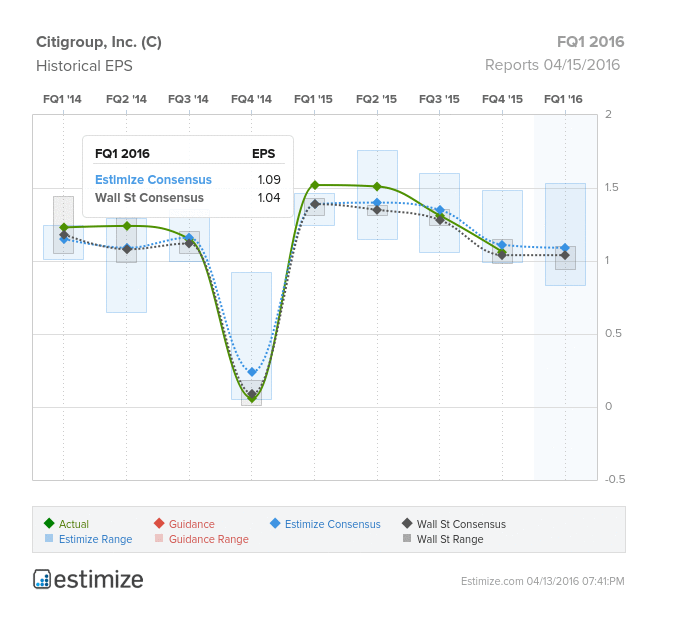

Last but not least, tomorrow, Citigroup will cap off the first week of earnings season with its first quarter earnings. Despite strong earnings over 2015, shares slipped over 21%. Like its peers, net interest income remains a focal point of Citi’s earnings this Friday. Expectations are that this will come in lower relative to fourth quarter results, with interest margins and core income fees declining as well.

Recently, Citi has moved toward a more customer driven model, abandoning its problem assets of the past. Ultimately the bank hopes it can reduce risk and free up capital by opening up additional growth avenues such as its deal with Costco (NASDAQ:COST).

According to the Estimize data, per share estimates have been cut 28% on a 7% decline in revenue, resulting in EPS of $1.09 and revenue expectations of $17.79 billion. Compared to the same period last year, this prediction amounts to a 22% decline on the bottom line while sales are expected to fall 8%.

How do you think these names will report this week?