Dogecoin and Shiba Inu could soon retest a critical support level that will determine whether a new downtrend will start.

Key Takeaways

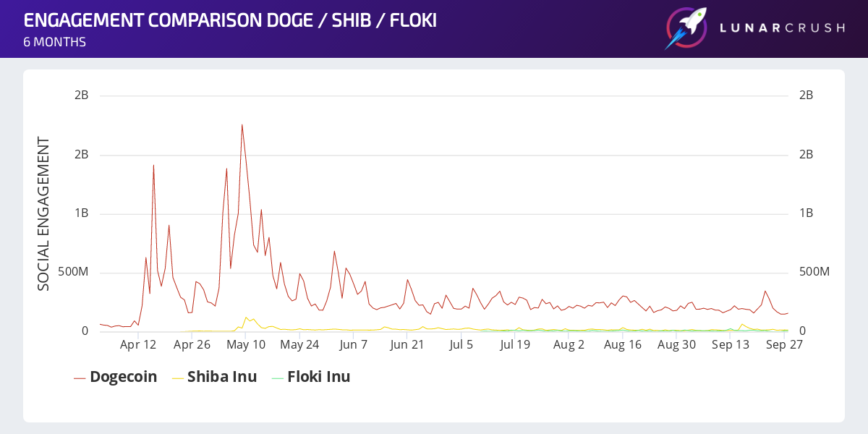

- Dogecoin and Shiba Inu’s social engagement metrics have plummeted since May.

- DOGE is now sitting on weak support, ready to retest $0.17.

- Likewise, SHIB is primed for a downswing to $0.00000582.

Dogecoin and Shiba Inu have lost the crowd support that allowed them to skyrocket to new all-time highs. Until retail interest is back, both assets could suffer further losses.

Dog Tokens Look Ready to Dip

Dog tokens are losing steam.

DOGE and SHIB surged in tandem earlier this year, posting extraordinary returns ahead of a market-wide crash in May. Along with many other digital assets, both hit all-time highs as retail interest in the space hit a peak.

Data from LunarCRUSH shows that Dogecoin and Shiba Inu’s social engagement metrics soared amid the market frenzy. LunarCRUSH measures social media engagements such as favorites, likes, comments, replies, retweets, and shares. DOGE recorded more than 1.76 billion on May 9, while SHIB hit 122 million.

However, the level of social activity for both assets has plummeted since May. Dogecoin’s social activity is currently hovering around 150 million engagements per day, while Shiba Inu’s is closer to 10 million.

As interest in DOGE and SHIB is weakening, their prices could be facing a steep decline.

Dogecoin Looks Stagnant

Dogecoin’s price action has been stagnant for the past five months. The tenth-largest cryptocurrency by market cap has been recording a series of lower highs while the $0.17 support level absorbs any downswing.

From a technical perspective, it seems that the price behavior has led to the formation of a descending triangle on the daily chart. With DOGE edging closer to the consolidation pattern’s apex, a significant price movement could be imminent.

A decisive daily candlestick close above the triangle’s hypotenuse at $0.26 could result in an explosive breakout towards $0.41. Still, investors need to watch out for the triangle’s x-axis at $0.17 since losing this level as support could see DOGE crash to $0.04.

While the macro outlook points to further stagnation until either support or resistance breaks, the near future looks bearish.

Dogecoin is currently being held by the Tom DeMark (TD) Sequential’s setup trendline at $0.198. This support level is getting weaker over time, suggesting that a violation is near. A break of this level is likely to happen soon, which would likely push DOGE down toward the triangle’s x-axis at $0.17.

Shiba Inu To Retest Support

Like Dogecoin, Shiba Inu has endured a prolonged stagnation period. Its price appears to be contained within a parallel channel on the daily chart.

Every time SHIB has risen to the channel’s upper or middle boundary since June 5, a rejection has occurred, pushing prices to the lower edge. From this point, it tends to rebound, which is consistent with the characteristic of a channel.

SHIB was recently rejected from the channel’s upper boundary and currently trades below the middle trendline. These conditions indicate that if the price action seen over the past month repeats, Shiba Inu will dive to the channel’s lower edge at $0.00000582.

It’s worth noting that SHIB needs to hold to $0.00000582 in the event of a bearish impulse, as closing below this critical demand wall could lead to a 36% correction.