- Focus is on Disney's earnings report, with close attention to subscriber losses due to recent price increases

- Despite concerns, forward-looking estimates suggest improved EPS and a 10% revenue boost this quarter

- Disney's stock touched pandemic lows recently and the earnings report and comments from management in the earnings call will be key for a turnaround

The spotlight is on Walt Disney Company (NYSE:DIS) as the entertainment behemoth prepares to unveil its latest quarterly financial results after today's market close.

In the previous report last August, the Burbank, California-based company managed to exceed expectations in earnings per share (EPS) but fell slightly short in quarterly revenue, showcasing a mixed performance.

DIS's lackluster performance in its broadcasting business has contributed to analysts' apprehensive outlook for the Q4 financial results.

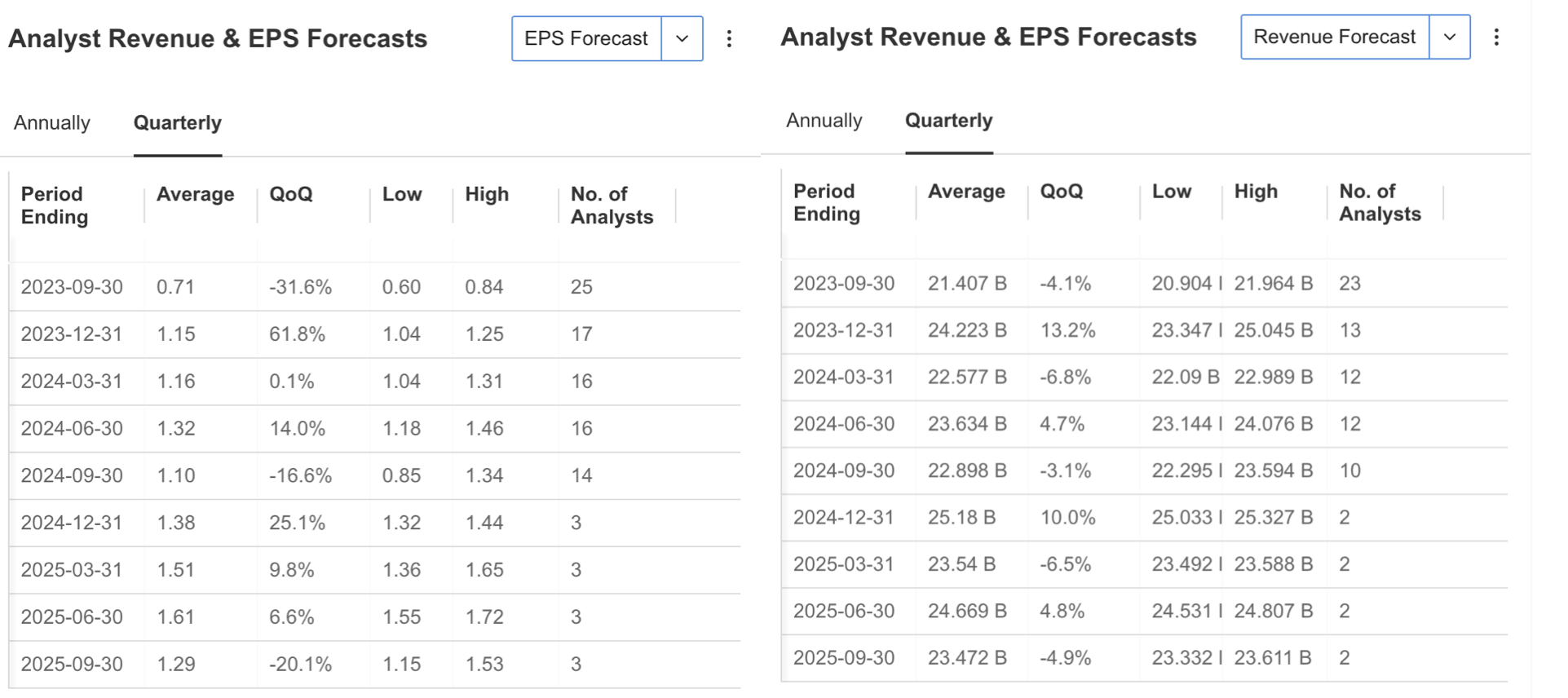

A look at the InvestingPro analyst survey reveals that over the past three months, 14 analysts have downwardly revised their expectations for both EPS and revenue. In contrast, only 3 analysts have raised their forecasts.

Source: InvestingPro

While some analysts present a pessimistic outlook for Disney's last quarter earnings, it's essential to consider the current negativity as a potentially short-lived phase, especially when focusing on future forecasts. In fact, there is an estimate that Disney's earnings per share (EPS) could increase to around $1 by the end of the year, showcasing an optimistic shift.

Projections also indicate that revenue expectations for the current quarter are currently set at $24.2 billion, marking a 10% increase. Notably, the company's robust performance in international theme parks is cited as a compelling reason for this improved outlook as the year concludes.

Source: InvestingPro

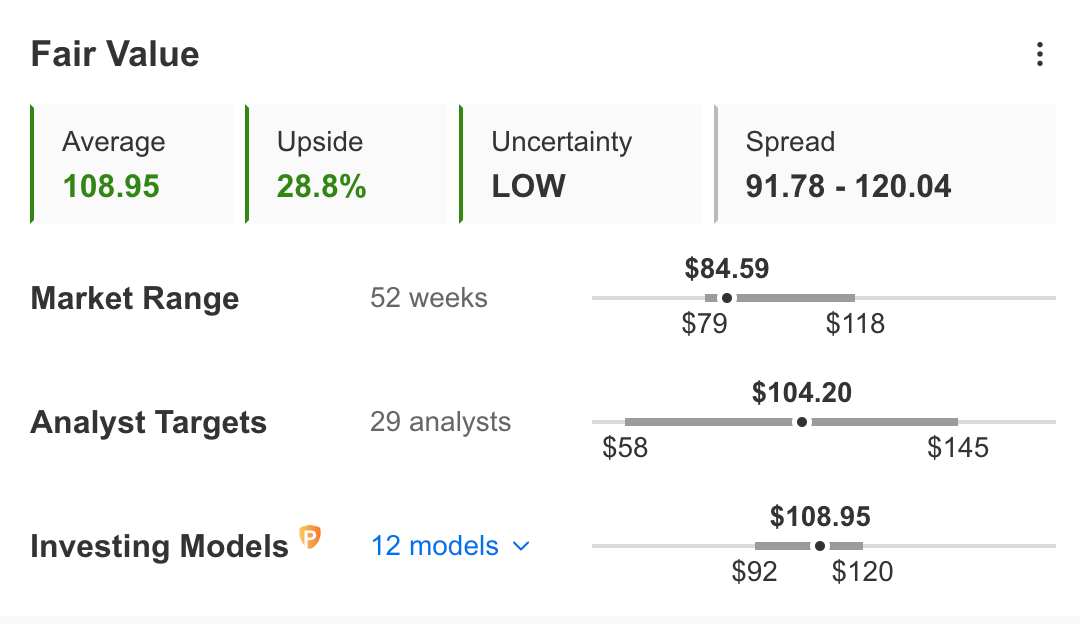

Price forecasts for DIS shares based on a 12-month period reflect the share's upside potential of close to 30%. Although analysts offer a downward revision for the 4th quarter, they foresee a value increase of close to 25% from the current level over a one-year period. InvestingPro's fair value analysis also calculates that DIS can rise up to $109 in the short term over 12 financial models.

Source: InvestingPro

Reviewing DIS's price chart, it's evident that the stock has been following a downward trajectory since March 2021. Despite some brief periods of upward movement early in the year, DIS maintained its overall downtrend, reaching a low of $79 in October. In the lead-up to the earnings report, the stock has been trading around the $84 range, reflecting a nearly 10% drop since the beginning of the year.

Disney's Potential Subscriber Loss in Focus Following Price Increase

In the earnings report to be announced today, the number of subscribers on Disney's digital platforms will once again be carefully monitored. As the number of subscribers continued to decline, the company decided to increase prices with rival companies to increase revenue per subscriber. Although this is seen as a revenue-enhancing effect, it also creates uncertainty by bringing the risk of increasing the company's subscriber loss.

Earlier this year, CEO Bob Iger pledged to make Disney's broadcasting business profitable. In addition, while the company continues to struggle in television networks such as Disney Channel, ESPN, and ABC, Iger's efforts to find potential strategic investors for ESPN and the decision to buy the rest of Hulu's shares are likely to be the issues that will stand out in the statement to be made after the earnings report.

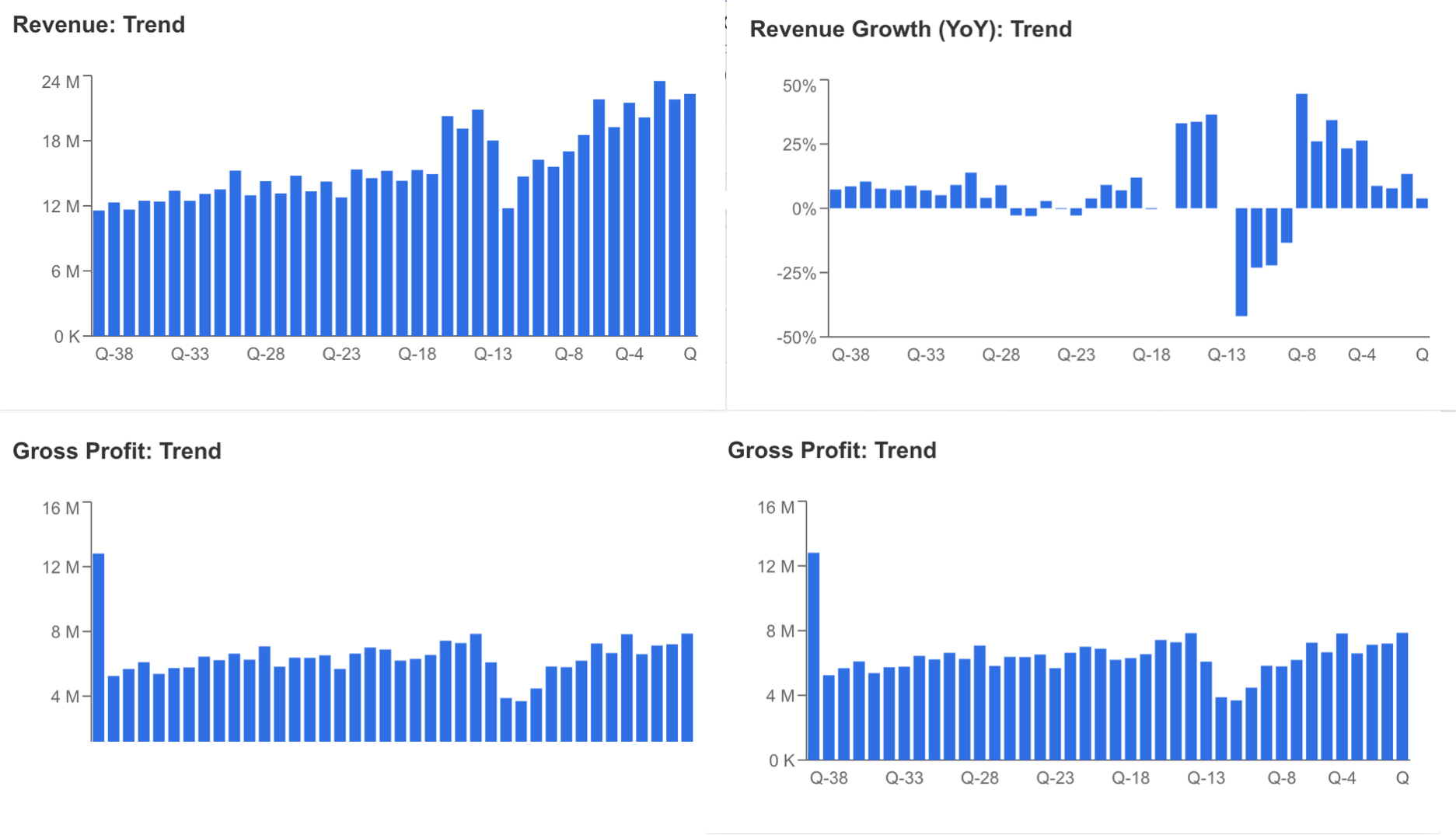

Among the important financial items of Disney before the earnings report, it is seen that revenue remained above $20 billion on a quarterly basis in the last 1-year period. But, the downward trend in revenue growth is a warning sign. While the upward trend in costs continues to suppress gross profit, the gross profit margin fluctuates between 30%-35%.

Source: InvestingPro

Another negative factor for Disney was the sharp decline in operating income in the previous quarter while operating expenses rose. Within all these negativities, we saw that net profit, which has been low for a long time, turned into a loss in the last quarter.

Source: InvestingPro

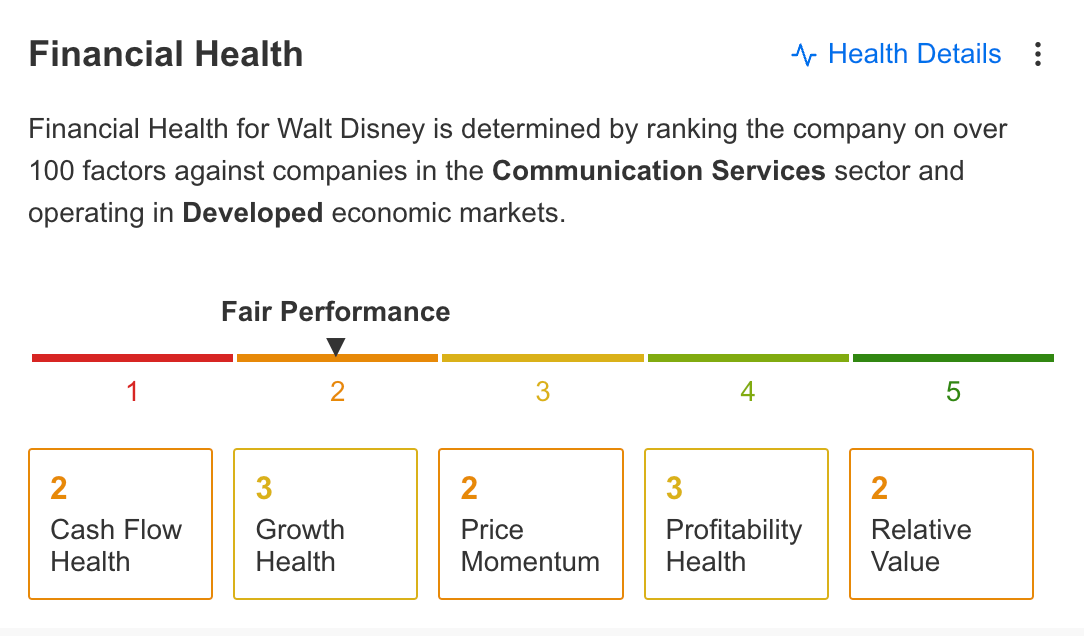

Summarizing the negatives for the company, there are analysts' negative revision of the earnings report, the recent decline in revenue growth, the continuing average debt level, and the high price/earnings ratio.

In light of the latest financial data, we can see that Disney's financial situation is below average.

Source: InvestingPro

Therefore, while Disney's shares may currently appear undervalued as they reach historic lows, the company's future remains uncertain amid challenging times. The fierce competition in the digital realm might not suffice to enhance profitability, even with subscription price hikes. Furthermore, the way the company's management handles asset allocation adds to this uncertainty.

Considering these factors, investors might opt to hold off until Disney achieves consistent profitability in its broadcasting business and successfully steers its linear network segment back on track.

Disney Stock: Technical Outlook

Last month, the stock plummeted to $79, marking its lowest level since March 2020. There have been limited buying attempts from these lower price ranges, and the stock's future remains uncertain.

If the statements made after the earnings report manage to convince investors, achieving a breakthrough to reach the $90 range in the initial stage could be interpreted as a positive step in breaking the long-term downtrend.

Subsequently, the significance of weekly closes above the $96 mark becomes crucial for a trend reversal, and it's plausible that buying activity may strengthen beyond this threshold.

Conversely, a surge in selling pressure post-earnings report might exert downward pressure around $85, which is the nearest resistance level for DIS shares. In such a scenario, the stock could potentially establish new lows below the $80 mark.

***

Disclaimer: The author does not own any of these shares. This content is purely for educational purposes and cannot be considered as investment advice.