It was a volatile week of trading heavily influenced by hedging flows, as noted by sharp rises and declines in implied volatility measures such as the VIX. This makes grasping the underlying message in the market hard.

Friday was difficult in some respects because it left me feeling somewhat defeated. Not because the equity market rallied by 1%—that was pretty much fully expected given short-term implied volatility levels—but more so because rates didn’t move higher, and the dollar weakened.

This was not what I was expecting. But when looking through some charts over the weekend, I noticed a few interesting patterns that developed. I first noticed how the bull flag in the DXY broke lower and how the DXY hit the 50-day moving average and bounced right off it.

It was also the same setup for the USD/CAD, which fell to the 50-day moving average and bounced to close higher on the day.

You also saw this in the USD/JPY, which is odd because it has been influenced heavily by intervention by the Ministry of Finance and the Bank of Japan.

We also saw the same thing happen in the 2-year. The last couple of times that the 2-year has been in an uptrend, the 50-day has served as support, and it has usually gone on to make a new high. Now, that doesn’t mean it has to happen again this time, but that has been what has happened in the past.

The NASDAQ 100 hit resistance at the 50-day moving average on Friday.

The S&P 500 also hit the 50-day moving average on Friday.

It was also the case for the Dow Jones.

Fed Members to Speak This Week

This suggests that positioning may have had a big say in what happened the last couple of days of last week, especially if investors were positioned for a more hawkish than expected Fed and a hot job report.

Typically, in my experience, algorithms and programs use these moving averages a lot. The Fed said much of what was expected, but Powell could have been more hawkish, and he wasn’t. But the one thing we should consider or that I have noticed is that Powell likes to play the middle man a lot these days, and with Fed speakers today so frequently public, Powell doesn’t have to be as vocal anymore.

He doesn’t need to be the one that “crashes” the market. He lets his speakers speak for themselves and lets the data do the heavy lifting. However, what comes from these meetings is pivotal for the market, and the pivot from this meeting is that the Fed has now officially acknowledged that the inflation process has stalled and that rate cuts will take longer to come.

With that said, I would be curious to see how Fed speakers come out this week and make their case for rate cuts or not. I would guess that there will be more members talking about fewer cuts and some members talking about no cuts. This implies that the dots for the June meeting will shift higher.

Last week’s data didn’t make a case for rate cuts, and the jobs data may have been somewhat skewed in April. I would guess that there will be more members talking about fewer cuts and some members talking about no cuts. This implies that the dots for the June meeting will shift higher.

Jobs Report Could Have Been Skewed

Some have observed that with Easter coming in March this year, seasonal hiring that would typically occur in April happened in March, pushing up hiring in March and down in April hiring. When you look at the 2-month rate of change in the nonfarm payrolls, it was down versus the previous value, but it has been within the same range since December.

Meanwhile, the 6-month annualized rate of change for wages was pretty much the same as it has been since December. So perhaps there is something to the idea of the earlier-than-normal Easter holiday playing a role.

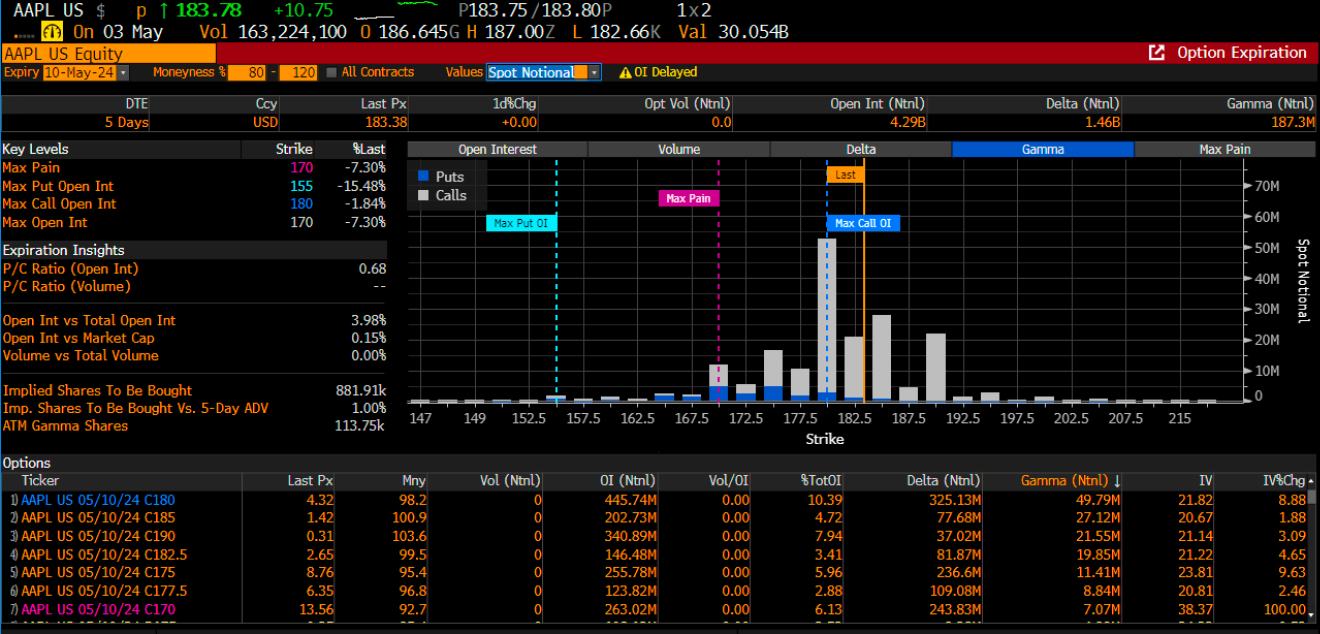

Apple Holds Gains

As for Apple (NASDAQ:AAPL), I was surprised to see it hold the gains on Friday. While it did close off its highs, I would be curious to see if it comes back below $180, as that was the level with the most gamma heading into Friday. That looks to be the case again this week, with $185 being the “call wall” or resistance.

Nvidia Looking at a Challenging Week Ahead

Meanwhile, $900 in NVIDIA (NASDAQ:NVDA) appears to be big resistance, with a break of $900 opening a path to $950 based on gamma positioning. But there is a lot of gamma built up between $900 and $950, and I think that will make the path higher for Nvidia very challenging this week. This probably means that $900 is more likely to be met with sellers than buyers.

But we will see.