After dovish US session ending, the Equities markets are waiting ahead for cues from US officials visit to China to find a breakthrough deal for calming trade tension.

While the greenback is still trying to keep its recent progress versus its rival currencies, After the Fed decided to maintain its fund rate unchanged at 1.75% as expected following lifting it by 0.25% last March.

The Fed maintained also its holding of gradual pace of tightening can be warranted by the economic expansion which decelerated in the first quarter to 2.3% annually.

The Fed did not ignore to mentioned that the inflation became near its 2% yearly target and it is expected to be close to this rate over the medium term and it named this inflation movement "symmetric" and that can show Fed's tolerance to accept inflation rates above 2% with no rush to take tightening action.

After Mar PCE has shown in the beginning of this week yearly rising by 2% to be the highest scale of rising since February 2017 and also Mar PCE core figure excluding food and energy has shown increasing by 1.9% y/y which has been the highest reached rate since April 2012.

Until now, it is still widely expected to see this year hiking by only 0.75%, as The markets have not seen yesterday any new sign of monetary policy shifting to collaborate with the current higher inflation outlook.

It seemed to be the same gradual path of tightening which has started during The Former Fed's Chief Yellen's Era, when the inflation was in lackluster stance lower than what has been expected by the Fed itself, as she has been highlighting several times during last year which has watched Fed fund rate rising by 0.75% also.

Anyway, The Fed's cautiousness stance is still not bad for US dollar and it looks more hawkish when we compare it with the current unchanged monetary stance in EU, UK and Japan.

EUR/USD is now trading well below 1.20, As European Central Bank is still has no clear plan to raise interest rates or even has the intention to shift its asset purchases tapering at the current inflation levels which are still well below its 2% yearly inflation target.

The ECB as expected kept yesterday the main refinancing rate at 0, the marginal lending rate at 0.25% and the deposit rate unchanged at -0.4% respectively, after EU CPI decelerated to only 1.3% yearly in March to weigh down on the interest rate outlook in EU.

While the situation in UK is looking weaker, after Governor Carney states to BBC that Brexit uncertainty could delay interest rate hiking which will be gradual way and concerning the inflationary wage pressure he said that "productivity is not increasing, which will limit the rate at which people's wages can pick up."

Carney's dovish comments came along with Q1 barely quarterly expansion by 0.1% which has been the weakest since the last quarter of 2013 to weigh down on the British pound versus the greenback sending it for trading currently below 1.36.

In the same in Japan, there is no sign yet of having a tightening action can be this year, as the BOJ is still looking eager to keep its Ultra easing policy running with Abe's "Abenomics" stimulating policy for propping up the inflation to reach its 2% yearly inflation target, While Japan National CPI ex fresh foods which is the favorite gauge of inflation to BOJ came recently to show yearly decelerating to only 0.9% in March.

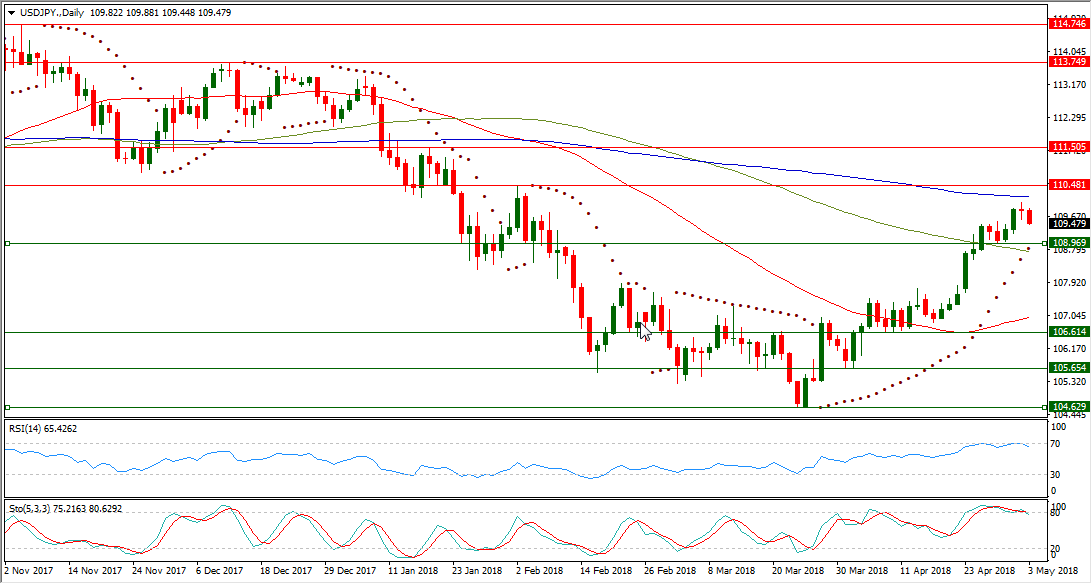

USD/JPY Daily Chart:

USD/JPY was unable to maintain a place above 110 psychological level yesterday to find it easier to retreat to the current level without surpassing its daily SMA200, however it is still underpinned over shorter range by continued trading above its daily SMA50, its daily SMA100.

USD/JPY is now trading close to 109.50, after reaching yesterday 110.03 on continued creeping up from its formed bottom on last Mar. 26 at 104.62.

USD/JPY is now trading on its day number 27 of continued being above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 108.83 today.

USD/JPY daily RSI-14 is still referring to existence inside its neutral territory reading 65.426, after inability to log in it overbought area above 30.

USD/JPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line inside its neutral region at 75.216 leading to the downside its signal line which is higher just in the overbought region at 80.629 following convergence to the downside,

Important levels: Daily SMA50 @ 107.00, Daily SMA100 @ 108.73 and Daily SMA200 @ 110.196

S&R:

S1: 108.96

S2: 106.61

S3: 105.65

R1: 110.48

R2: 111.50

R3: 113.74