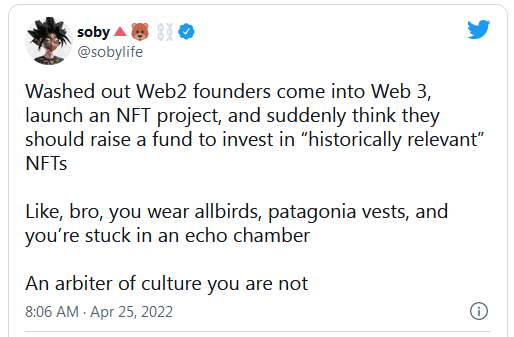

Moonbirds stormed onto the NFT scene when it launched on Apr. 16, raking in $66 million on mint and surpassing 100,000 ETH in trading volume within days. Now, the project’s COO is launching a fund—with annual subscription fees coming in at 100 ETH. Ryan Carson was widely criticized when he unveiled the 121G NFT fund’s website only nine days after Moonbirds launched. One of the core team members behind the hit NFT project Moonbirds is already starting to focus his attention elsewhere. Ryan Carson, the Chief Operating Officer at Moonbirds and PROOF, is preparing to launch a new NFT-focused fund called 121G. The venture’s website describes the current NFT landscape as an “historic opportunity” and says it will focus on sourcing “hard-to-acquire blue chip NFTs.” It paints the NFT space of today as a rare chance to capitalize while the technology is in its infancy and styles 121G as “the fund you wish you could go back in time and invest in.” According to the website, there are 99 spots available with a quarterly 25 ETH subscription fee. Investors must subscribe for a minimum of one year, meaning the fund is looking to raise at least 9,900 ETH worth around $27.7 million at current market prices. In that sense, 121G appears to be the equivalent of an exclusive members’ group that grants exposure to NFTs that could theoretically grow in value over time. While 121G is not set to launch until next month, Carson took to Twitter early Monday to share the website and say that he was “blown away by the interest” it had received so far. In response, multiple members of the NFT community criticized Carson over the fund. Much of the pushback has referenced Moonbirds’ huge financial success, which raised $66 million when it launched on Apr. 16 and has since surpassed 110,000 ETH in trading volume on the secondary market. As the project takes a 5% cut from every secondary sale, that’s another 5,500 ETH (around $15.4 million) in revenue on top of the $66 million raised in the mint. It’s important to note, however, that Carson does not have direct access to the millions Moonbirds has raised. The project’s website says that the proceeds from both the mint and secondary sales will be used exclusively for expanding the team, launching new products, and delivering value to the Moonbirds community. “annnnnd the paid group is live… didnt you guys just rake in $70 million? lmao,” said the pseudonymous NFT trader MoonOverlord. Nic Wilkins responded with a meme comparing Carson to a controversial NFT collector known as Beanie, which prompted the popular NFT tastemaker gmoney to respond “This is hilarious.” Another NFT enthusiast known as Soby posted a critical tweet referencing an unnamed NFT fund investing in “historically relevant” NFTs. This is not the first time Carson has faced heat for his conduct since Moonbirds launched. He was also slammed for repeatedly making reference to the floor price for the NFTs, and deleted at least one post when he was called out for excessively focusing on the value of the collection. “I hear you and I agree it was a mistake. I got caught up in the excitement and should’ve thought twice before hitting the button. We are focused on building and hiring. I won’t be posting about price again,” he wrote in response to a Deeze callout on Apr. 23. Despite Carson’s apparent blunder, Moonbirds is still the talk of the NFT space and remains the most-traded collection by some distance. Part of the project’s early success can be attributed to PROOF, which also boomed when it launched earlier this year. Moonbirds has been described as “the official Proof PFP.” Prior to his endeavors in the NFT space, Carson spent a decade at the helm of Treehouse until the firm was acquired by Xenon Partners in December 2021. Treehouse has also been embroiled in controversy, including a mass layoff event in September 2021 after a separate acquisition deal with Skillsoft fell through. According to his LinkedIn page, Carson became a full-time “entrepreneur” in December 2021, which would’ve been around the time PROOF was gearing up to launch. Moonbirds has taken a slight hit since Carson’s 121G announcement gained traction, currently trading at a minimum of 35 ETH. Still, that’s almost $100,000—a huge sum even in the sometimes-dizzying NFT market. Ryan Carson did not immediately respond to Crypto Briefing’s request for comment. Key Takeaways

Moonbirds COO Slammed Over NFT Fund

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Days After $66M NFT Drop, Moonbirds Executive Unveils Fund

Published 04/25/2022, 07:13 AM

Days After $66M NFT Drop, Moonbirds Executive Unveils Fund

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.